Question: A bond has 2 years remaining until maturity. Jake determines that the bond has a 6% default rate on the 3rd and 4th coupon

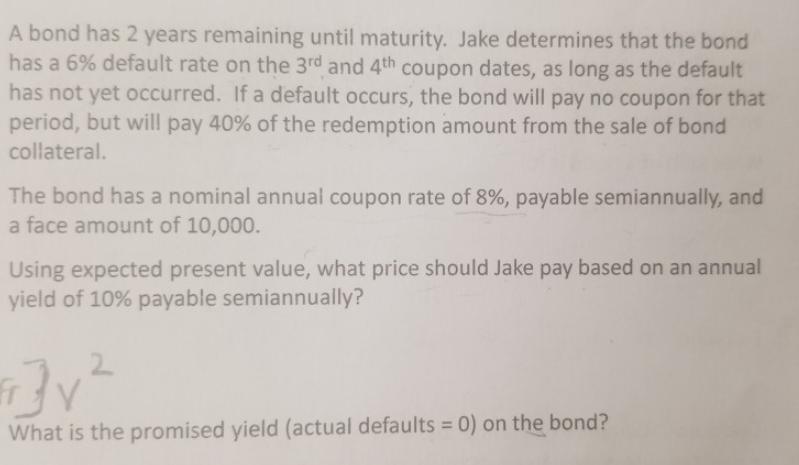

A bond has 2 years remaining until maturity. Jake determines that the bond has a 6% default rate on the 3rd and 4th coupon dates, as long as the default has not yet occurred. If a default occurs, the bond will pay no coupon for that period, but will pay 40% of the redemption amount from the sale of bond collateral. The bond has a nominal annual coupon rate of 8%, payable semiannually, and a face amount of 10,000. Using expected present value, what price should Jake pay based on an annual yield of 10% payable semiannually? 2. What is the promised yield (actual defaults = 0) on the bond? %3D

Step by Step Solution

3.52 Rating (172 Votes )

There are 3 Steps involved in it

lets assume coupons are paid semi annually so there are two payments per period FV Face Value 100000 ... View full answer

Get step-by-step solutions from verified subject matter experts