Question

A bond trader purchased each of the following bonds at a yield to maturity of 10%. Immediately after she purchased the bonds, interest rates fell

A bond trader purchased each of the following bonds at a yield to maturity of 10%. Immediately after she purchased the bonds, interest rates fell to 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

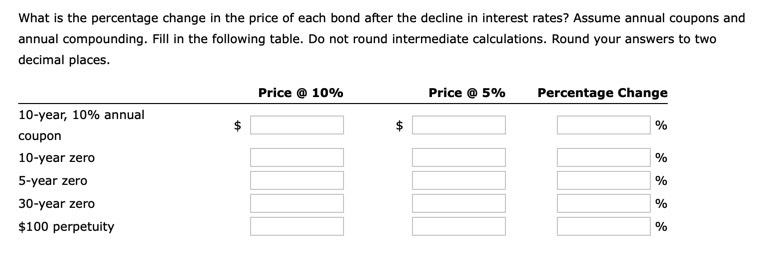

What is the percentage change in the price of each bond after the decline in interest rates? Assume annual coupons and annual compounding. Fill in the following table. Do not round intermediate calculations. Round your answers to two decimal places.

| Interest Rate Sensitivity | |||||

| Original yield to maturity at issue | 10.00% | ||||

| Changed yield to maturity immediately after purchase | 5.00% | ||||

| 10-year, 10% annual coupon bond | 10-year zero coupon bond | ||||

| Maturity term, N | 10 | Maturity term, N | 10 | ||

| Coupon rate | 10.00% | Coupon rate | 0.00% | ||

| Par value, FV | $1,000.00 | Par value, FV | $1,000.00 | ||

| PMT | PMT | $0.00 | |||

| Original price at issue | Original price at issue | ||||

| Price with changed yield to maturity | Price with changed yield to maturity | ||||

| Percentage change | Percentage change | ||||

| Formulas | Formulas | ||||

| PMT | #N/A | ||||

| Original price at issue | #N/A | Original price at issue | #N/A | ||

| Price with changed yield to maturity | #N/A | Price with changed yield to maturity | #N/A | ||

| Percentage change | #N/A | Percentage change | #N/A | ||

| 5-year zero coupon bond | 30-year zero coupon bond | ||||

| Maturity term, N | 5 | Maturity term, N | 30 | ||

| Coupon rate | 0.00% | Coupon rate | 0.00% | ||

| Par value, FV | $1,000.00 | Par value, FV | $1,000.00 | ||

| PMT | $0.00 | PMT | $0.00 | ||

| Original price at issue | Original price at issue | ||||

| Price with changed yield to maturity | Price with changed yield to maturity | ||||

| Percentage change | Percentage change | ||||

| Formulas | Formulas | ||||

| Original price at issue | #N/A | Original price at issue | #N/A | ||

| Price with changed yield to maturity | #N/A | Price with changed yield to maturity | #N/A | ||

| Percentage change | #N/A | Percentage change | #N/A | ||

| Perpetuity, $100 annual coupon | |||||

| Annual coupon | $100 | ||||

| Original price at issue | |||||

| Price with changed yield to maturity | |||||

| Percentage change | |||||

| Formulas | |||||

| Original price at issue | #N/A | ||||

| Price with changed yield to maturity | #N/A | ||||

| Percentage change | #N/A | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started