Question

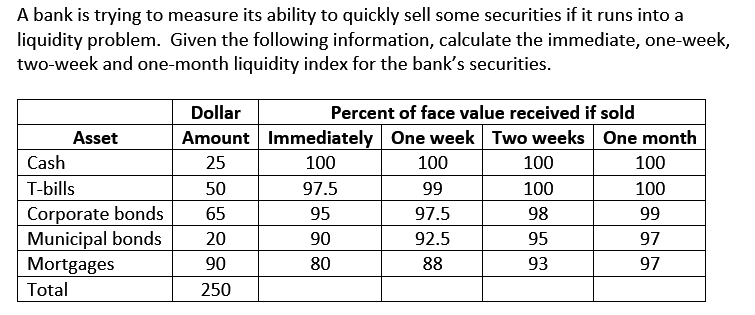

A bank is trying to measure its ability to quickly sell some securities if it runs into a liquidity problem. Given the following information,

A bank is trying to measure its ability to quickly sell some securities if it runs into a liquidity problem. Given the following information, calculate the immediate, one-week, two-week and one-month liquidity index for the bank's securities. Dollar Percent of face value received if sold Asset Amount Immediately One week Two weeks One month Cash 25 100 100 100 100 T-bills 50 97.5 99 100 100 Corporate bonds 65 95 97.5 98 99 Municipal bonds 20 90 92.5 95 97 Mortgages 90 80 88 93 97 Total 250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management A Managerial Approach

Authors: Jack R. Meredith, Samuel J. Mantel Jr.

8th edition

470533021, 978-0470533024

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App