Answered step by step

Verified Expert Solution

Question

1 Approved Answer

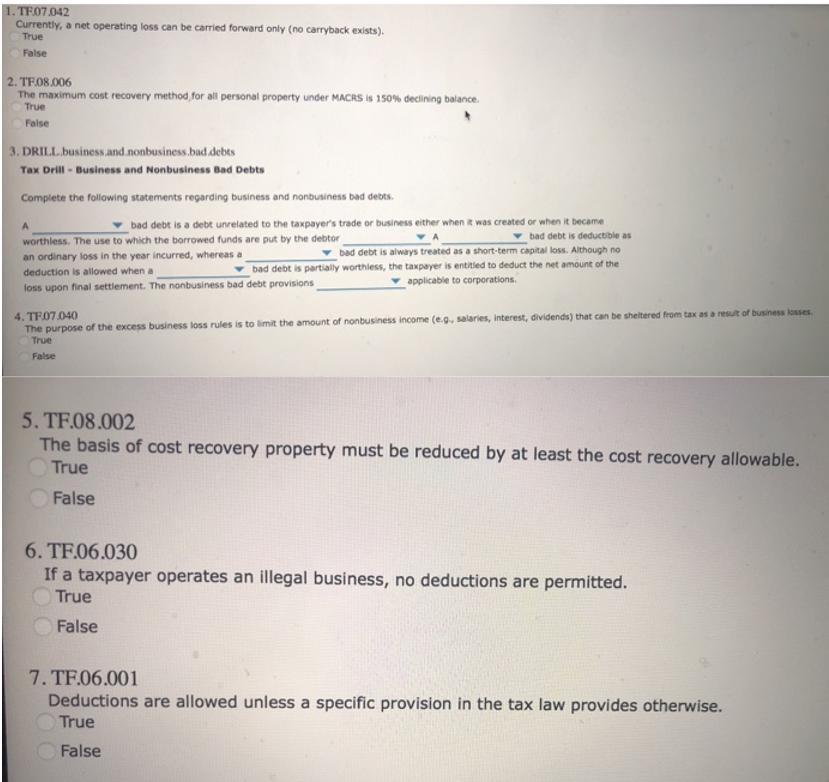

1. TF.07.042 Currently, a net operating loss can be carried forward only (no carryback exists). True False 2. TF.08.006 The maximum cost recovery method,

1. TF.07.042 Currently, a net operating loss can be carried forward only (no carryback exists). True False 2. TF.08.006 The maximum cost recovery method, for all personal property under MACRS is 150% declining balance. True False 3. DRILL.business, and nonbusiness.bad.debts Tax Drill - Business and Nonbusiness Bad Debts Complete the following statements regarding business and nonbusiness bad debts. bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became bad debt is deductible as worthless. The use to which the borrowed funds are put by the debtor an ordinary loss in the year incurred, whereas a deduction is allowed when a bad debt is always treated as a short-term capital loss. Although no bad debt is partially worthless, the taxpayer is entitled to deduct the net amount of the applicable to corporations. A loss upon final settlement. The nonbusiness bad debt provisions 4. TF07.040 The purpose of the excess business loss rules is to limit the amount of nonbusiness income (e.g., salaries, Interest, dividends) that can be sheltered from tax as a result of business losses. True False 5. TF.08.002 The basis of cost recovery property must be reduced by at least the cost recovery allowable. True False 6. TF.06.030 If a taxpayer operates an illegal business, no deductions are permitted. True False 7. TF.06.001 Deductions are allowed unless a specific provision in the tax law provides otherwise. True False

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Q1 False According to the IRS a net operating loss NOL can be carried back two years and carried forward 20 year s Q2 False The maximum cost recovery ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started