Answered step by step

Verified Expert Solution

Question

1 Approved Answer

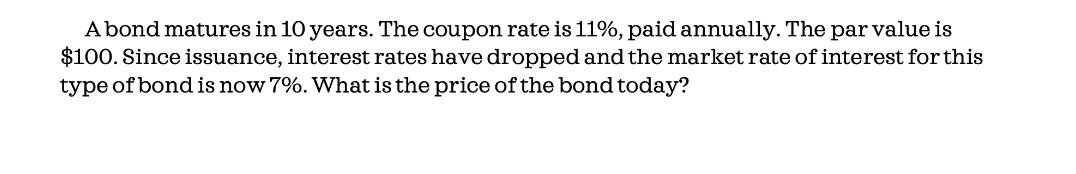

A bond matures in 10 years. The coupon rate is 11%, paid annually. The par value is $100. Since issuance, interest rates have dropped

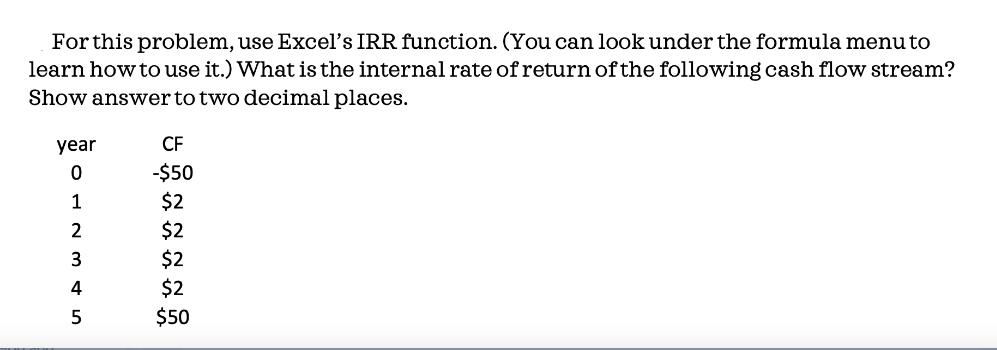

A bond matures in 10 years. The coupon rate is 11%, paid annually. The par value is $100. Since issuance, interest rates have dropped and the market rate of interest for this type of bond is now 7%. What is the price of the bond today? For this problem, use Excel's IRR function. (You can look under the formula menu to learn how to use it.) What is the internal rate of return of the following cash flow stream? Show answer to two decimal places. year -$50 1322225 P012345

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To find the internal rate of return IRR of the given cash flow stream in Excel you ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started