Answered step by step

Verified Expert Solution

Question

1 Approved Answer

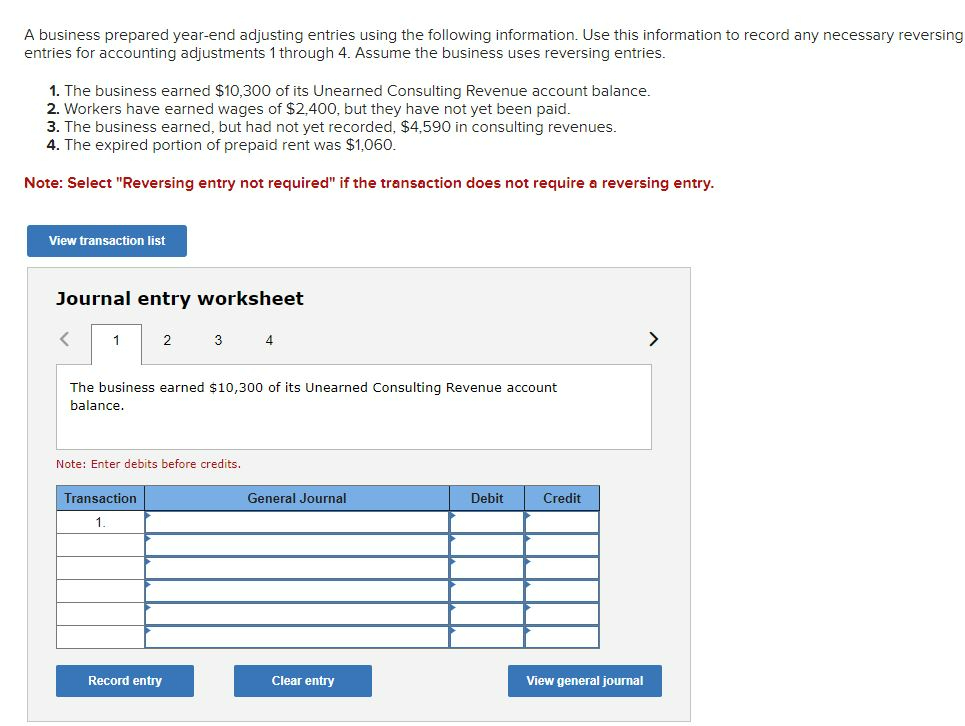

A business prepared year-end adjusting entries using the following information. Use this information to record any necessary reversing entries for accounting adjustments 1 through

A business prepared year-end adjusting entries using the following information. Use this information to record any necessary reversing entries for accounting adjustments 1 through 4. Assume the business uses reversing entries. 1. The business earned $10,300 of its Unearned Consulting Revenue account balance. 2. Workers have earned wages of $2,400, but they have not yet been paid. 3. The business earned, but had not yet recorded, $4,590 in consulting revenues. 4. The expired portion of prepaid rent was $1,060. Note: Select "Reversing entry not required" if the transaction does not require a reversing entry. View transaction list Journal entry worksheet 1 2 3 4 The business earned $10,300 of its Unearned Consulting Revenue account balance. Note: Enter debits before credits. Transaction 1. General Journal Debit Credit Record entry Clear entry View general journal >

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries 1 Unearned Consulting Revenue Debit Cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started