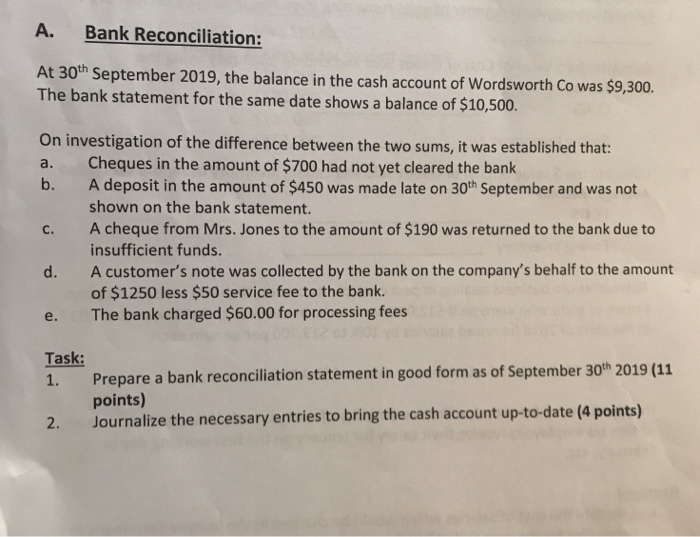

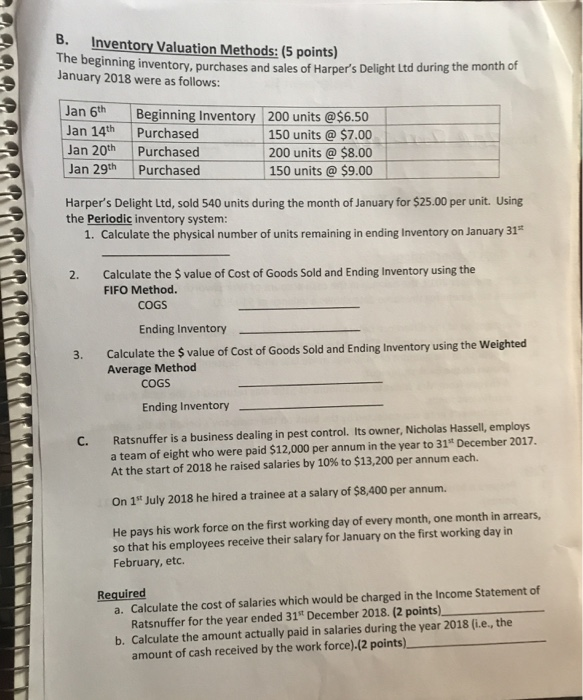

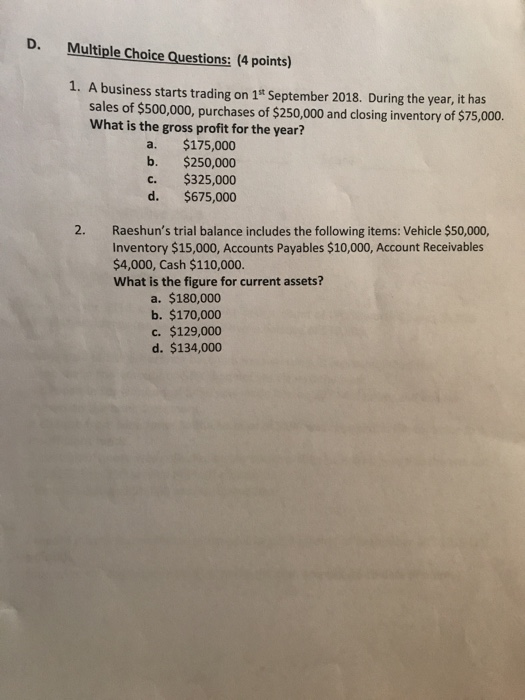

A. Bank Reconciliation: At 30th September 2019, the balance in the cash account of Wordsworth Co was $9,300. The bank statement for the same date shows a balance of $10,500. On investigation of the difference between the two sums, it was established that: a. Cheques in the amount of $700 had not yet cleared the bank b. A deposit in the amount of $450 was made late on 30th September and was not shown on the bank statement. A cheque from Mrs. Jones to the amount of $190 was returned to the bank due to insufficient funds. A customer's note was collected by the bank on the company's behalf to the amount of $1250 less $50 service fee to the bank. The bank charged $60.00 for processing fees Task: 1. Prepare a bank reconciliation statement in good form as of September 30th 2019 (11 points) 2. Journalize the necessary entries to bring the cash account up-to-date (4 points) B. Inventory Valuation Methods: (5 points) The beginning inventory, purchases and sales of Harper's Delight Ltd during the month of January 2018 were as follows: Jan 6th Jan 14th Jan 20th Jan 29th Beginning Inventory 200 units @ $6.50 Purchased 150 units @ $7.00 Purchased 200 units @ $8.00 Purchased 150 units @ $9.00 Harper's Delight Ltd, sold 540 units during the month of January for $25.00 per unit. Using the Periodic inventory system: 1. Calculate the physical number of units remaining in ending Inventory on January 31" 2. Calculate the $ value of Cost of Goods Sold and Ending Inventory using the FIFO Method. COGS Ending Inventory Calculate the $ value of Cost of Goods Sold and Ending Inventory using the Weighted Average Method COGS Ending Inventory 3. Ratsnuffer is a business dealing in pest control. Its owner, Nicholas Hassell, employs a team of eight who were paid $12,000 per annum in the year to 31" December 2017. At the start of 2018 he raised salaries by 10% to $13,200 per annum each. On 15 July 2018 he hired a trainee at a salary of $8,400 per annum. He pays his work force on the first working day of every month, one month in arrears, so that his employees receive their salary for January on the first working day in February, etc. Required a. Calculate the cost of salaries which would be charged in the Income Statement of Ratsnuffer for the year ended 31" December 2018. (2 points) b. Calculate the amount actually paid in salaries during the year 2018 (i.e., the amount of cash received by the work force).(2 points) D. Multiple Choice Questions: (4 points) 1. A business starts trading on 1 September 2018. During the year, it has sales of $500,000, purchases of $250,000 and closing inventory of $75,000. What is the gross profit for the year? a. $175,000 b. $250,000 C. $325,000 $675,000 2. Raeshun's trial balance includes the following items: Vehicle $50,000, Inventory $15,000, Accounts Payables $10,000, Account Receivables $4,000, Cash $110,000. What is the figure for current assets? a. $180,000 b. $170,000 c. $129,000 d. $134,000