Question

A bank today makes $100 in 3-year loans with a 16% fixed annual interest rate. It funds the loans today with $100 in 1-year

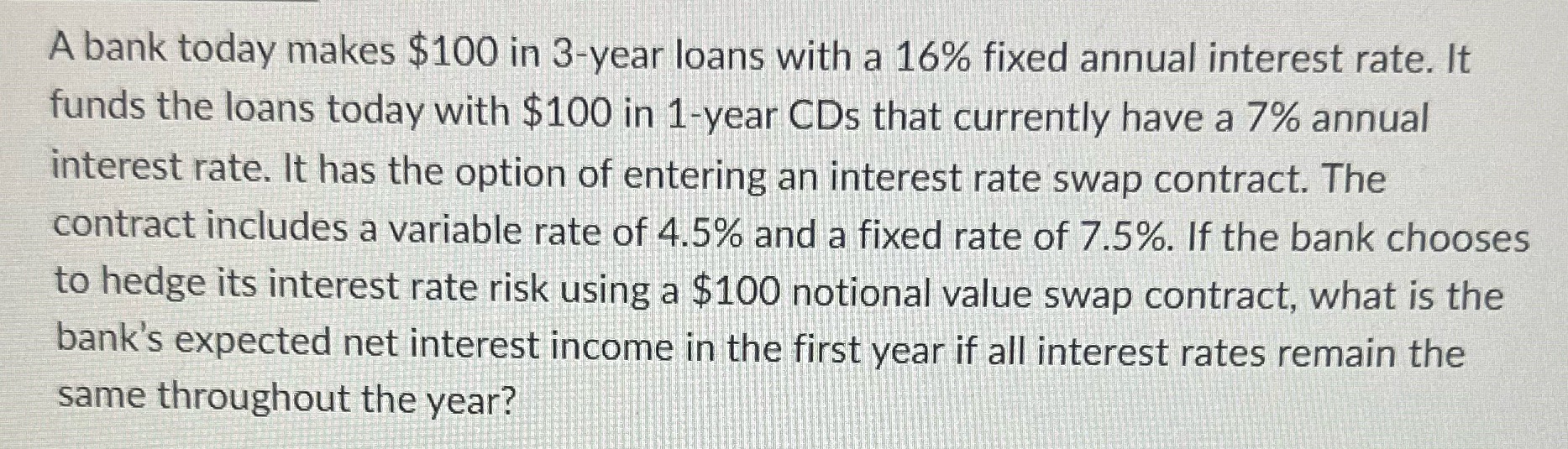

A bank today makes $100 in 3-year loans with a 16% fixed annual interest rate. It funds the loans today with $100 in 1-year CDs that currently have a 7% annual interest rate. It has the option of entering an interest rate swap contract. The contract includes a variable rate of 4.5% and a fixed rate of 7.5%. If the bank chooses to hedge its interest rate risk using a $100 notional value swap contract, what is the bank's expected net interest income in the first year if all interest rates remain the same throughout the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income from Loans The bank makes 100 in 3year loans at a fixed annual interest rate of 16 In the fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

7th edition

1259722651, 978-1259722653

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App