A bond pays coupons of size 30 every 6-months and the bond is redeemable for 1100. Furthermore, you are given the following information: The

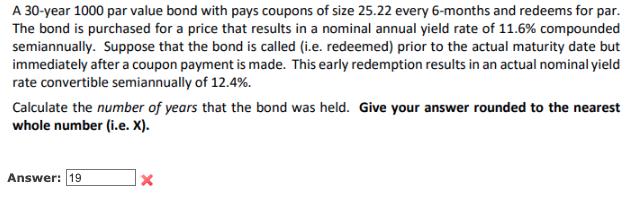

A bond pays coupons of size 30 every 6-months and the bond is redeemable for 1100. Furthermore, you are given the following information: The bond is purchased at P to yield and annual rate of 8% convertible semiannually. The absolute difference between the book-value (i.e. bond value) after the 15th coupon and the book-value after the 16th coupon is 1.50. Calculate P. Give your answer rounded to the nearest whole number (i.e. X). A 30-year 1000 par value bond with pays coupons of size 25.22 every 6-months and redeems for par. The bond is purchased for a price that results in a nominal annual yield rate of 11.6 % compounded semiannually. Suppose that the bond is called (i.e. redeemed) prior to the actual maturity date but immediately after a coupon payment is made. This early redemption results in an actual nominal yield rate convertible semiannually of 12.4%. Calculate the number of years that the bond was held. Give your answer rounded to the nearest whole number (i.e. X). Answer: 19 X

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the bond price P we use the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started