Question

A baseball team has signed a draft pick to a two year contract. The player's expected marginal revenue product in year 1 and year

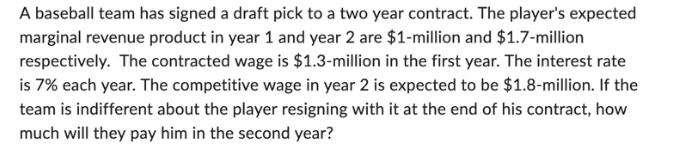

A baseball team has signed a draft pick to a two year contract. The player's expected marginal revenue product in year 1 and year 2 are $1-million and $1.7-million respectively. The contracted wage is $1.3-million in the first year. The interest rate is 7% each year. The competitive wage in year 2 is expected to be $1.8-million. If the team is indifferent about the player resigning with it at the end of his contract, how much will they pay him in the second year?

Step by Step Solution

3.39 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Determining Second Year Wage for Indifference To find the secondyear wage that makes the team indiff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics Principles Applications And Tools

Authors: Arthur O'Sullivan, Steven Sheffrin, Stephen Perez

9th Edition

013407887X, 9780134078878

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App