Answered step by step

Verified Expert Solution

Question

1 Approved Answer

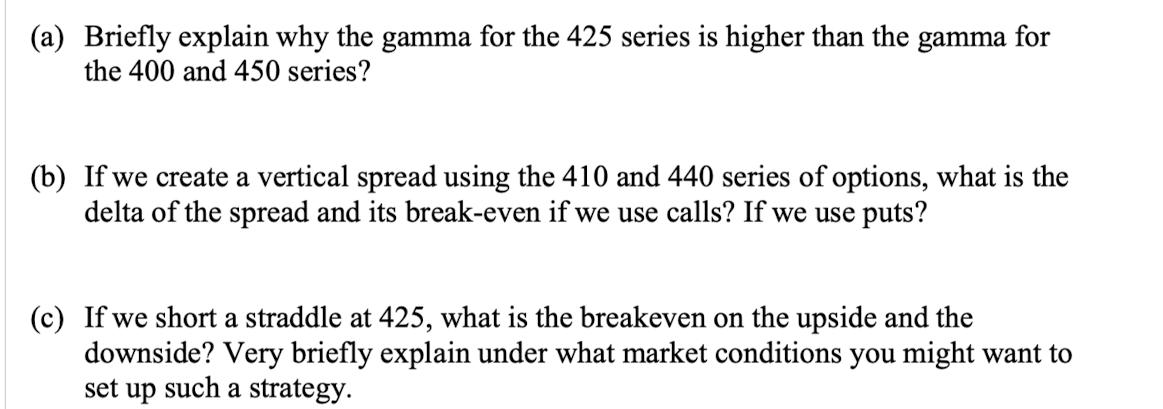

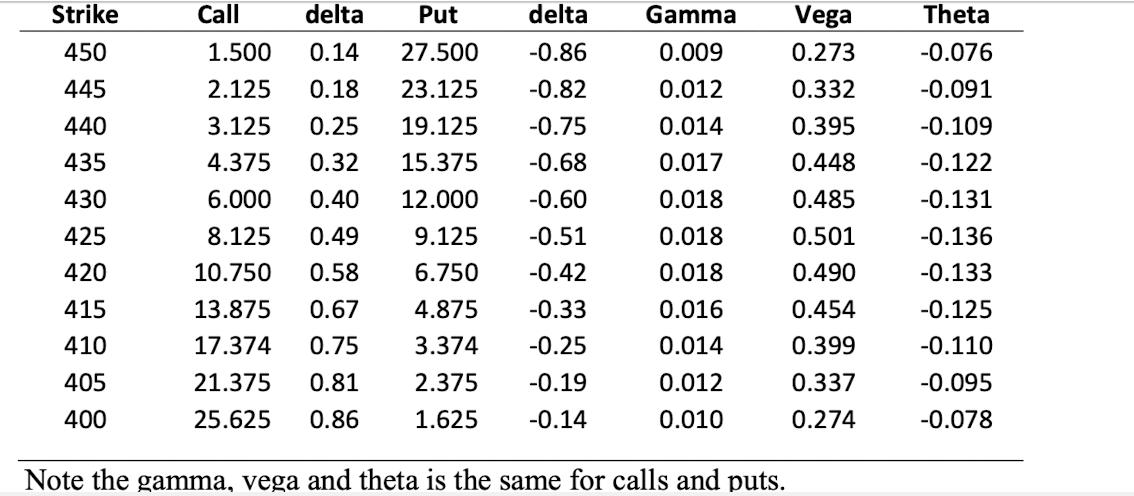

(a) Briefly explain why the gamma for the 425 series is higher than the gamma for the 400 and 450 series? (b) If we

(a) Briefly explain why the gamma for the 425 series is higher than the gamma for the 400 and 450 series? (b) If we create a vertical spread using the 410 and 440 series of options, what is the delta of the spread and its break-even if we use calls? If we use puts? (c) If we short a straddle at 425, what is the breakeven on the upside and the downside? Very briefly explain under what market conditions you might want to set up such a strategy. Strike 450 445 440 435 430 425 420 415 410 405 400 Call delta Put delta 1.500 0.14 27.500 -0.86 2.125 0.18 23.125 -0.82 3.125 0.25 19.125 -0.75 4.375 0.32 15.375 -0.68 6.000 0.40 12.000 -0.60 8.125 0.49 9.125 -0.51 10.750 0.58 6.750 -0.42 13.875 0.67 4.875 -0.33 17.374 0.75 3.374 -0.25 21.375 0.81 2.375 -0.19 25.625 0.86 1.625 -0.14 Gamma 0.009 0.012 0.014 0.017 0.018 0.018 0.018 0.016 0.014 0.012 0.010 Note the gamma, vega and theta is the same for calls and puts. Vega 0.273 0.332 0.395 0.448 0.485 0.501 0.490 0.454 0.399 0.337 0.274 Theta -0.076 -0.091 -0.109 -0.122 -0.131 -0.136 -0.133 -0.125 -0.110 -0.095 -0.078

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The gamma measures the rate of change of an options delta in response to changes in the underlying assets price A higher gamma indicates that the de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started