Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A borrower is interested in comparing the monthly payments on two otherwise equivalent 30 year FRMS. Both loans are for $200,000.00 and have a

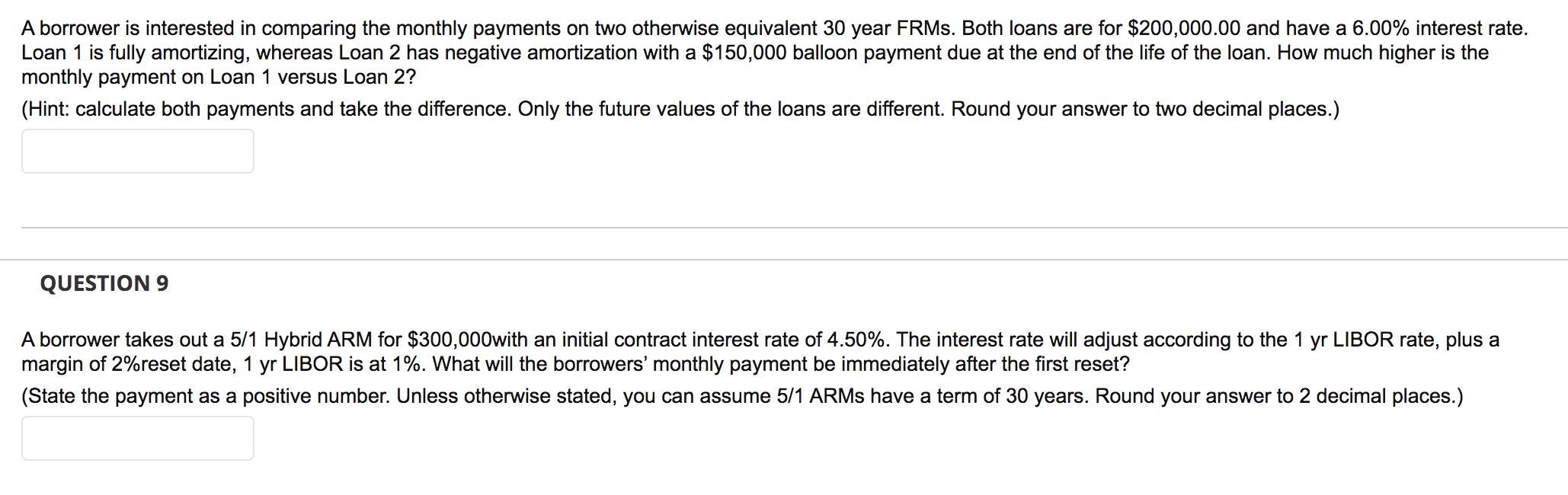

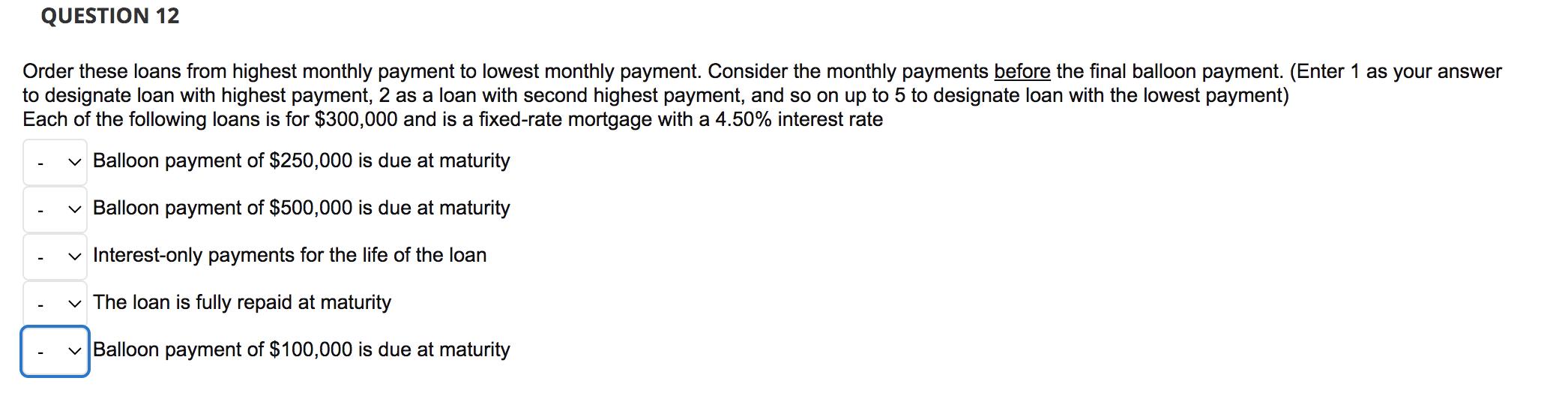

A borrower is interested in comparing the monthly payments on two otherwise equivalent 30 year FRMS. Both loans are for $200,000.00 and have a 6.00% interest rate. Loan 1 is fully amortizing, whereas Loan 2 has negative amortization with a $150,000 balloon payment due at the end of the life of the loan. How much higher is the monthly payment on Loan 1 versus Loan 2? (Hint: calculate both payments and take the difference. Only the future values of the loans are different. Round your answer to two decimal places.) QUESTION 9 A borrower takes out a 5/1 Hybrid ARM for $300,000with an initial contract interest rate of 4.50%. The interest rate will adjust according to the 1 yr LIBOR rate, plus a margin of 2%reset date, 1 yr LIBOR is at 1%. What will the borrowers' monthly payment be immediately after the first reset? (State the payment as a positive number. Unless otherwise stated, you can assume 5/1 ARMS have a term of 30 years. Round your answer to 2 decimal places.) QUESTION 12 Order these loans from highest monthly payment to lowest monthly payment. Consider the monthly payments before the final balloon payment. (Enter 1 as your answer to designate loan with highest payment, 2 as a loan with second highest payment, and so on up to 5 to designate loan with the lowest payment) Each of the following loans is for $300,000 and is a fixed-rate mortgage with a 4.50% interest rate v Balloon payment of $250,000 is due at maturity v Balloon payment of $500,000 is due at maturity v Interest-only payments for the life of the loan v The loan is fully repaid at maturity vBalloon payment of $100,000 is due at maturity

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 EXCEL FORMULA Part 2 Initial monthly payment Monthly payment P x r x 1r n 1r n 1 Loan amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started