Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Caclulate the after-tax dollar amount that the transaction is accretive or dilutive (Hint: Subtract adjustments to target net income from target net income) b.

a. Caclulate the after-tax dollar amount that the transaction is accretive or dilutive (Hint: Subtract adjustments to target net income from target net income)

b. What pre-tax synergy amount results in a zero-dilution transaction? (Hint: May be higher or lower than budgeted synergies)

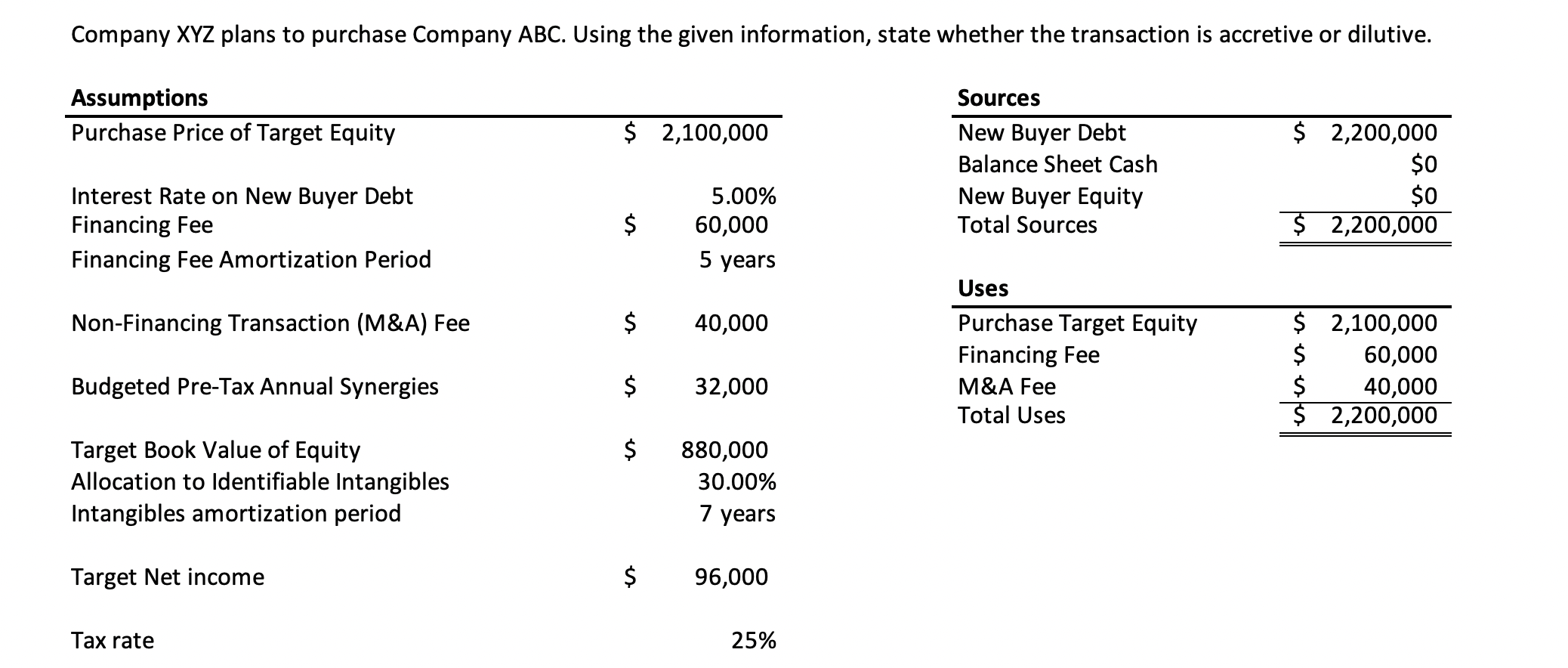

Company XYZ plans to purchase Company ABC. Using the given information, state whether the transaction is accretive or dilutive. Assumptions Purchase Price of Target Equity $ 2,100,000 $ 2,200,000 Sources New Buyer Debt Balance Sheet Cash New Buyer Equity Total Sources $0 Interest Rate on New Buyer Debt Financing Fee Financing Fee Amortization Period 5.00% 60,000 5 years $0 $ 2,200,000 $ Non-Financing Transaction (M&A) Fee $ 40,000 Uses Purchase Target Equity Financing Fee M&A Fee Total Uses $ 2,100,000 60,000 $ 40,000 $ 2,200,000 Budgeted Pre-Tax Annual Synergies $ 32,000 $ Target Book Value of Equity Allocation to Identifiable Intangibles Intangibles amortization period 880,000 30.00% 7 years Target Net income $ 96,000 Tax rate 25% Company XYZ plans to purchase Company ABC. Using the given information, state whether the transaction is accretive or dilutive. Assumptions Purchase Price of Target Equity $ 2,100,000 $ 2,200,000 Sources New Buyer Debt Balance Sheet Cash New Buyer Equity Total Sources $0 Interest Rate on New Buyer Debt Financing Fee Financing Fee Amortization Period 5.00% 60,000 5 years $0 $ 2,200,000 $ Non-Financing Transaction (M&A) Fee $ 40,000 Uses Purchase Target Equity Financing Fee M&A Fee Total Uses $ 2,100,000 60,000 $ 40,000 $ 2,200,000 Budgeted Pre-Tax Annual Synergies $ 32,000 $ Target Book Value of Equity Allocation to Identifiable Intangibles Intangibles amortization period 880,000 30.00% 7 years Target Net income $ 96,000 Tax rate 25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started