Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate Riverside's financial ratios for 2014. Assume that Riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (Hint:

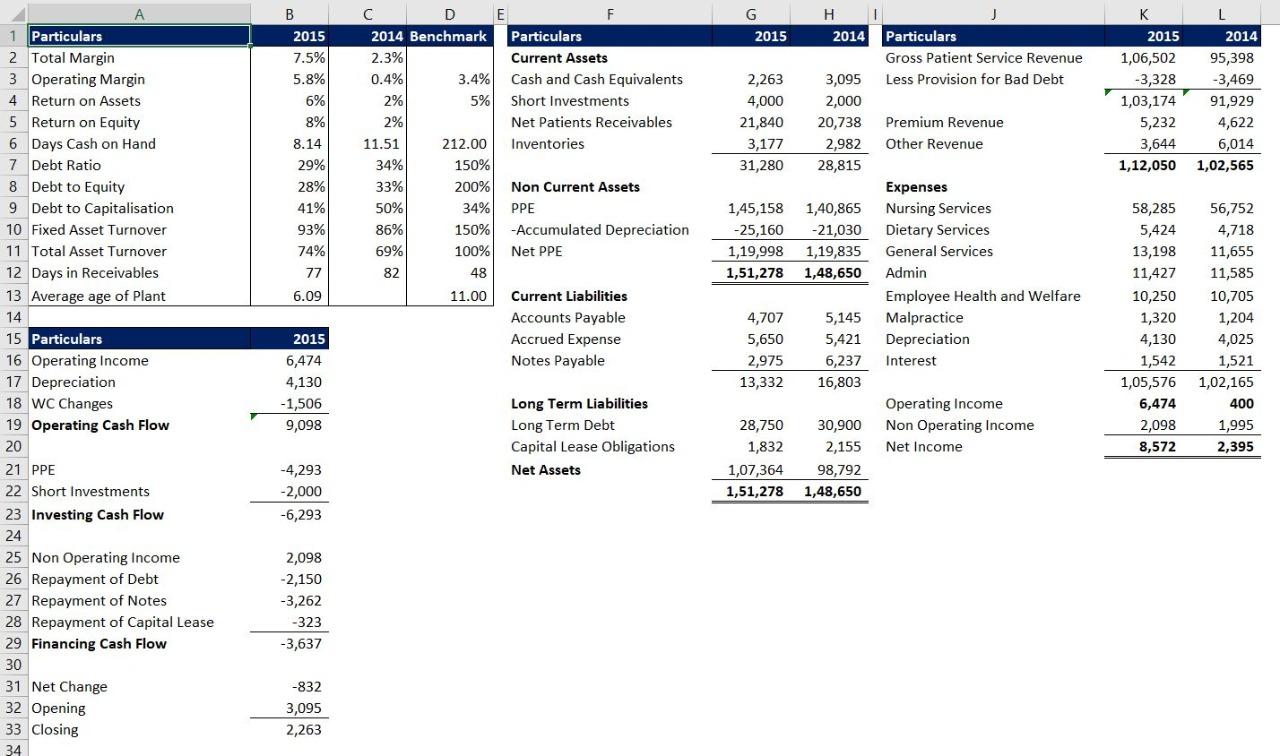

a. Calculate Riverside's financial ratios for 2014. Assume that Riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (Hint: Use the book discussion to identify the applicable ratios.) b. Interpret the ratios. Use both trend and comparative analyses. For the comparative analysis, assume that the industry average data presented in the book are valid for both 2014 and 2015. A B C D E F G H J K L 1 Particulars 2015 2014 Benchmark Particulars 2015 2014 Particulars 2015 2014 2 Total Margin 7.5% 2.3% Current Assets Gross Patient Service Revenue 1,06,502 95,398 3 Operating Margin 5.8% 0.4% 3.4% Cash and Cash Equivalents 2,263 3,095 Less Provision for Bad Debt -3,328 -3,469 4 Return on Assets 6% 2% 5% Short Investments 4,000 2,000 1,03,174 91,929 5 Return on Equity 8% 2% Net Patients Receivables 21,840 20,738 Premium Revenue 5,232 4,622 6 Days Cash on Hand 8.14 11.51 212.00 Inventories 3,177 2,982 Other Revenue 3,644 6,014 7 Debt Ratio 29% 34% 150% 31,280 28,815 1,12,050 1,02,565 8 Debt to Equity 28% 33% 200% Non Current Assets Expenses 9 Debt to Capitalisation 41% 50% 34% PPE 1,45,158 1,40,865 Nursing Services 58,285 56,752 10 Fixed Asset Turnover 93% 86% 150% Accumulated Depreciation -25,160 -21,030 Dietary Services 5,424 4,718 11 Total Asset Turnover 74% 69% 100% Net PPE 1,19,998 1,19,835 General Services 13,198 11,655 12 Days in Receivables 77 82 48 1,51,278 1,48,650 Admin 11,427 11,585 13 Average age of Plant 6.09 11.00 Current Liabilities Employee Health and Welfare 10,250 10,705 14 Accounts Payable 4,707 5,145 Malpractice 1,320 1,204 15 Particulars 2015 Accrued Expense 5,650 5,421 Depreciation 4,130 4,025 16 Operating Income 6,474 Notes Payable 2,975 6,237 Interest 1,542 1,521 17 Depreciation 4,130 13,332 16,803 1,05,576 1,02,165 18 WC Changes -1,506 Long Term Liabilities Operating Income 6,474 400 19 Operating Cash Flow 9,098 Long Term Debt 28,750 30,900 Non Operating Income 2,098 1,995 20 Capital Lease Obligations 1,832 2,155 Net Income 8,572 2,395 21 PPE -4,293 Net Assets 1,07,364 98,792 22 Short Investments -2,000 1,51,278 1,48,650 23 Investing Cash Flow -6,293 24 25 Non Operating Income 2,098 26 Repayment of Debt -2,150 27 Repayment of Notes -3,262 28 Repayment of Capital Lease -323 29 Financing Cash Flow -3,637 30 31 Net Change 32 Opening 33 Closing 34 -832 3,095 2,263

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate Riversides financial ratios for 2014 we need to use the provided data Here are the calculations for the given ratios Total Margin Total Margin Net Income Gross Patient Service Revenue T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started