Answered step by step

Verified Expert Solution

Question

1 Approved Answer

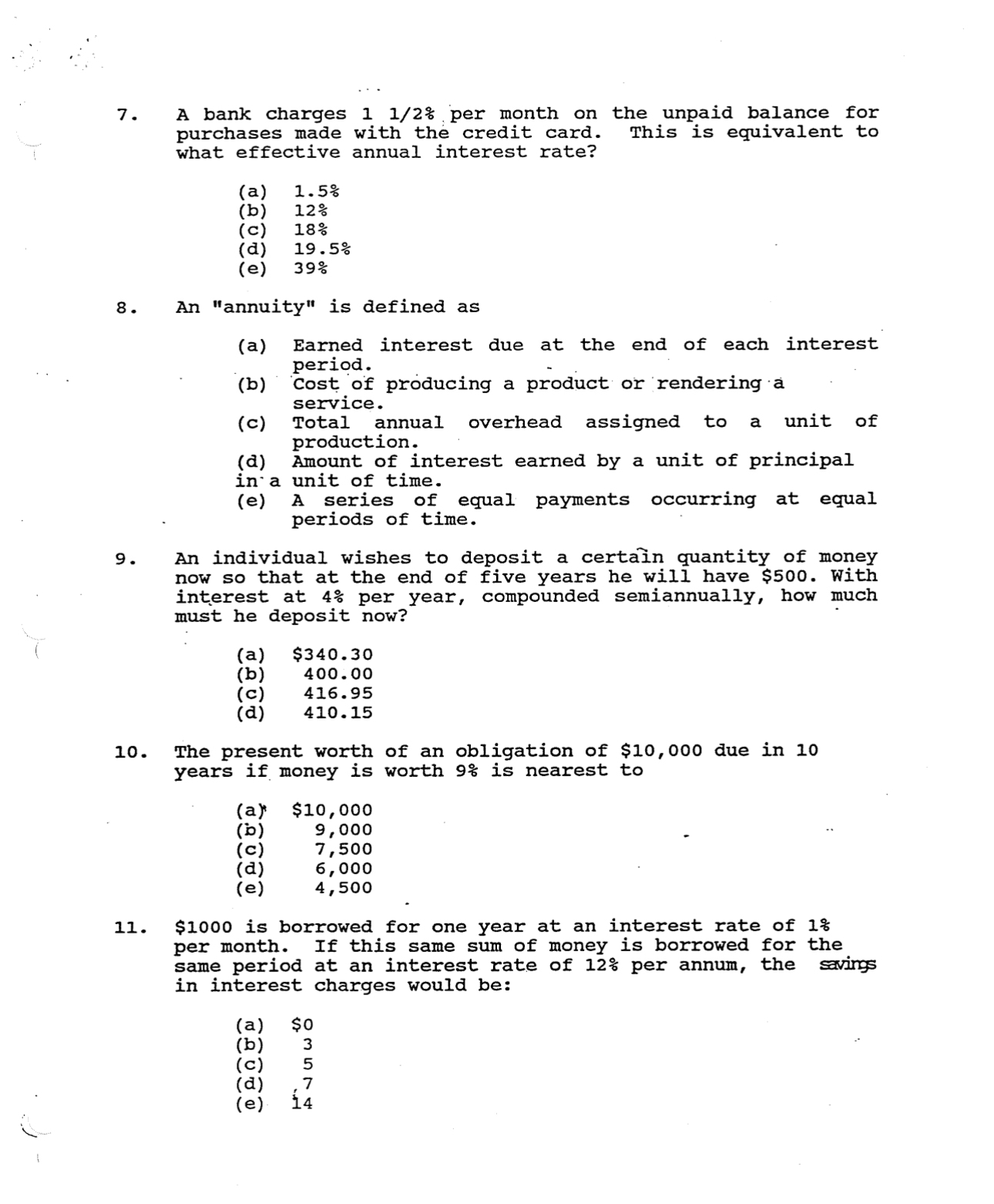

A bank charges 1 1 / 2 % per month on the unpaid balance for purchases made with the credit card. This is equivalent to

A bank charges per month on the unpaid balance for purchases made with the credit card. This is equivalent to what effective annual interest rate?

a

b

c

d

e

An "annuity" is defined as

a Earned interest due at the end of each interest period.

b Cost of producing a product or rendering a service.

c Total annual overhead assigned to a unit of production.

d Amount of interest earned by a unit of principal in a unit of time.

e A series of equal payments occurring at equal periods of time.

An individual wishes to deposit a certain quantity of money now so that at the end of five years he will have $ With interest at per year, compounded semiannually, how much must he deposit now?

a $

b

c

d

The present worth of an obligation of $ due in years if money is worth is nearest to

a $

b

c

d

e

$ is borrowed for one year at an interest rate of per month. If this same sum of money is borrowed for the same period at an interest rate of per annum, the savings in interest charges would be:

a $

b

c

d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started