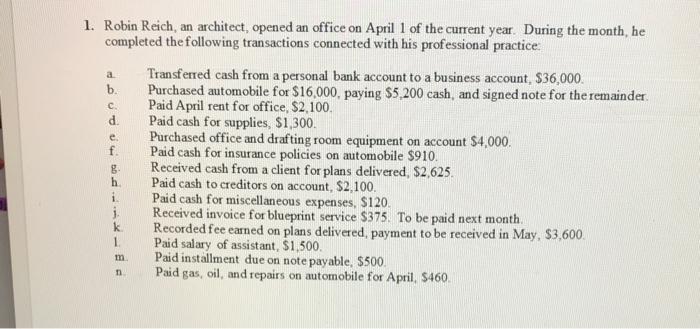

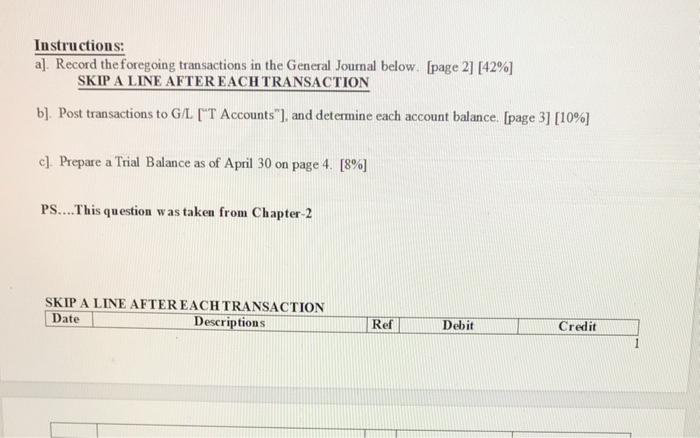

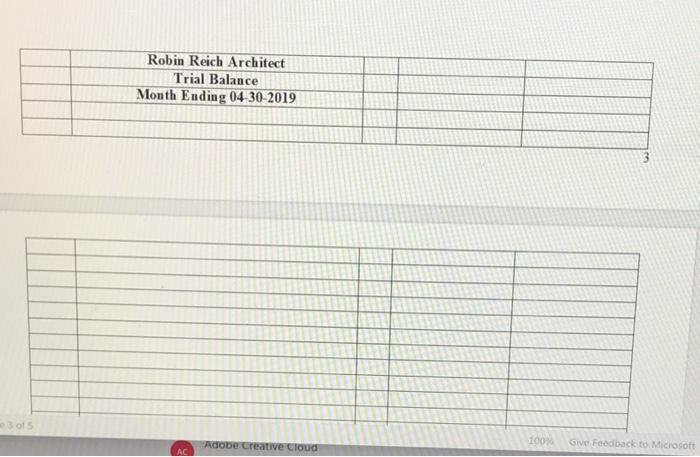

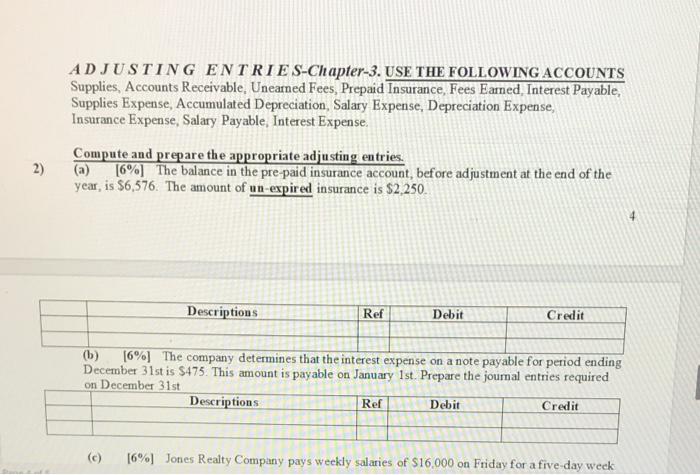

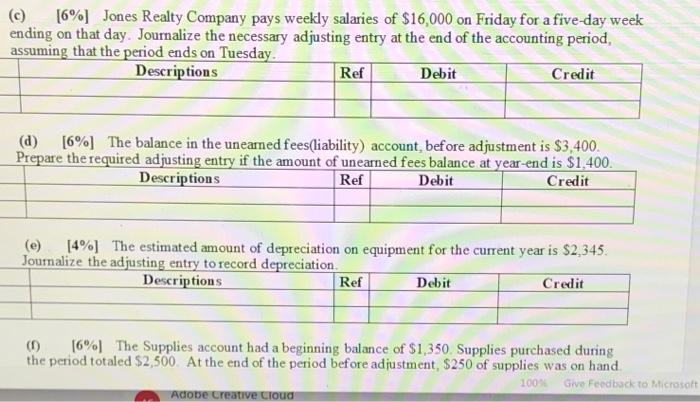

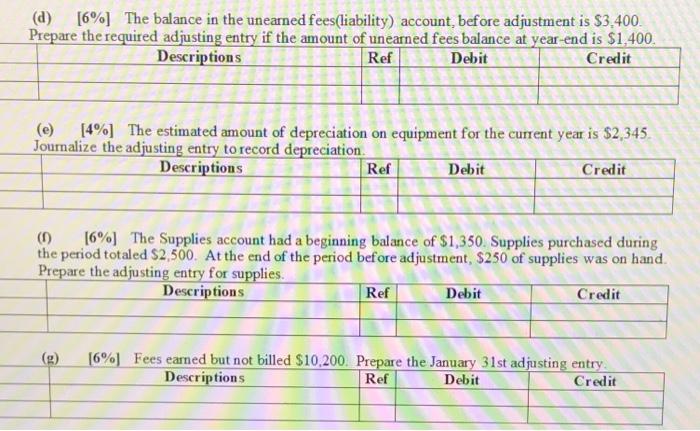

a c d 1. Robin Reich, an architect, opened an office on April 1 of the current year. During the month, he completed the following transactions connected with his professional practice: Transferred cash from a personal bank account to a business account, $36,000. b. Purchased automobile for $16,000, paying $5,200 cash, and signed note for the remainder Paid April rent for office, $2,100. Paid cash for supplies, $1,300. Purchased office and drafting room equipment on account $4,000. Paid cash for insurance policies on automobile $910. Received cash from a client for plans delivered, $2,625 Paid cash to creditors on account, $2,100. Paid cash for miscellaneous expenses, $120. Received invoice for blueprint service $375. To be paid next month Recorded fee earned on plans delivered payment to be received in May, $3,600 Paid salary of assistant, $1,500. Paid installment due on note payable, $500, Paid gas, oil and repairs on automobile for April, $460 e. f g h k 1 m ni Instructions: a]. Record the foregoing transactions in the General Journal below. (page 2] [42%] SKIP A LINE AFTEREACH TRANSACTION b]. Post transactions to G/L ["T Accounts"), and determine each account balance. (page 3] (10%] c). Prepare a Trial Balance as of April 30 on page 4. [8%] PS...This question was taken from Chapter-2 SKIP A LINE AFTEREACH TRANSACTION Date Descriptions Ref Debit Credit 1 Robin Reich Architect Trial Balance Month Ending 04-30-2019 3 of Adobe Creative Cloud 100 Give Feedback to Microsoft AC (c) [6%] Jones Realty Company pays weekly salaries of $16,000 on Friday for a five-day week ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Tuesday Descriptions Ref Debit Credit (d) [6%] The balance in the unearned fees(liability) account, before adjustment is $3,400. Prepare the required adjusting entry if the amount of unearned fees balance at year-end is $1,400. Descriptions Ref Debit Credit (e) [4%] The estimated amount of depreciation on equipment for the current year is $2,345. Journalize the adjusting entry to record depreciation Descriptions Ref Debit Credit (1) 16%) The Supplies account had a beginning balance of $1,350 Supplies purchased during the period totaled $2,500. At the end of the period before adjustment, $250 of supplies was on hand 100 Give Feedback to Microsoft Adobe Creative Cloud (a) [6%] The balance in the unearned fees(liability) account, before adjustment is $3,400 Prepare the required adjusting entry if the amount of unearned fees balance at year-end is $1,400. Descriptions Ref Debit Credit (e) [4%] The estimated amount of depreciation on equipment for the current year is $2,345 Journalize the adjusting entry to record depreciation Descriptions Ref Debit Credit (1) 16%) The Supplies account had a beginning balance of $1,350. Supplies purchased during the period totaled $2,500. At the end of the period before adjustment, $250 of supplies was on hand. Prepare the adjusting entry for supplies. Descriptions Ref Debit Credit (2) [6% Fees earned but not billed $10.200. Prepare the January 31st adjusting entry Descriptions Ref Debit Credit