Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bond is issued on Sep. 2022 and matures on Sep. 2026. Its face value is $1,000, and its coupon rate is 4.5% Coupons are

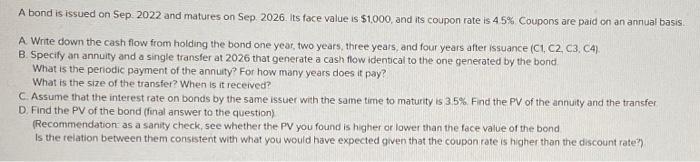

A bond is issued on Sep. 2022 and matures on Sep. 2026. Its face value is $1,000, and its coupon rate is 4.5% Coupons are paid on an annual basis. A. Write down the cash flow from holding the bond one year, two years, three years, and four years after issuance (C1, C2, C3, C4). B. Specify an annuity and a single transfer at 2026 that generate a cash flow identical to the one generated by the bond. What is the periodic payment of the annuity? For how many years does it pay? What is the size of the transfer? When is it received? C. Assume that the interest rate on bonds by the same issuer with the same time to maturity is 3.5%. Find the PV of the annuity and the transfer. D. Find the PV of the bond (final answer to the question). (Recommendation: as a sanity check, see whether the PV you found is higher or lower than the face value of the bond. Is the relation between them consistent with what you would have expected given that the coupon rate is higher than the discount rate?).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started