Question

a. Based on the following stock price and shares outstanding information compute the beginning and ending values for a price-weighted index and a market-value-weighted

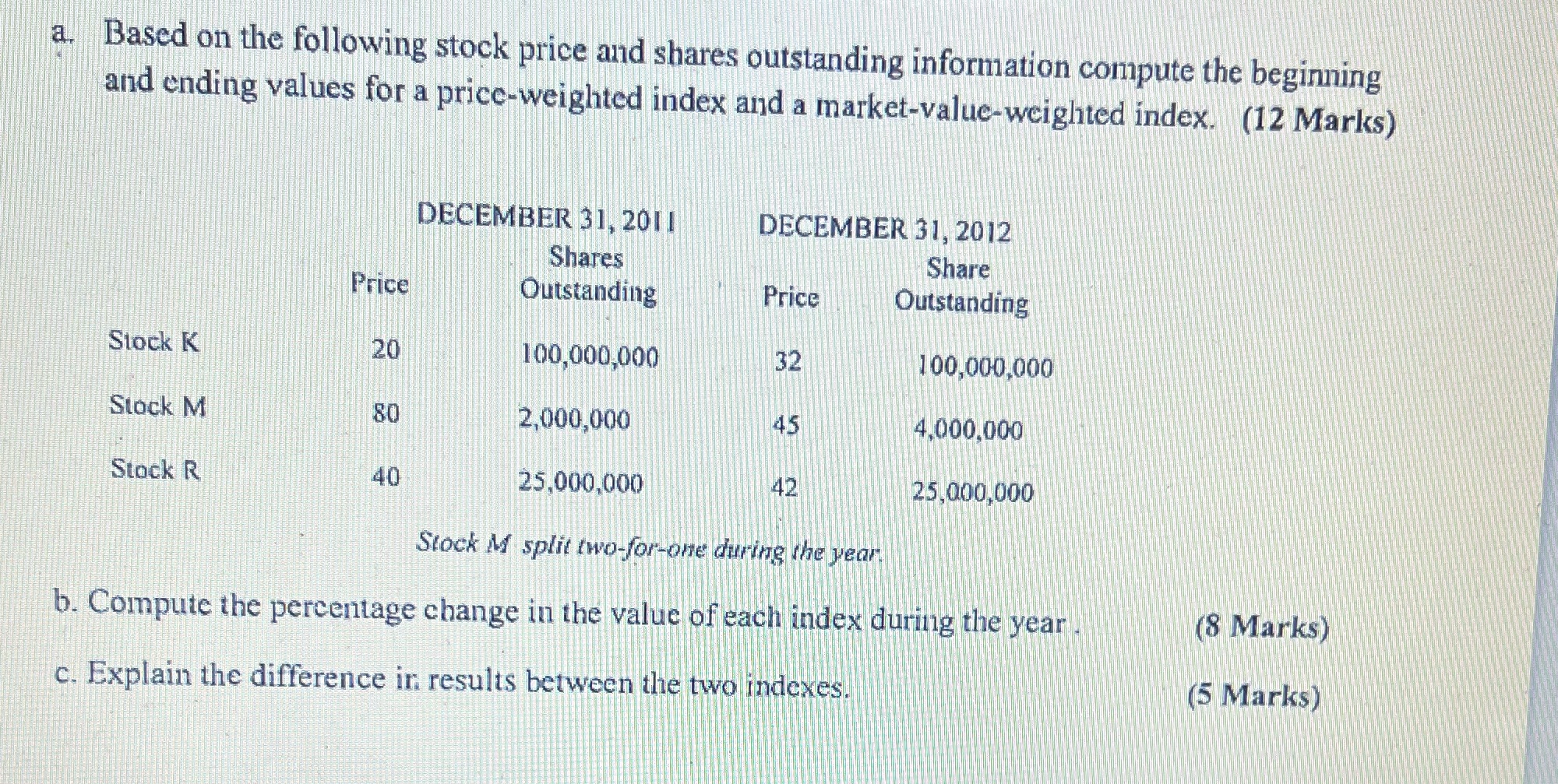

a. Based on the following stock price and shares outstanding information compute the beginning and ending values for a price-weighted index and a market-value-weighted index. (12 Marks) DECEMBER 31, 2011 Price Shares Outstanding Price DECEMBER 31, 2012 Share Outstanding Stock K 20 100,000,000 32 100,000,000 Stock M 80 2,000,000 45 4,000,000 Stock R 40 25,000,000 42 25,000,000 Stock M split two-for-one during the year. b. Compute the percentage change in the value of each index during the year c. Explain the difference in results between the two indexes. (8 Marks) (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Beginning and Ending Values for PriceWeighted Index and MarketValueWeighted Index PriceWeighted Index To calculate the priceweighted index you sum t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App