Question

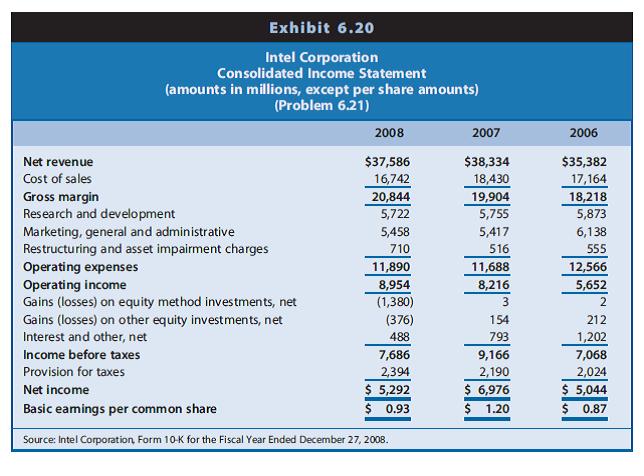

Intel Corporations consolidated income statement appears in Exhibit 6.20. Note 15, which follows, explains the source of the restructuring charges, the breakdown of the charges

Intel Corporation’s consolidated income statement appears in Exhibit 6.20.

Note 15, which follows, explains the source of the restructuring charges, the breakdown of the charges into employee-related costs and asset impairments, and the balance of the accrued restructuring liability account.

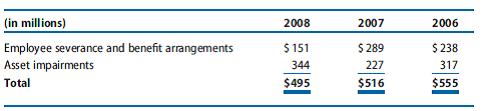

Note 15: Restructuring and Asset Impairment Charges

The following table summarizes restructuring and asset impairment charges by plan for the three years ended December 27, 2008:

We may incur additional restructuring charges in the future for employee severance and benefit arrangements, and facility-related or other exit activities. Subsequent to the end of 2008, management approved plans to restructure some of our manufacturing and assembly and test operations, and align our manufacturing and assembly and test capacity to current market conditions. These actions, which are expected to take place beginning in 2009, include closing two assembly and test facilities in Malaysia, one facility in the Philippines, and one facility in China; stopping production at a 200mm wafer fabrication facility in Oregon; and ending production at our 200mm wafer fabrication facility in California.

In the fourth quarter of 2008, management approved a plan with Micron to discontinue the supply of NAND flash memory from the 200mm facility within the IMFT manufacturing network. The agreement resulted in a $215 million restructuring charge, primarily related to the IMFT 200mm supply agreement. The restructuring charge resulted in a reduction of our investment in IMFT of $184 million, a cash payment to Micron of $24 million, and other cash payments of $7 million.

The following table summarizes charges for the 2006 efficiency program for the three years ended December 27, 2008:

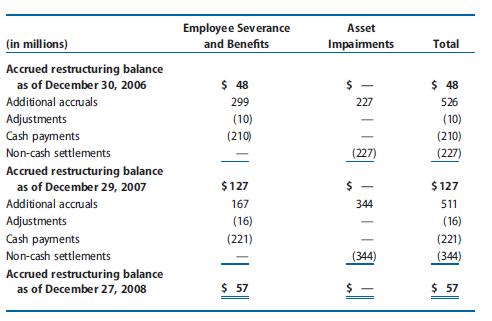

The following table summarizes the restructuring and asset impairment activity for the 2006 efficiency program during 2007 and 2008:

We recorded the additional accruals, net of adjustments, as restructuring and asset impairment charges. The remaining accrual as of December 27, 2008 was related to severance benefits that we recorded within accrued compensation and benefits.

From the third quarter of 2006 through the fourth quarter of 2008, we incurred a total of $1.6 billion in restructuring and asset impairment charges related to this program. These charges included a total of $678 million related to employee severance and benefit arrangements for approximately 11,900 employees, and $888 million in asset impairment charges.

REQUIRED

a. Based on your reading of the note, how would you treat Intel’s restructuring charges in the assessment of current profitability and the prediction of future earnings?

b. Why is the balance of the ‘‘accrued restructuring’’ limited to employee-related costs?

c. Describe the effect on net income of each entry in the ‘‘accrued restructuring balance’’ account reconciliation. (For example, what is the effect of ‘‘Additional accruals’’ on net income?)

d. How do U.S. GAAP and IFRS differ on the rules used to compute the restructuring charge?

Exhibit 6.20 Intel Corporation Consolidated Income Statement (amounts in millions, except per share amounts) (Problem 6.21) 2008 2007 2006 $37,586 $38,334 18,430 19,904 5,755 Net revenue $35,382 Cost of sales 16,742 20,844 5,722 17,164 Gross margin Research and develo pment Marketing, general and administrative Restructuring and asset impairment charges 18,218 5,873 6,138 5,458 5,417 710 516 555 11,688 8,216 11,890 12,566 5,652 Operating expenses Operating income Gains (losses) on equity method investments, net Gains (losses) on other equity investments, net Interest and other, net 8,954 (1,380) 3 2 (376) 154 212 488 793 9,166 2,190 $ 6,976 $ 1.20 1,202 Income before taxes 7,686 7,068 Provision for taxes 2,394 2,024 $ 5,292 $ 0.93 $ 5,044 $ 0.87 Net income Basic eamings per common share Source: Intel Corporation, Form 10-K for the Fiscal Year Ended December 27, 2008.

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 2 Intels Restructuring Charges a 1 Assessment of current profitability Based on the note on Restructuring and Asset Impairment Charges its evident that restructuring at Intel is an ongoing p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started