Answered step by step

Verified Expert Solution

Question

1 Approved Answer

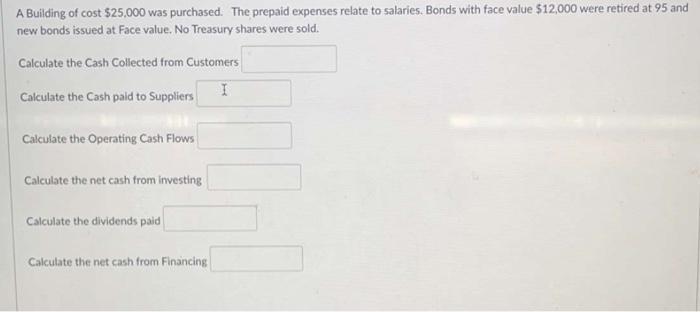

A Building of cost $25,000 was purchased. The prepaid expenses relate to salaries. Bonds with face value $12,000 were retired at 95 and new

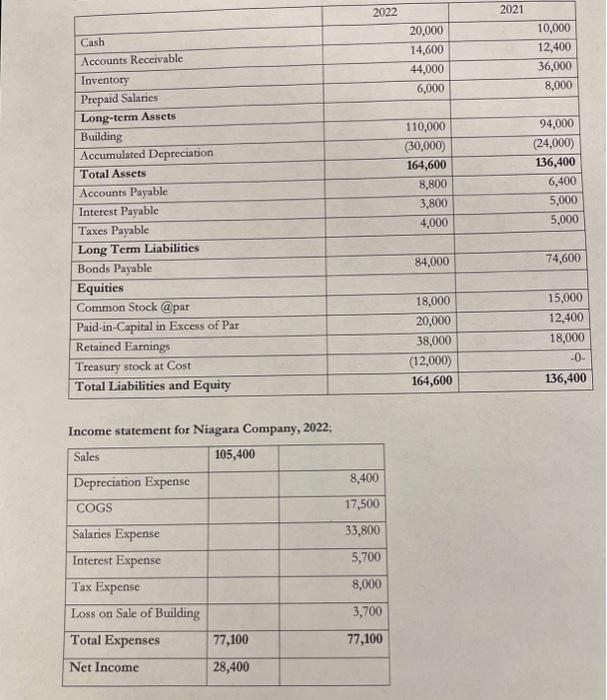

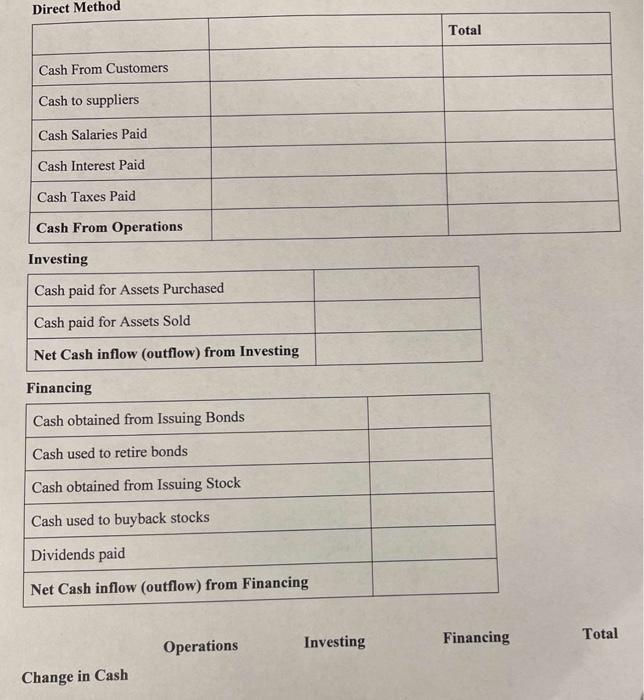

A Building of cost $25,000 was purchased. The prepaid expenses relate to salaries. Bonds with face value $12,000 were retired at 95 and new bonds issued at Face value. No Treasury shares were sold. Calculate the Cash Collected from Customers I Calculate the Cash paid to Suppliers Calculate the Operating Cash Flows Calculate the net cash from investing Calculate the dividends paid Calculate the net cash from Financing Cash Accounts Receivable Inventory Prepaid Salaries Long-term Assets Building Accumulated Depreciation Total Assets Accounts Payable Interest Payable Taxes Payable Long Term Liabilities Bonds Payable Equities Common Stock @par Paid-in-Capital in Excess of Par Retained Earnings Treasury stock at Cost Total Liabilities and Equity Income statement for Niagara Company, 2022; Sales 105,400 Depreciation Expense COGS Salaries Expense Interest Expense Tax Expense Loss on Sale of Building Total Expenses Net Income 77,100 28,400 2022 8,400 17,500 33,800 5,700 8,000 3,700 77,100 20,000 14,600 44,000 6,000 110,000 (30,000) 164,600 8,800 3,800 4,000 84,000 18,000 20,000 38,000 (12,000) 164,600 2021 10,000 12,400 36,000 8,000 94,000 (24,000) 136,400 6,400 5,000 5,000 74,600 15,000 12,400 18,000 -0- 136,400 Direct Method Cash From Customers Cash to suppliers Cash Salaries Paid Cash Interest Paid Cash Taxes Paid Cash From Operations Investing Cash paid for Assets Purchased Cash paid for Assets Sold Net Cash inflow (outflow) from Investing Financing Cash obtained from Issuing Bonds Cash used to retire bonds Cash obtained from Issuing Stock Cash used to buyback stocks Dividends paid Net Cash inflow (outflow) from Financing Change in Cash Operations Investing Total Financing Total

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets calculate each component based on the provided information 1 Cash Collected from Custome...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started