Question

A brewery is considering adding a new line of craft beers to its product mix. The new beer will require additional brewing and bottling capacity

A brewery is considering adding a new line of craft beers to its product mix. The new beer will require additional brewing and bottling capacity at a cost of $15 million, but is expected to generate new sales of $5 million per year for the next 5 years. If the brewery has a cost of capital of 6%, what is the NPV of this investment?

You are considering an investment opportunity that will cost you $20,000 up front, but return $5,000 per year for the next 10 years. What is the IRR for this investment?

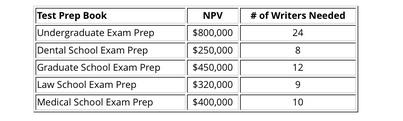

A company that creates education products is planning to create a suite of books to he customers prepare for high-stakes tests for entry into college and grad school. They h house writers to create these books. Due to the expertise needed in creating this content be possible to hire temporary writers within the planned time-frame. Which pro undertaken?

Test Prep Book Undergraduate Exam Prep Dental School Exam Prep Graduate School Exam Prep Law School Exam Prep Medical School Exam Prep NPV $800,000 $250,000 $450,000 $320,000 $400,000 # of Writers Needed 24 8 12 9 10

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each of your questions one by one NPV Calculation for Brewery Investment The Net Present Value NPV of an investment is calculated as foll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started