Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bond has 2 years to maturity and face value $1000. Its coupon rate is 4%. If its yield to maturity is 6%, its price

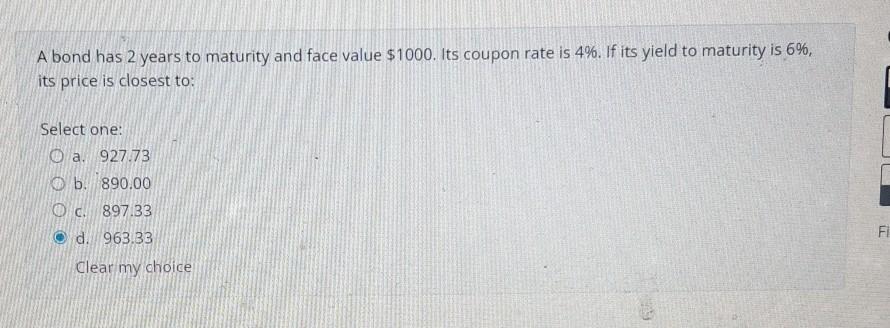

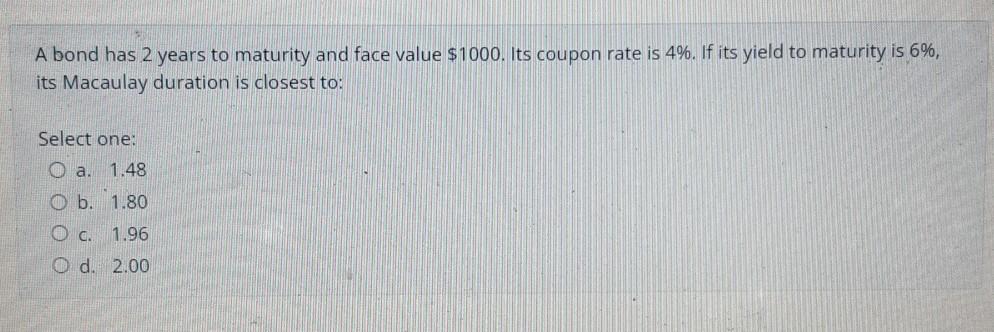

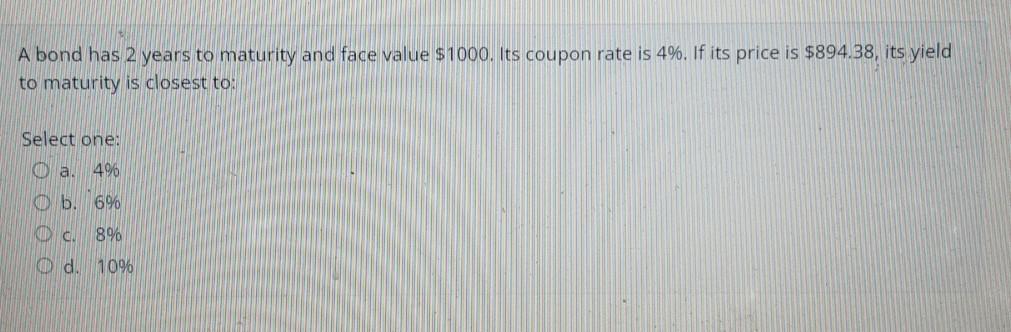

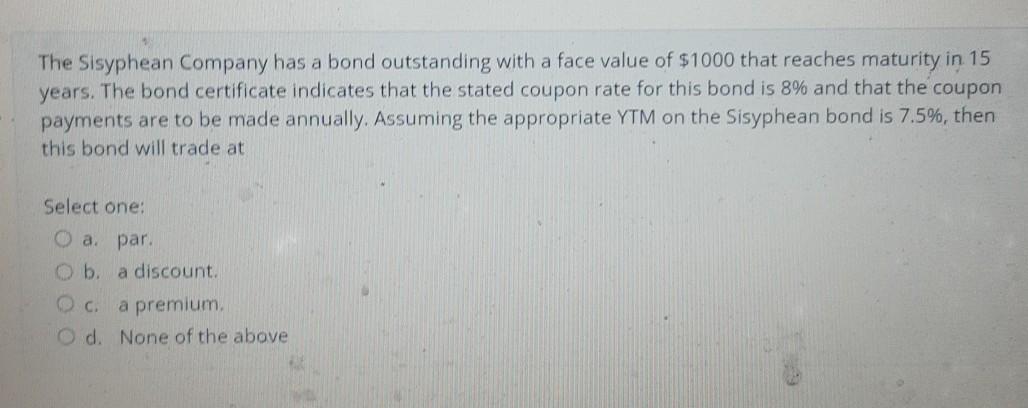

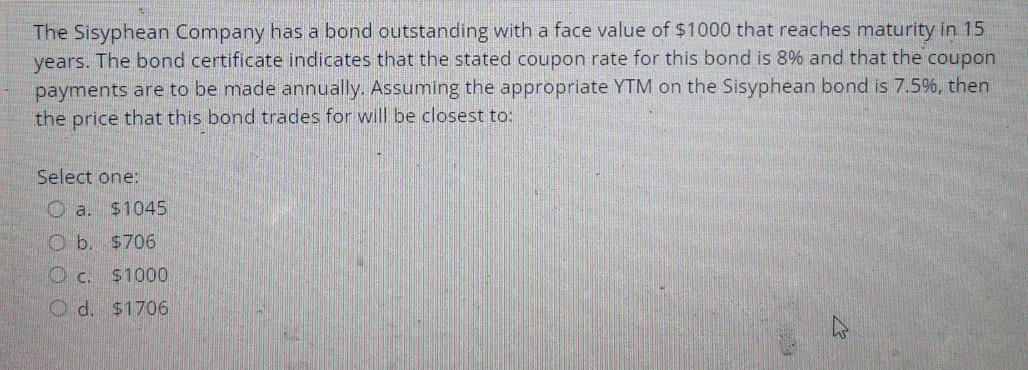

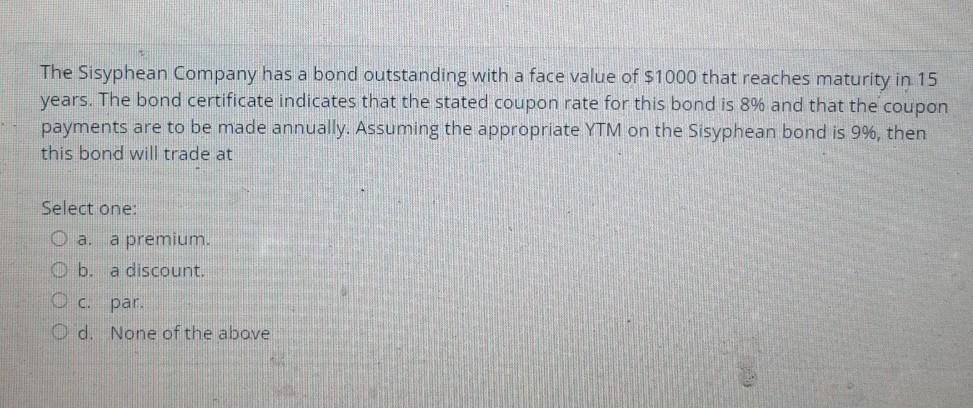

A bond has 2 years to maturity and face value $1000. Its coupon rate is 4%. If its yield to maturity is 6%, its price is closest to: Select one: O a. 927.73 b. 890.00 O c. 897.33 d. 963.33 Clear my choice A bond has 2 years to maturity and face value $1000. Its coupon rate is 4%. If its yield to maturity is 6%, its Macaulay duration is closest to: Select one: O a. 1.48 O b. 1.80 O c. 1.96 d. 2.00 A bond has 2 years to maturity and face value $1000. Its coupon rate is 4%. If its price is $894.38, its yield to maturity is closest to: Select one: 0 a 4% O b. 6% 2 C. 80 0 d. 10% The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made annually. Assuming the appropriate YTM on the Sisyphean bond is 7.5%, then this bond will trade at Select one: O a. par. Ob a discount. c. a premium O d. None of the above The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made annually. Assuming the appropriate YTM on the Sisyphean bond is 7.5%, then the price that this bond trades for will be closest to: Select one: $1045 a. b. $706 O c. $1000 Od $1706 The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years. The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made annually. Assuming the appropriate YTM on the Sisyphean bond is 9%, then this bond will trade at Select one: O a. a premium. O b. a discount. OC. par. O d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started