Answered step by step

Verified Expert Solution

Question

1 Approved Answer

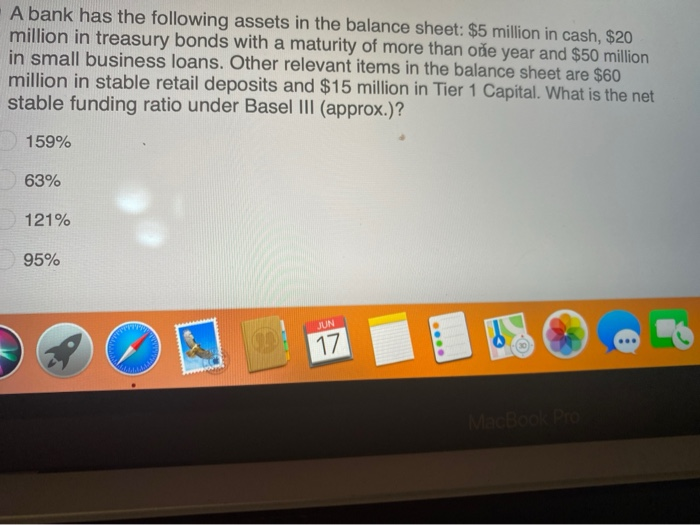

A bank has the following assets in the balance sheet: $5 million in cash, $20 million in treasury bonds with a maturity of more than

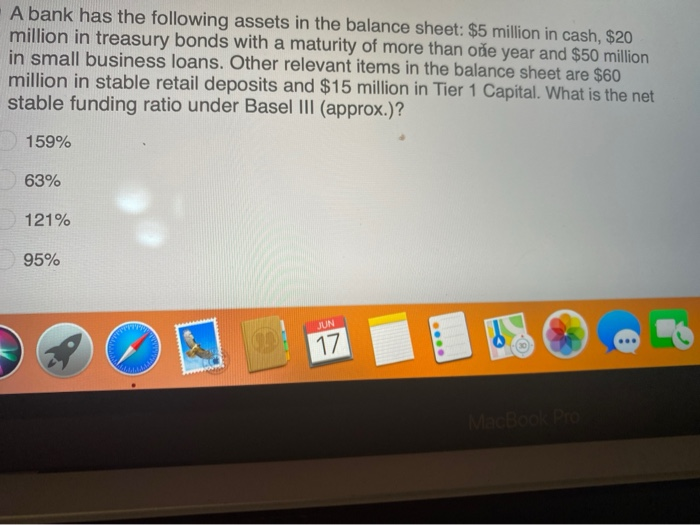

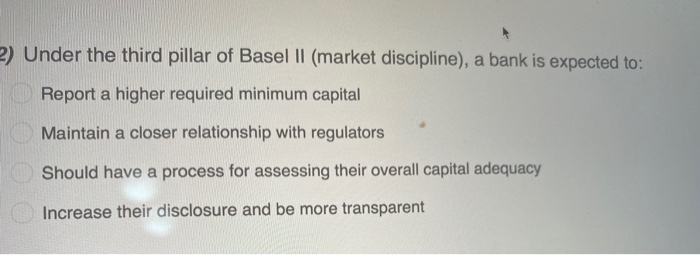

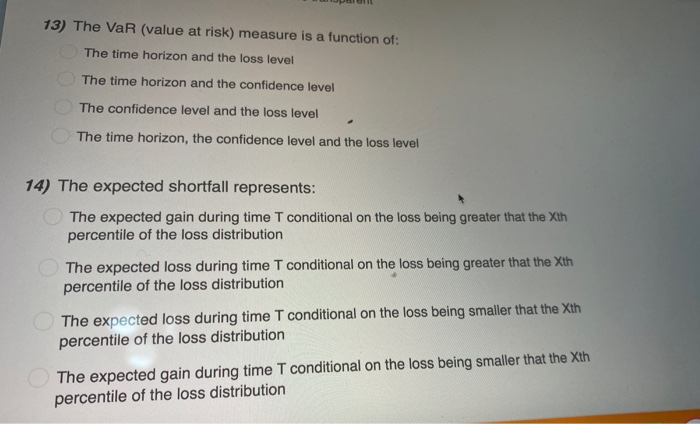

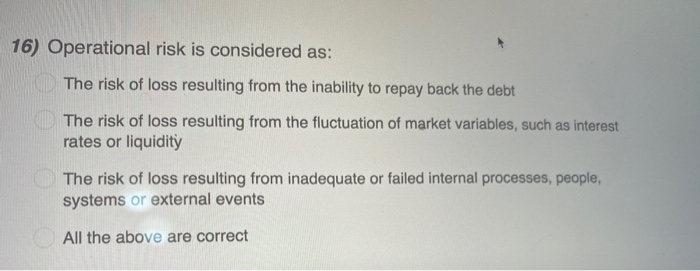

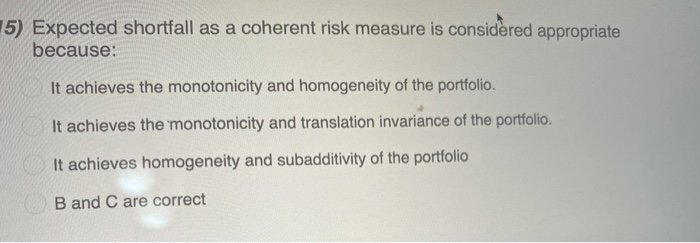

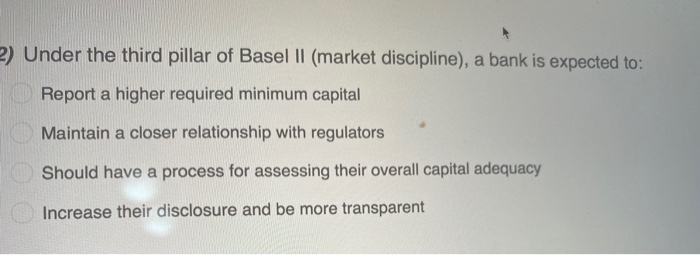

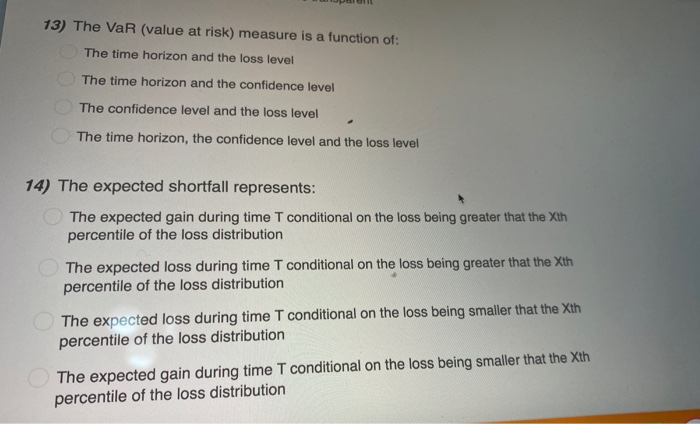

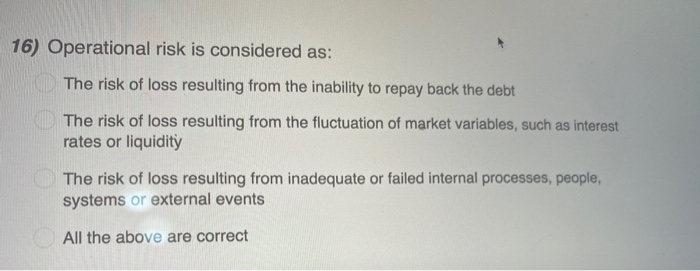

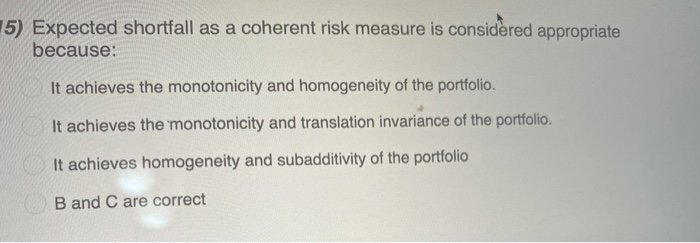

A bank has the following assets in the balance sheet: $5 million in cash, $20 million in treasury bonds with a maturity of more than one year and $50 million in small business loans. Other relevant items in the balance sheet are $60 million in stable retail deposits and $15 million in Tier 1 Capital. What is the net stable funding ratio under Basel III (approx.)? 159% 63% 121% 95% JUN 17 MERCEDES 2) Under the third pillar of Basel II ( market discipline), a bank is expected to: Report a higher required minimum capital Maintain a closer relationship with regulators Should have a process for assessing their overall capital adequacy Increase their disclosure and be more transparent 13) The VaR (value at risk) measure is a function of: The time horizon and the loss level The time horizon and the confidence level The confidence level and the loss level The time horizon, the confidence level and the loss level 14) The expected shortfall represents: The expected gain during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being smaller that the Xth percentile of the loss distribution The expected gain during time T conditional on the loss being smaller that the Xth percentile of the loss distribution 16) Operational risk is considered as: The risk of loss resulting from the inability to repay back the debt The risk of loss resulting from the fluctuation of market variables, such as interest rates or liquidity The risk of loss resulting from inadequate or failed internal processes, people, systems or external events All the above are correct 5) Expected shortfall as a coherent risk measure is considered appropriate because: It achieves the monotonicity and homogeneity of the portfolio. It achieves the monotonicity and translation invariance of the portfolio. It achieves homogeneity and subadditivity of the portfolio B and C are correct

A bank has the following assets in the balance sheet: $5 million in cash, $20 million in treasury bonds with a maturity of more than one year and $50 million in small business loans. Other relevant items in the balance sheet are $60 million in stable retail deposits and $15 million in Tier 1 Capital. What is the net stable funding ratio under Basel III (approx.)? 159% 63% 121% 95% JUN 17 MERCEDES 2) Under the third pillar of Basel II ( market discipline), a bank is expected to: Report a higher required minimum capital Maintain a closer relationship with regulators Should have a process for assessing their overall capital adequacy Increase their disclosure and be more transparent 13) The VaR (value at risk) measure is a function of: The time horizon and the loss level The time horizon and the confidence level The confidence level and the loss level The time horizon, the confidence level and the loss level 14) The expected shortfall represents: The expected gain during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being greater that the Xth percentile of the loss distribution The expected loss during time T conditional on the loss being smaller that the Xth percentile of the loss distribution The expected gain during time T conditional on the loss being smaller that the Xth percentile of the loss distribution 16) Operational risk is considered as: The risk of loss resulting from the inability to repay back the debt The risk of loss resulting from the fluctuation of market variables, such as interest rates or liquidity The risk of loss resulting from inadequate or failed internal processes, people, systems or external events All the above are correct 5) Expected shortfall as a coherent risk measure is considered appropriate because: It achieves the monotonicity and homogeneity of the portfolio. It achieves the monotonicity and translation invariance of the portfolio. It achieves homogeneity and subadditivity of the portfolio B and C are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started