Answered step by step

Verified Expert Solution

Question

1 Approved Answer

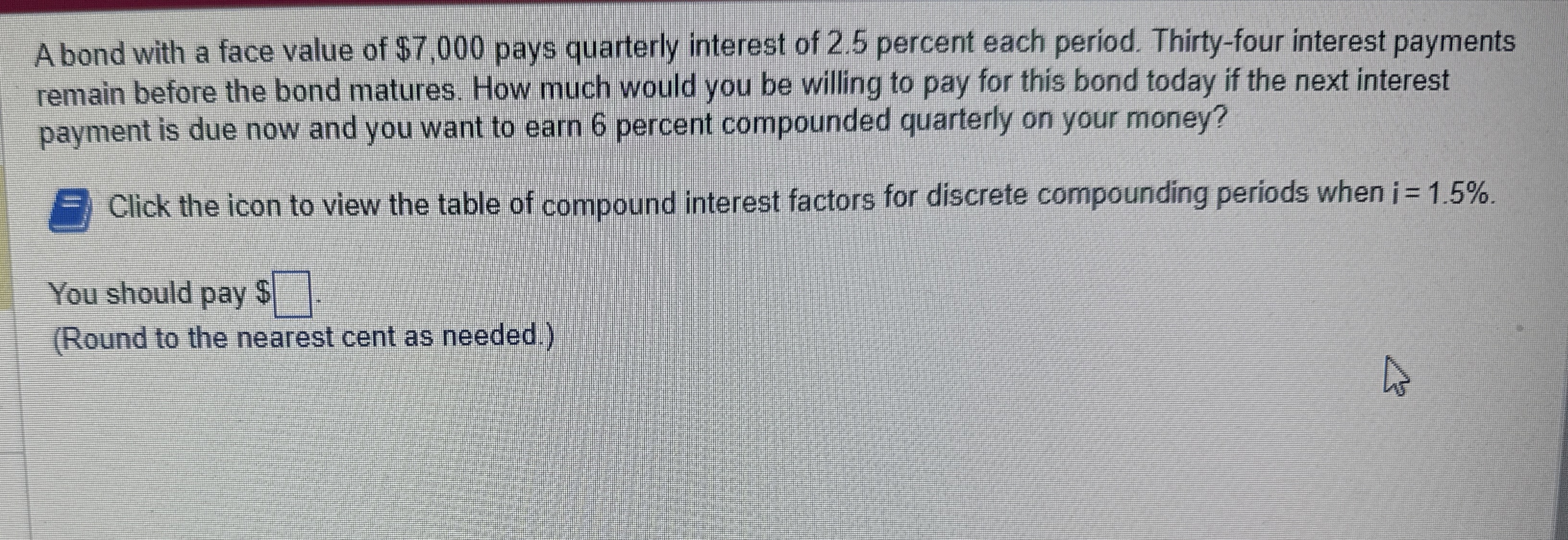

A bond with a face value of $ 7 , 0 0 0 pays quarterly interest of 2 . 5 percent each period. Thirty -

A bond with a face value of $ pays quarterly interest of percent each period. Thirtyfour interest payments remain before the bond matures. How much would you be willing to pay for this bond today if the next interest payment is due now and you want to earn percent compounded quarterly on your money?

Click the icon to view the table of compound interest factors for discrete compounding periods when

You should pay $

Round to the nearest cent as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started