Question

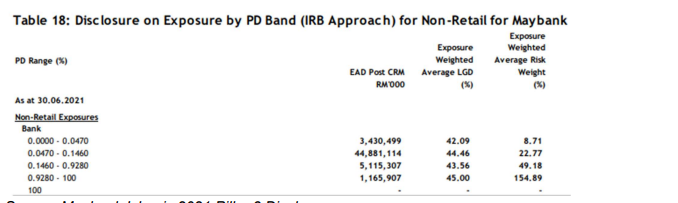

a) Calculate Expected Loss (EL) of exposures at Probability of Default (PD) of 0.04.7% and 0.146% respectively. b) Explain risk appetite of the bank based

a) Calculate Expected Loss (EL) of exposures at Probability of Default (PD) of 0.04.7% and 0.146% respectively.

b) Explain risk appetite of the bank based on the PD of the non-retail exposures.

c) What is the meaning of Loss Given Default (LGD) at 44.6%?

d) Rising interest rates will increase cost of debt servicing and many companies with high PD and LGD may default on their financing obligation. In what way can the investment account fund (IAF) act as a risk mitigant against business fallouts from rising interest rates.

e) Explain how price risk in Tawarruq financing is mitigated and also explain the loss to the bank if price risk is allowed to affect the value of the sale and purchase transactions.

Table 18: Disclosure on Exposure by PD Band (IRB Approach) for Non-Retail for Maybank Table 18: Disclosure on Exposure by PD Band (IRB Approach) for Non-Retail for MaybankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started