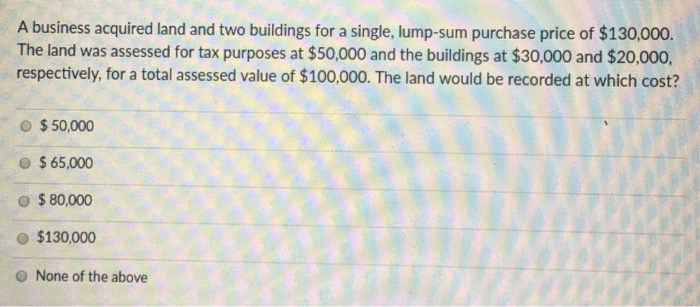

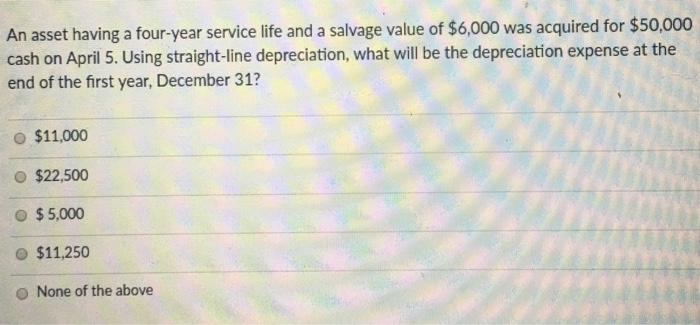

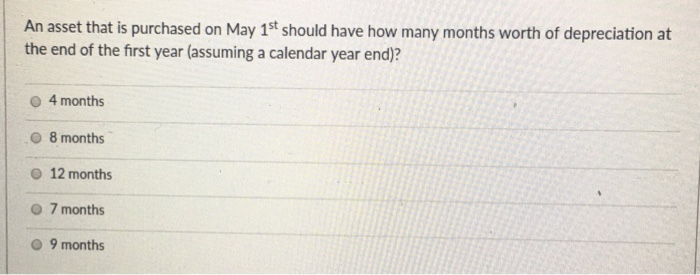

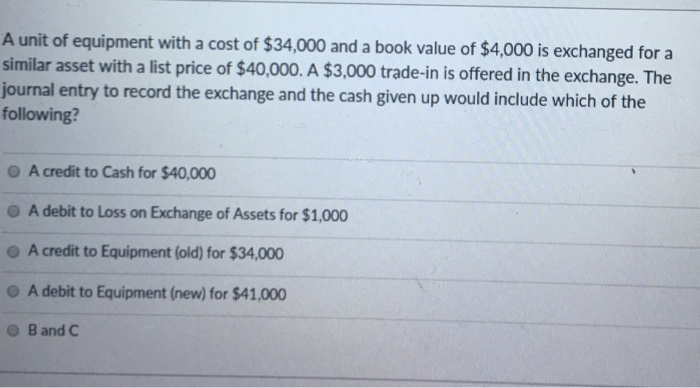

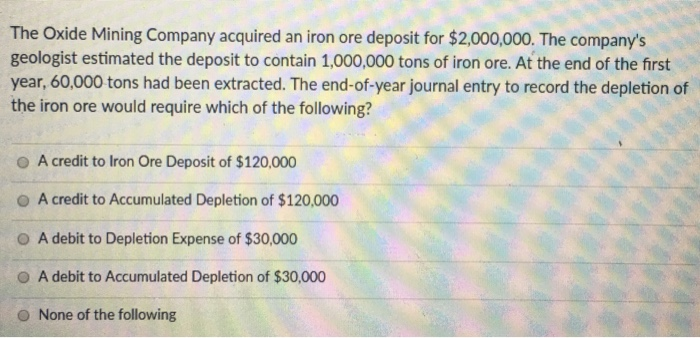

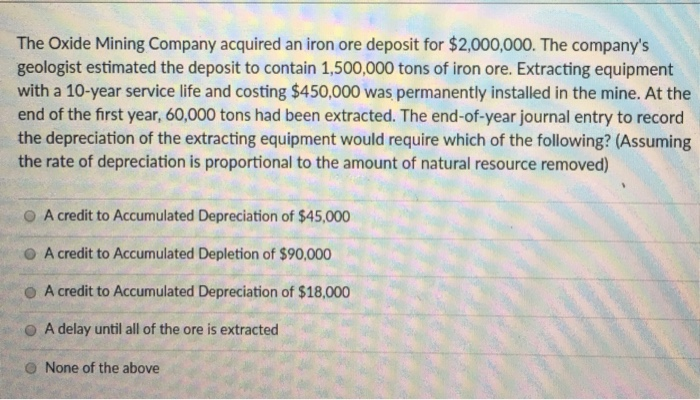

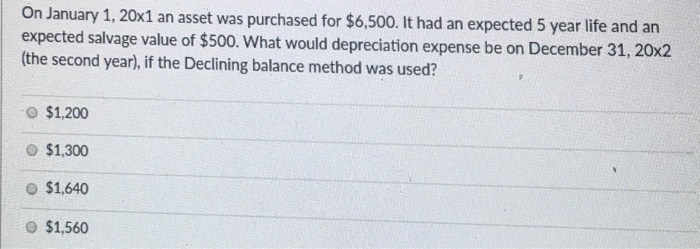

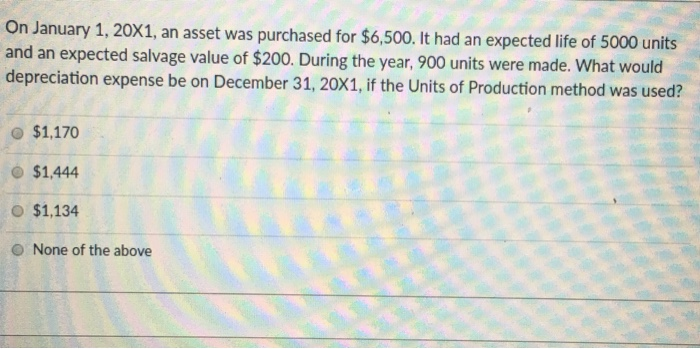

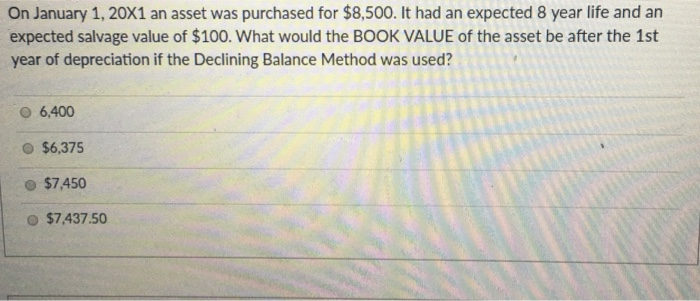

A business acquired land and two buildings for a single, lump-sum purchase price of $130,000. The land was assessed for tax purposes at $50,000 and the buildings at $30,000 and $20,000, respectively, for a total assessed value of $100,000. The land would be recorded at which cost? O $50,000 $65,000 O $ 80,000 o $130,000 O None of the above An asset having a four-year service life and a salvage value of $6,000 was acquired for $50,000 cash on April 5. Using straight-ine depreciation, what will be the depreciation expense at the end of the first year, December 31? o $11,000 o $22,500 $ 5,000 $11,250 O None of the above An asset that is purchased on May 1st should have how many months worth of depreciation at the end of the first year (assuming a calendar year end)? 4 months O 8 months O 12 months O 7 months 9 months hat is the straight-line rate of depreciation for a 5-year asset that has no salvage value? A unit of equipment with a cost of $34,000 and a book value of $4,000 is exchanged for a similar asset with a list price of $40,000. A $3,000 trade-in is offered in the exchange. The journal entry to record the echange and the cash given up would include which of the following? O A credit to Cash for $40,000 A debit to Loss on Exchange of Assets for $1,000 OA credit to Equipment (old) for $34,000 O A debit to Equipment (new) for $41,000 O B and C The Oxide Mining Company acquired an iron ore deposit for $2,000,000. The company's geologist estimated the deposit to contain 1,000,000 tons of iron ore. At the end of the first year, 60,000 tons had been extracted. The end-of-year journal entry to record the depletion of the iron ore would require which of the following? O A credit to Iron Ore Deposit of $120,000 O A credit to Accumulated Depletion of $120,000 O A debit to Depletion Expense of $30,000 O A debit to Accumulated Depletion of $30,000 None of the following The Oxide Mining Company acquired an iron ore deposit for $2,000,000. The company's geologist estimated the deposit to contain 1,500,000 tons of iron ore. Extracting equipment with a 10-year service life and costing $450,000 was permanently installed in the mine. At the end of the first year, 60,000 tons had been extracted. The end-of-year journal entry to record the depreciation of the extracting equipment would require which of the following? (Assuming the rate of depreciation is proportional to the amount of natural resource removed) O A credit to Accumulated Depreciation of $45,000 O A credit to Accumulated Depletion of $90,000 O A credit to Accumulated Depreciation of $18,000 O A delay until all of the ore is extracted O None of the above On January 1, 20x1 an asset was purchased for $6,500. It had an expected 5 year life and an expected salvage value of $500. What would depreciation expense be on December 31, 20x2 (the second year), if the Declining balance method was used? O $1,200 O $1,300 o $1,640 $1,560 On January 1, 20X1, an asset was purchased for $6,500. It had an expected life of 5 and an expected salvage value of $200. During the year, 900 units were made. What would depreciation expense be on December 31, 20X1, if the Units of Production method was used? 000 units O $1,170 $1,444 o $1,134 O None of the above On January 1, 20X1 an asset was purchased for $8,500. It had an expected 8 year life and an expected salvage value of $100. What would the BOOK VALUE of the asset be after the 1st year of depreciation if the Declining Balance Method was used? O 6,400 O $6,375 o $7,450 o $7,437.50