Delta Fund, a South African-based investment fund, which has USD 400 million invested in a USD Property Fund and EUR500M invested in Euro Fund.

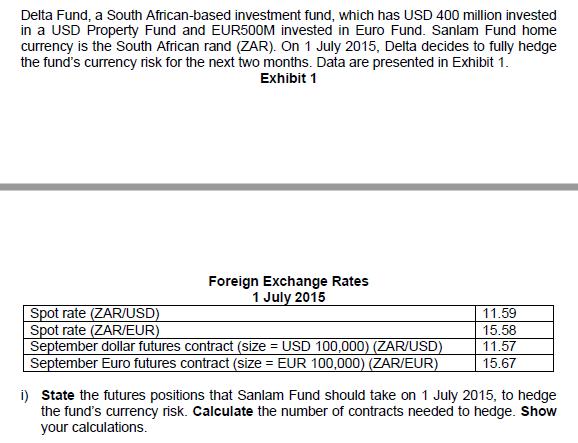

Delta Fund, a South African-based investment fund, which has USD 400 million invested in a USD Property Fund and EUR500M invested in Euro Fund. Sanlam Fund home currency is the South African rand (ZAR). On 1 July 2015, Delta decides to fully hedge the fund's currency risk for the next two months. Data are presented in Exhibit 1. Exhibit 1 Spot rate (ZAR/USD) Spot rate (ZAR/EUR) Foreign Exchange Rates 1 July 2015 September dollar futures contract (size = USD 100,000) (ZAR/USD) September Euro futures contract (size = EUR 100,000) (ZAR/EUR) 11.59 15.58 11.57 15.67 i) State the futures positions that Sanlam Fund should take on 1 July 2015, to hedge the fund's currency risk. Calculate the number of contracts needed to hedge. Show your calculations.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

I Amount invested in USD 400 Million equivalent 4001159 4636 Z...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started