Answered step by step

Verified Expert Solution

Question

1 Approved Answer

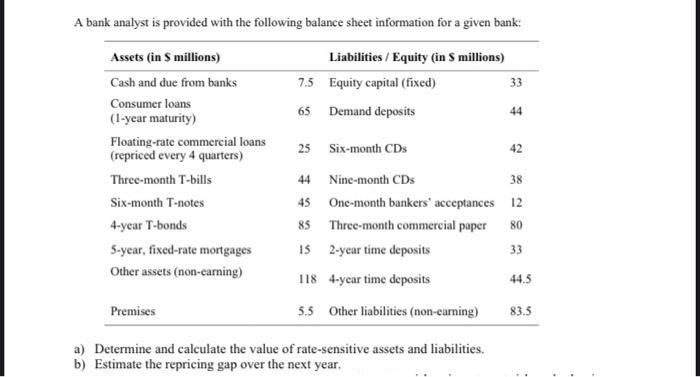

A bank analyst is provided with the following balance sheet information for a given bank: Assets (in S millions) Liabilities/ Equity (in S millions)

A bank analyst is provided with the following balance sheet information for a given bank: Assets (in S millions) Liabilities/ Equity (in S millions) Cash and due from banks Equity capital (fixed) Consumer loans Demand deposits (1-year maturity) Floating-rate commercial loans (repriced every 4 quarters) Three-month T-bills Six-month T-notes 4-year T-bonds 5-year, fixed-rate mortgages Other assets (non-earning) Premises 7.5 65 25 Six-month CDs 44 Nine-month CDs 45 One-month bankers' acceptances 85 Three-month commercial paper 15 2-year time deposits 118 4-year time deposits 5.5 Other liabilities (non-carning) a) Determine and calculate the value of rate-sensitive assets and liabilities. b) Estimate the repricing gap over the next year. 33 44 42 38 12 80 33 44.5 83.5

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 a determine and calculate the value of rate sensitiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started