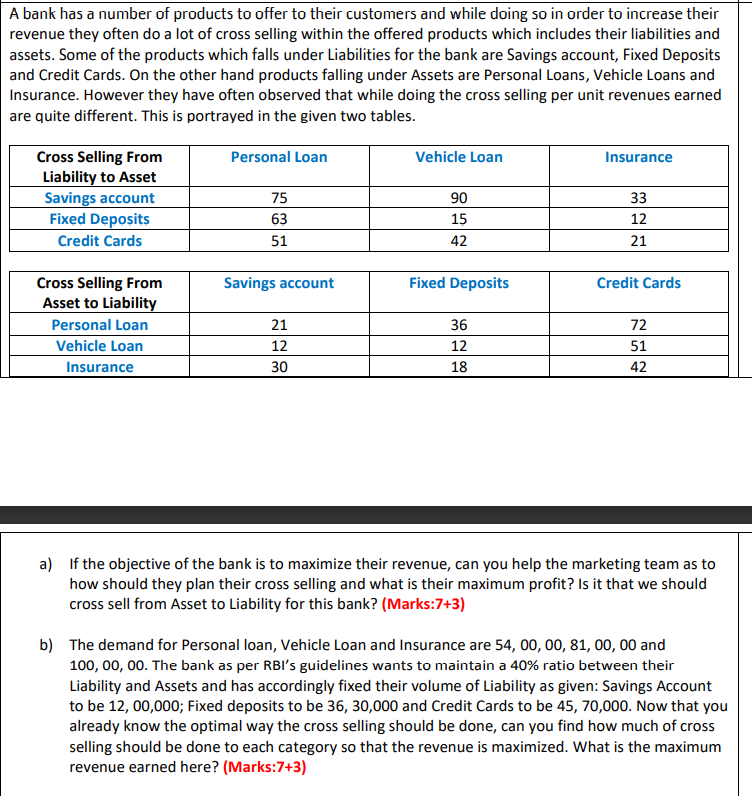

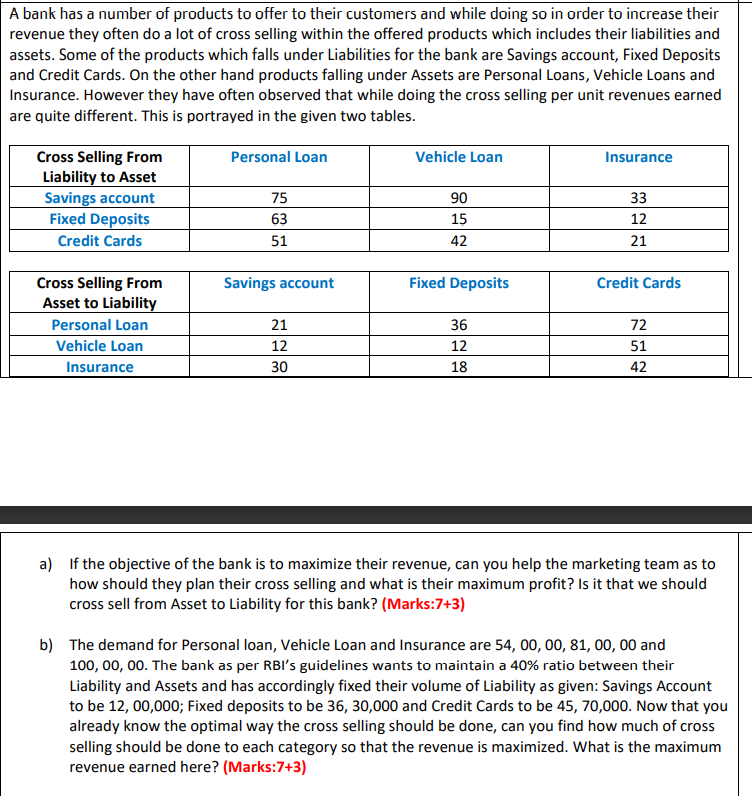

A bank has a number of products to offer to their customers and while doing so in order to increase their revenue they often do a lot of cross selling within the offered products which includes their liabilities and assets. Some of the products which falls under Liabilities for the bank are Savings account, Fixed Deposits and Credit Cards. On the other hand products falling under Assets are Personal Loans, Vehicle Loans and Insurance. However they have often observed that while doing the cross selling per unit revenues earned are quite different. This is portrayed in the given two tables. Personal Loan Vehicle Loan Insurance Cross Selling From Liability to Asset Savings account Fixed Deposits Credit Cards 75 63 51 90 15 42 33 12 21 Savings account Fixed Deposits Credit Cards Cross Selling From Asset to Liability Personal Loan Vehicle Loan Insurance 21 12 36 12 18 72 51 42 30 a) If the objective of the bank is to maximize their revenue, can you help the marketing team as to how should they plan their cross selling and what is their maximum profit? Is it that we should cross sell from Asset to Liability for this bank? (Marks:7+3) b) The demand for Personal loan, Vehicle Loan and Insurance are 54, 00,00, 81, 00, 00 and 100,00, 00. The bank as per RBI's guidelines wants to maintain a 40% ratio between their Liability and Assets and has accordingly fixed their volume of Liability as given: Savings Account to be 12, 00,000; Fixed deposits to be 36, 30,000 and Credit Cards to be 45, 70,000. Now that you already know the optimal way the cross selling should be done, can you find how much of cross selling should be done to each category so that the revenue is maximized. What is the maximum revenue earned here? (Marks:7+3) A bank has a number of products to offer to their customers and while doing so in order to increase their revenue they often do a lot of cross selling within the offered products which includes their liabilities and assets. Some of the products which falls under Liabilities for the bank are Savings account, Fixed Deposits and Credit Cards. On the other hand products falling under Assets are Personal Loans, Vehicle Loans and Insurance. However they have often observed that while doing the cross selling per unit revenues earned are quite different. This is portrayed in the given two tables. Personal Loan Vehicle Loan Insurance Cross Selling From Liability to Asset Savings account Fixed Deposits Credit Cards 75 63 51 90 15 42 33 12 21 Savings account Fixed Deposits Credit Cards Cross Selling From Asset to Liability Personal Loan Vehicle Loan Insurance 21 12 36 12 18 72 51 42 30 a) If the objective of the bank is to maximize their revenue, can you help the marketing team as to how should they plan their cross selling and what is their maximum profit? Is it that we should cross sell from Asset to Liability for this bank? (Marks:7+3) b) The demand for Personal loan, Vehicle Loan and Insurance are 54, 00,00, 81, 00, 00 and 100,00, 00. The bank as per RBI's guidelines wants to maintain a 40% ratio between their Liability and Assets and has accordingly fixed their volume of Liability as given: Savings Account to be 12, 00,000; Fixed deposits to be 36, 30,000 and Credit Cards to be 45, 70,000. Now that you already know the optimal way the cross selling should be done, can you find how much of cross selling should be done to each category so that the revenue is maximized. What is the maximum revenue earned here? (Marks:7+3)