Answered step by step

Verified Expert Solution

Question

1 Approved Answer

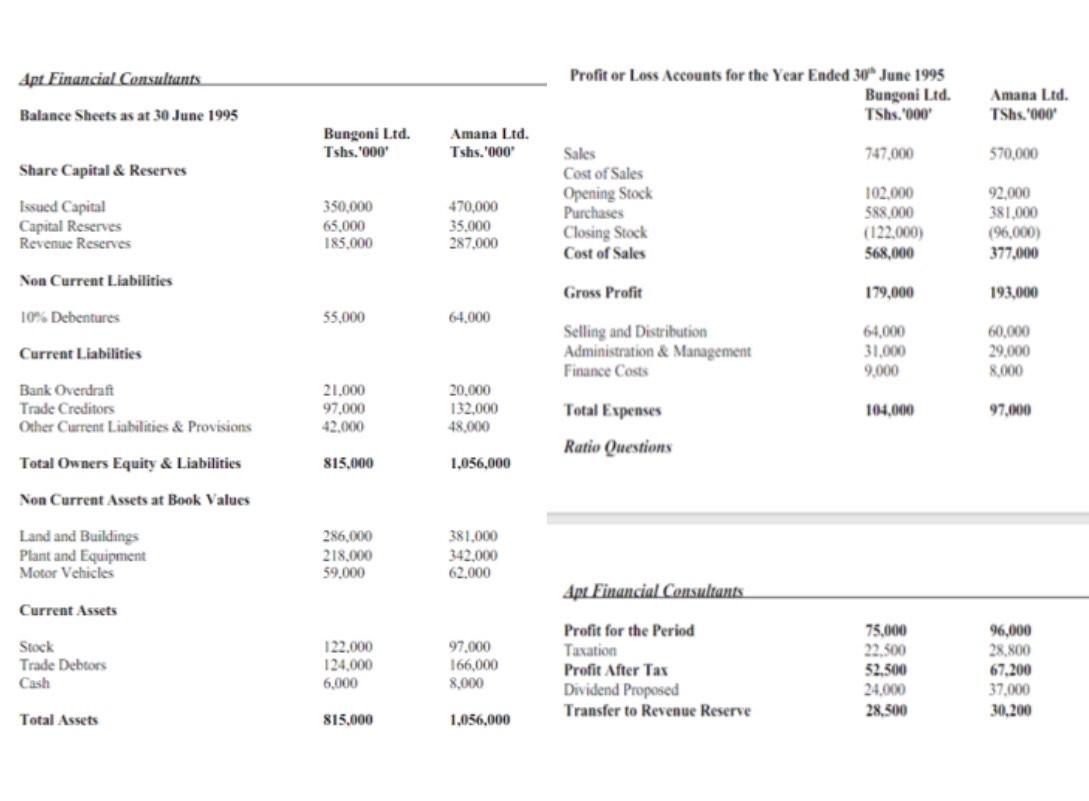

The financial information provided below is for two companies which operate in similar retail fields, using the same business and accounting policies A. Calculate for

The financial information provided below is for two companies which operate in similar retail fields, using the same business and accounting policies

A. Calculate for each company, ratios that shows the financial position, which you consider most appropriate for indicating the efficiency of operations and short-term financial strength of the two firms.

B. interpret the results and point out weaknesses, if, any, in the computations above.

Apt Einancial Consultants Profit or Loss Accounts for the Year Ended 30 June 1995 Bungoni Ltd. TShs. 000 Amana Ltd. TShs. 000 Balance Sheets as at 30 June 1995 Bungoni Ltd. Tshs. '000 Amana Ltd. Tshs.'000 Sales 747,000 570,000 Share Capital & Reserves Cost of Sales Issued Capital Capital Reserves Revenue Reserves 470,000 35,000 287,000 Opening Stock Purchases 102,000 588,000 (122,000) 92,000 381,000 (96,000) 377,000 350,000 65,000 185,000 Closing Stock Cost of Sales 568,000 Non Current Liabilities Gross Profit 179,000 193,000 10% Debentures 55,000 64,000 Selling and Distribution Administration & Management Finance Costs 64,000 31,000 9,000 60,000 29,000 8,000 Current Liabilities Bank Overdraft Trade Creditors Other Current Liabilities & Provisions 21,000 97,000 42,000 20,000 132,000 48,000 Total Expenses 104,000 97,000 Ratio Questions Total Owners Equity & Liabilitie 815,000 1,056,000 Non Current Assets at Book Values Land and Buildings Plant and Equipment Motor Vehicles 286,000 218,000 59,000 381,000 342,000 62.000 Apt Financial Consultants Current Assets 75,000 22,500 52,500 24,000 96,000 28,800 67,200 37,000 30,200 Stock Trade Debtors 97,000 166,000 8,000 Profit for the Period Taxation 122.000 124,000 Profit After Tax Cash 6,000 Dividend Proposed Transfer to Revenue Reserve 28,500 Total Assets 815,000 1,056,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started