Question

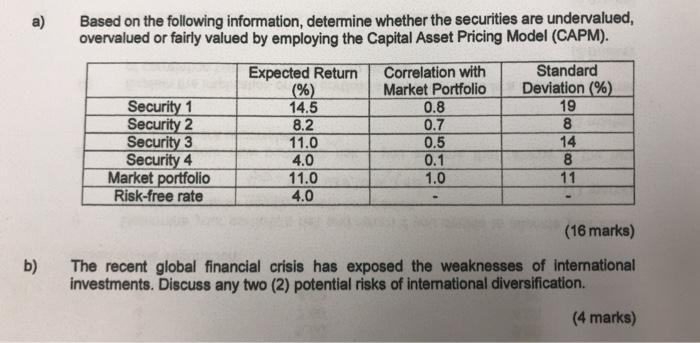

a) Based on the following information, determine whether the securities are undervalued, overvalued or fairly valued by employing the Capital Asset Pricing Model (CAPM).

a) Based on the following information, determine whether the securities are undervalued, overvalued or fairly valued by employing the Capital Asset Pricing Model (CAPM). b) Expected Return Correlation with (%) Market Portfolio Standard Deviation (%) Security 1 14.5 0.8 19 Security 2 8.2 0.7 8 Security 3 11.0 0.5 14 Security 4 4.0 0.1 8 Market portfolio 11.0 1.0 11 Risk-free rate 4.0 (16 marks) The recent global financial crisis has exposed the weaknesses of international investments. Discuss any two (2) potential risks of international diversification. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To determine whether the securities are undervalued overvalued or fairly valued using the Capital Asset Pricing Model CAPM we need to calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Stochastic Finance With Market Examples

Authors: Nicolas Privault

2nd Edition

1032288272, 9781032288277

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App