Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A big deposit. You deposit $1.2 million into your account to cover expenses in the next 12 years. The account earns interest at the

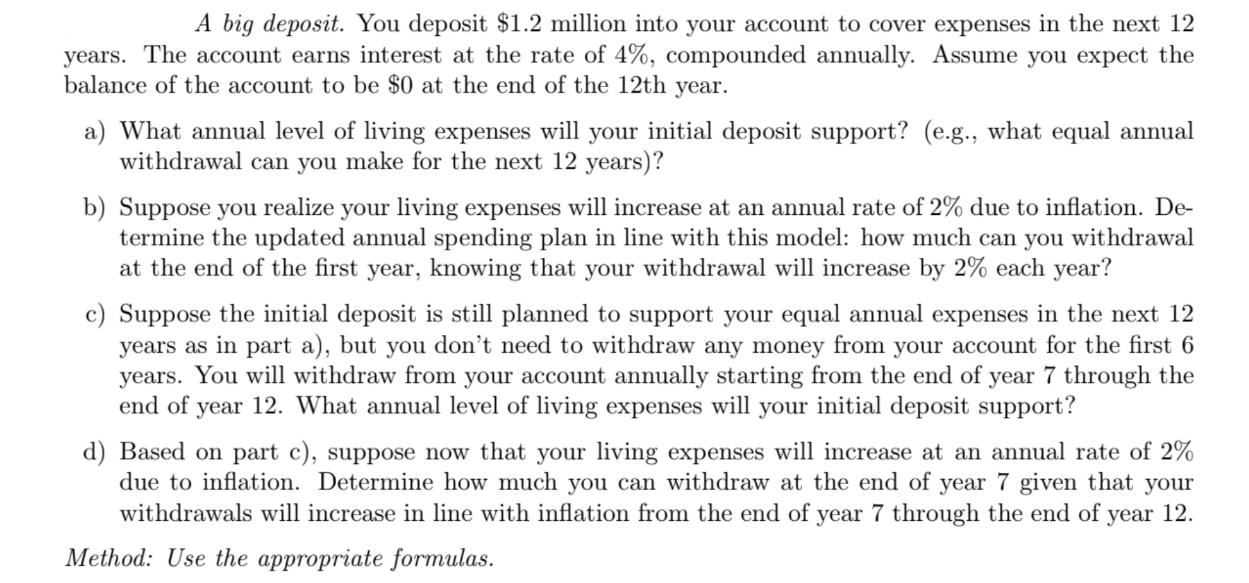

A big deposit. You deposit $1.2 million into your account to cover expenses in the next 12 years. The account earns interest at the rate of 4%, compounded annually. Assume you expect the balance of the account to be $0 at the end of the 12th year. a) What annual level of living expenses will your initial deposit support? (e.g., what equal annual withdrawal can you make for the next 12 years)? b) Suppose you realize your living expenses will increase at an annual rate of 2% due to inflation. De- termine the updated annual spending plan in line with this model: how much can you withdrawal at the end of the first year, knowing that your withdrawal will increase by 2% each year? c) Suppose the initial deposit is still planned to support your equal annual expenses in the next 12 years as in part a), but you don't need to withdraw any money from your account for the first 6 years. You will withdraw from your account annually starting from the end of year 7 through the end of year 12. What annual level of living expenses will your initial deposit support? 12. d) Based on part c), suppose now that your living expenses will increase at an annual rate of 2% due to inflation. Determine how much you can withdraw at the end of year 7 given that your withdrawals will increase in line with inflation from the end of year 7 through the end of year Method: Use the appropriate formulas.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve each part of the problem a To find the annual level of living expenses that the initial deposit will support we can use the formula for the present value of an annuity PV PMT1 11 rnight r W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started