Answered step by step

Verified Expert Solution

Question

1 Approved Answer

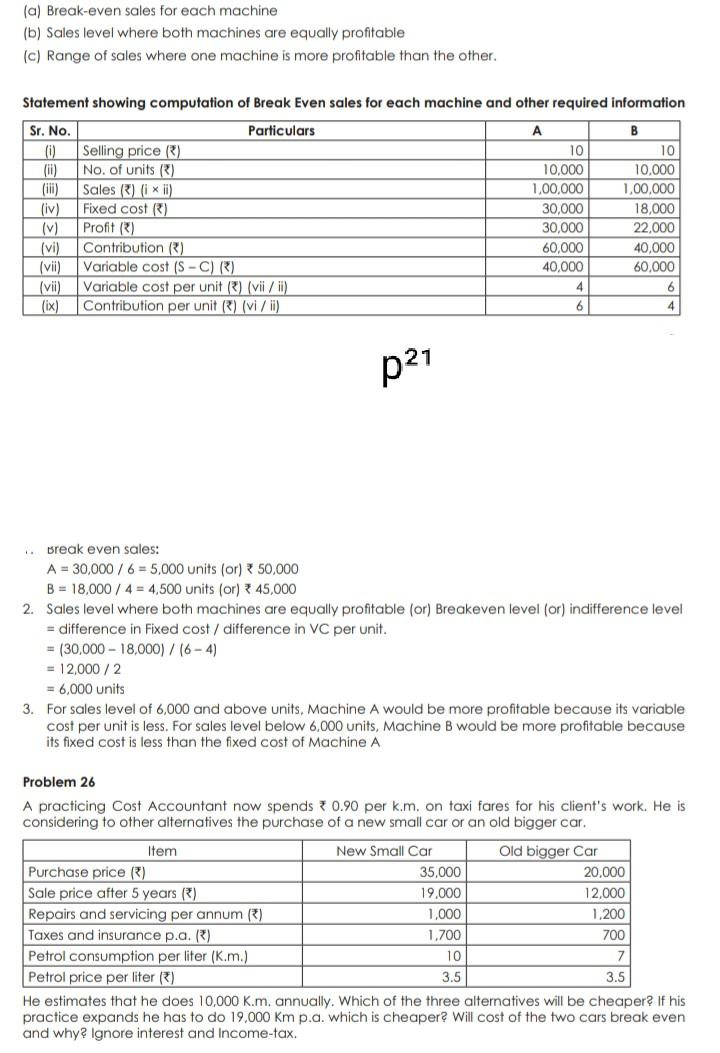

(a) Break-even sales for each machine (b) Sales level where both machines are equally profitable (c) Range of sales where one machine is more profitable

(a) Break-even sales for each machine (b) Sales level where both machines are equally profitable (c) Range of sales where one machine is more profitable than the other. Statement showing computation of Break Even sales for each machine and other required information Sr. No. Particulars B (0) Selling price R) 10 10 No. of units) 10,000 10.000 (iii) Sales (R) ( iii) 1,00,000 1.00,000 (iv) Fixed cost R) 30,000 18,000 (v) Profit (R) 30,000 22.000 (vi) Contribution R) 60,000 40.000 (vii) Variable cost (S-C) (R) 40.000 60,000 (vii) Variable cost per unit (R) (vii/ii) 4 (ix) Contribution per unit() (viii) 6 4 6 p21 break even sales: A = 30,000/ 6 = 5,000 units (or) 50,000 B = 18,000 / 4 = 4,500 units (or) 45,000 2. Sales level where both machines are equally profitable (or) Breakeven level (or) indifference level = difference in Fixed cost / difference in VC per unit. = (30,000 -18,000) / (6-4) = 12,000/2 = 6,000 units 3. For sales level of 6,000 and above units, Machine A would be more profitable because its variable cost per unit is less. For sales level below 6,000 units, Machine B would be more profitable because its fixed cost is less than the fixed cost of Machine A Problem 26 A practicing Cost Accountant now spends 0.90 per k.m. on taxi fares for his client's work. He is considering to other alternatives the purchase of a new small car or an old bigger car, Item New Small Car Old bigger Car Purchase price ) 35,000 20,000 Sale price after 5 years) 19.000 12,000 Repairs and servicing per annum () 1,000 1.200 Taxes and insurance p.a.) 1,700 700 Petrol consumption per liter (K.m.) 10 7 Petrol price per liter (3) 3.5 3.5 He estimates that he does 10,000 K.m. annually. Which of the three alternatives will be cheaper? If his practice expands he has to do 19.000 Km p.a, which is cheaper? Will cost of the two cars break even and why? Ignore interest and Income-tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started