Question

A bear spread based on call options is the combination of a long call with strike price 2 and a short call with strike price

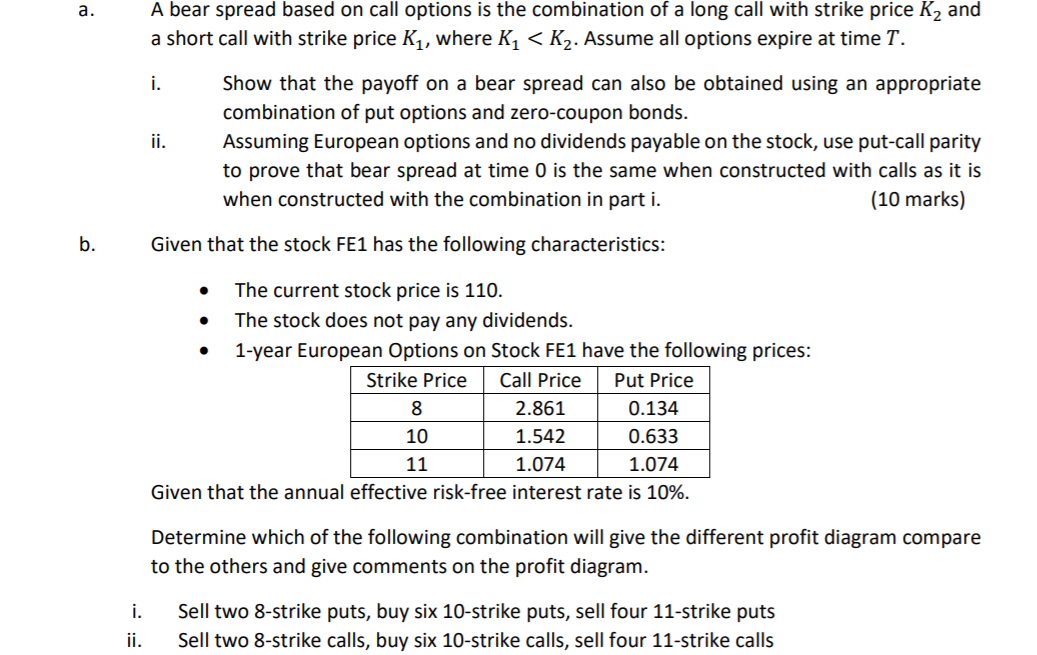

A bear spread based on call options is the combination of a long call with strike price 2 and a short call with strike price 1, where 1 < 2. Assume all options expire at time . i. Show that the payoff on a bear spread can also be obtained using an appropriate combination of put options and zero-coupon bonds. ii. Assuming European options and no dividends payable on the stock, use put-call parity to prove that bear spread at time 0 is the same when constructed with calls as it is when constructed with the combination in part i. (10 marks) b. Given that the stock FE1 has the following characteristics: The current stock price is 110. The stock does not pay any dividends. 1-year European Options on Stock FE1 have the following prices: Strike Price Call Price Put Price 8 2.861 0.134 10 1.542 0.633 11 1.074 1.074 Given that the annual effective risk-free interest rate is 10%. Determine which of the following combination will give the different profit diagram compare to the others and give comments on the profit diagram. i. Sell two 8-strike puts, buy six 10-strike puts, sell four 11-strike puts ii. Sell two 8-strike calls, buy six 10-strike calls, sell four 11-strike calls iii. Sell two 8-strike calls, buy two 10-strike calls, buy four 10-strike puts, sell four 11-strike puts. iv. Sell two 8-strike puts, buy two 10-strike puts, buy four 10-strike calls, sell four 11-strike calls v. Sell two shares, sell two 8-strike calls, buy two 10-strike puts, buy four 10-strike calls, sell four 11-strike calls.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started