Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bank's risk management team is assessing its trading portfolio's vulnerability to market risk using the Daily Earnings at Risk ( DEAR ) model. The

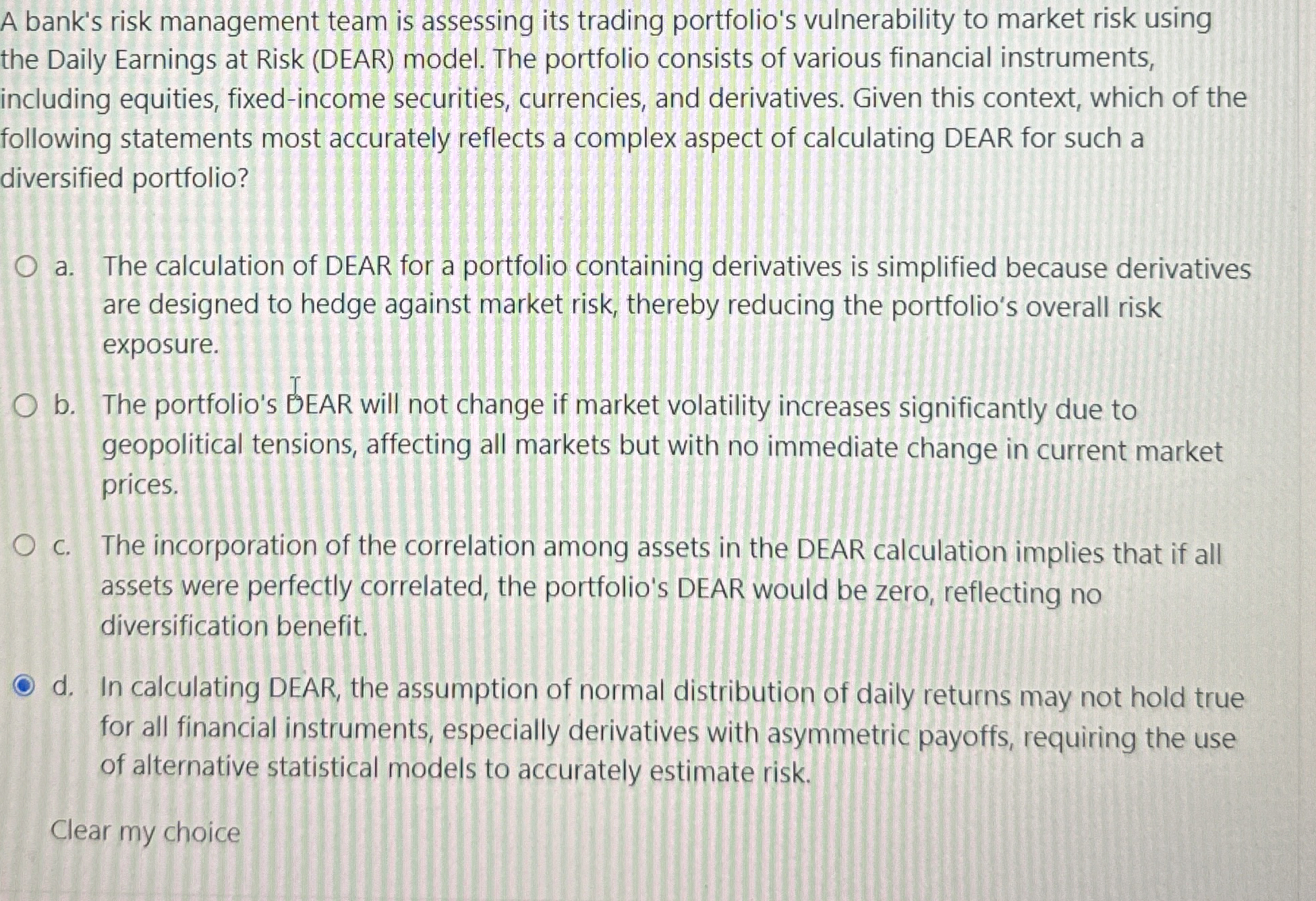

A bank's risk management team is assessing its trading portfolio's vulnerability to market risk using the Daily Earnings at Risk DEAR model. The portfolio consists of various financial instruments, including equities, fixedincome securities currencies, and derivatives. Given this context, which of the following statements most accurately reflects a complex aspect of calculating DEAR for such a diversified portfolio?

a The calculation of DEAR for a portfolio containing derivatives is simplified because derivatives are designed to hedge against market risk, thereby reducing the portfolio's overall risk exposure.

b The portfolio's BEAR will not change if market volatility increases significantly due to geopolitical tensions, affecting all markets but with no immediate change in current market prices.

c The incorporation of the correlation among assets in the DEAR calculation implies that if all assets were perfectly correlated, the portfolio's DEAR would be zero, reflecting no diversification benefit.

d In calculating DEAR, the assumption of normal distribution of daily returns may not hold true for all financial instruments, especially derivatives with asymmetric payoffs, requiring the use of alternative statistical models to accurately estimate risk.

Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started