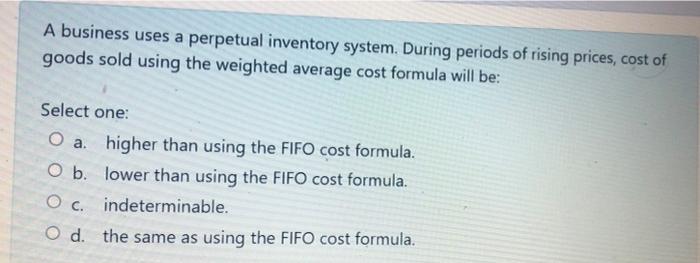

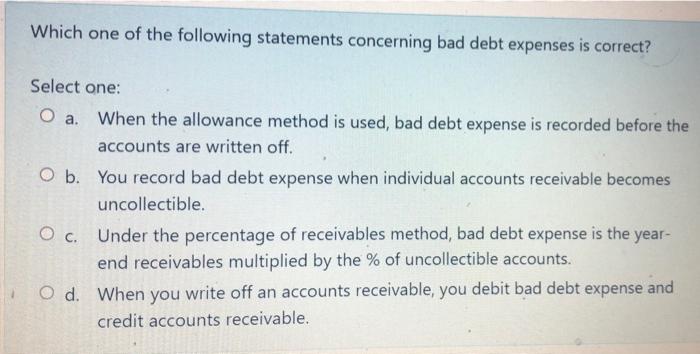

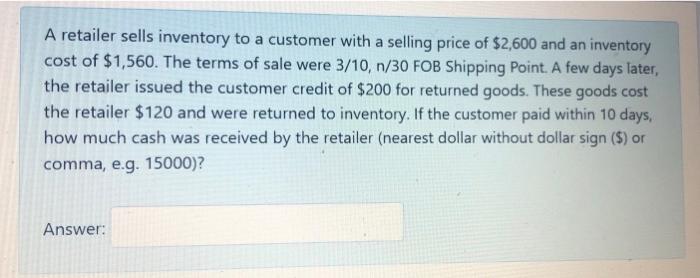

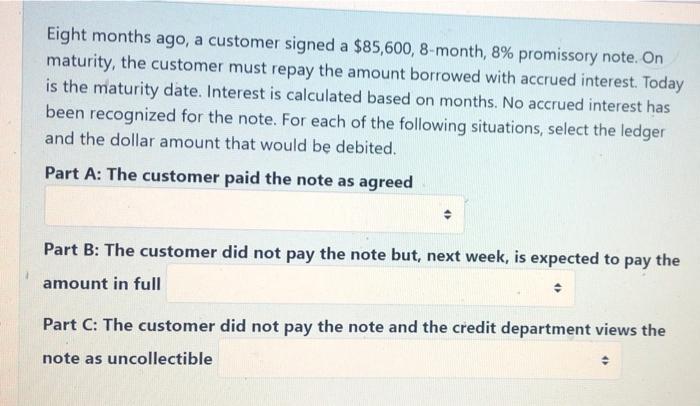

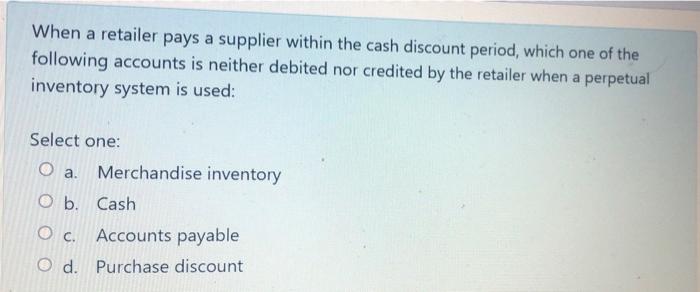

A business uses a perpetual inventory system. During periods of rising prices, cost of goods sold using the weighted average cost formula will be: Select one: O a higher than using the FIFO cost formula. O b. lower than using the FIFO cost formula. O c. indeterminable. Od the same as using the FIFO cost formula. Which one of the following statements concerning bad debt expenses is correct? Select one: O a. When the allowance method is used, bad debt expense is recorded before the accounts are written off. O b. You record bad debt expense when individual accounts receivable becomes uncollectible. Oc. Under the percentage of receivables method, bad debt expense is the year- end receivables multiplied by the % of uncollectible accounts. O d. When you write off an accounts receivable, you debit bad debt expense and credit accounts receivable. A retailer sells inventory to a customer with a selling price of $2,600 and an inventory cost of $1,560. The terms of sale were 3/10, 1/30 FOB Shipping Point. A few days later, the retailer issued the customer credit of $200 for returned goods. These goods cost the retailer $120 and were returned to inventory. If the customer paid within 10 days, how much cash was received by the retailer (nearest dollar without dollar sign ($) or comma, e.g. 15000)? Answer: Eight months ago, a customer signed a $85,600, 8-month, 8% promissory note. On maturity, the customer must repay the amount borrowed with accrued interest. Today is the maturity date. Interest is calculated based on months. No accrued interest has been recognized for the note. For each of the following situations, select the ledger and the dollar amount that would be debited. Part A: The customer paid the note as agreed Part B: The customer did not pay the note but, next week, is expected to pay the amount in full Part C: The customer did not pay the note and the credit department views the note as uncollectible When a retailer pays a supplier within the cash discount period, which one of the following accounts is neither debited nor credited by the retailer when a perpetual inventory system is used: O a Select one: Merchandise inventory O b. Cash O c. Accounts payable O d. Purchase discount