Question

a) Calculate the effect of the error on opening retained earnings for the year ended 31 December 20X7. b) Prepare the adjusting journal entry in

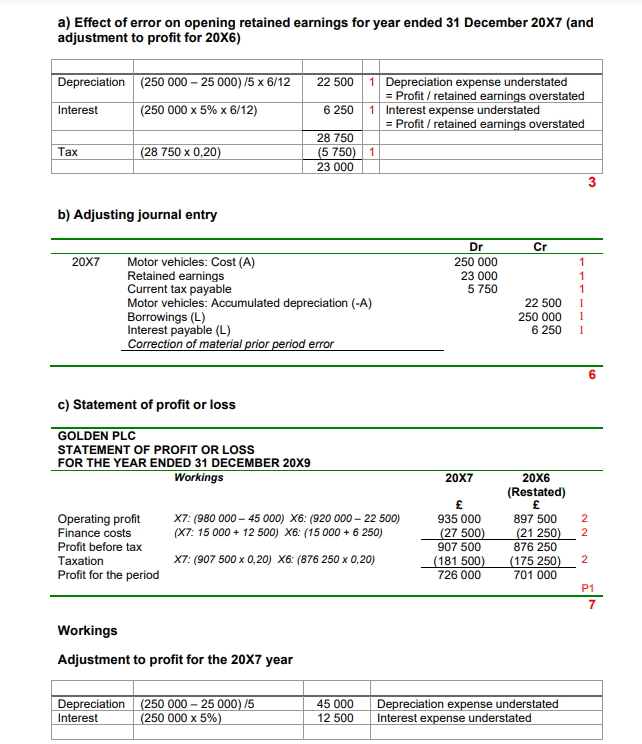

a) Calculate the effect of the error on opening retained earnings for the year ended 31 December 20X7.

b) Prepare the adjusting journal entry in the accounting records of Golden plc for the year ended 31 December 20X7 in relation to the error. Narration is not required.

c) Prepare the statement of profit or loss of Golden plc for the year ended 31 December 20X7, in accordance with International Financial Reporting Standards. Begin the statement of profit or loss with operating profit. Comparative amounts are required.

I have attached the answer, i just want to understand the concepts behind everything and how the workings are done in detail.

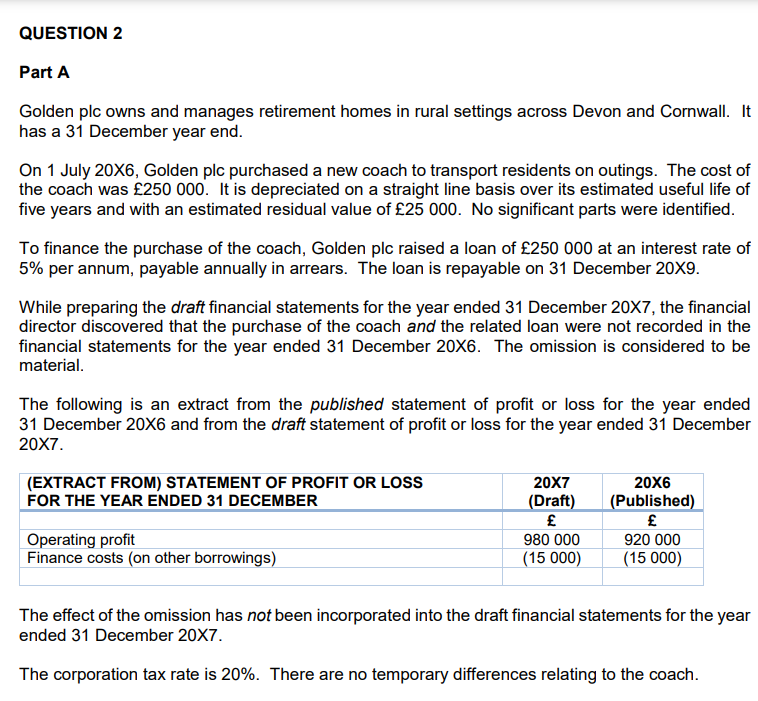

Golden plc owns and manages retirement homes in rural settings across Devon and Cornwall. It has a 31 December year end. On 1 July 20X6, Golden plc purchased a new coach to transport residents on outings. The cost of the coach was \\( 250000 \\). It is depreciated on a straight line basis over its estimated useful life of five years and with an estimated residual value of \\( 25000 \\). No significant parts were identified. To finance the purchase of the coach, Golden plc raised a loan of \\( 250000 \\) at an interest rate of \5 per annum, payable annually in arrears. The loan is repayable on 31 December 20X9. While preparing the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\), the financial director discovered that the purchase of the coach and the related loan were not recorded in the financial statements for the year ended 31 December 20X6. The omission is considered to be material. The following is an extract from the published statement of profit or loss for the year ended 31 December \\( 20 \\times 6 \\) and from the draft statement of profit or loss for the year ended 31 December \\( 20 \\times 7 \\). The effect of the omission has not been incorporated into the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\). The corporation tax rate is \20. There are no temporary differences relating to the coach. a) Effect of error on opening retained earnings for year ended 31 December \\( 20 \\times 7 \\) (and adjustment to profit for \\( 20 \\times 6 \\) ) b) Adjusting journal entry 6 c) Statement of profit or loss Workings Adjustment to profit for the \\( 20 \\times 7 \\) year Golden plc owns and manages retirement homes in rural settings across Devon and Cornwall. It has a 31 December year end. On 1 July 20X6, Golden plc purchased a new coach to transport residents on outings. The cost of the coach was \\( 250000 \\). It is depreciated on a straight line basis over its estimated useful life of five years and with an estimated residual value of \\( 25000 \\). No significant parts were identified. To finance the purchase of the coach, Golden plc raised a loan of \\( 250000 \\) at an interest rate of \5 per annum, payable annually in arrears. The loan is repayable on 31 December 20X9. While preparing the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\), the financial director discovered that the purchase of the coach and the related loan were not recorded in the financial statements for the year ended 31 December 20X6. The omission is considered to be material. The following is an extract from the published statement of profit or loss for the year ended 31 December \\( 20 \\times 6 \\) and from the draft statement of profit or loss for the year ended 31 December \\( 20 \\times 7 \\). The effect of the omission has not been incorporated into the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\). The corporation tax rate is \20. There are no temporary differences relating to the coach. a) Effect of error on opening retained earnings for year ended 31 December \\( 20 \\times 7 \\) (and adjustment to profit for \\( 20 \\times 6 \\) ) b) Adjusting journal entry 6 c) Statement of profit or loss Workings Adjustment to profit for the \\( 20 \\times 7 \\) year

Golden plc owns and manages retirement homes in rural settings across Devon and Cornwall. It has a 31 December year end. On 1 July 20X6, Golden plc purchased a new coach to transport residents on outings. The cost of the coach was \\( 250000 \\). It is depreciated on a straight line basis over its estimated useful life of five years and with an estimated residual value of \\( 25000 \\). No significant parts were identified. To finance the purchase of the coach, Golden plc raised a loan of \\( 250000 \\) at an interest rate of \5 per annum, payable annually in arrears. The loan is repayable on 31 December 20X9. While preparing the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\), the financial director discovered that the purchase of the coach and the related loan were not recorded in the financial statements for the year ended 31 December 20X6. The omission is considered to be material. The following is an extract from the published statement of profit or loss for the year ended 31 December \\( 20 \\times 6 \\) and from the draft statement of profit or loss for the year ended 31 December \\( 20 \\times 7 \\). The effect of the omission has not been incorporated into the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\). The corporation tax rate is \20. There are no temporary differences relating to the coach. a) Effect of error on opening retained earnings for year ended 31 December \\( 20 \\times 7 \\) (and adjustment to profit for \\( 20 \\times 6 \\) ) b) Adjusting journal entry 6 c) Statement of profit or loss Workings Adjustment to profit for the \\( 20 \\times 7 \\) year Golden plc owns and manages retirement homes in rural settings across Devon and Cornwall. It has a 31 December year end. On 1 July 20X6, Golden plc purchased a new coach to transport residents on outings. The cost of the coach was \\( 250000 \\). It is depreciated on a straight line basis over its estimated useful life of five years and with an estimated residual value of \\( 25000 \\). No significant parts were identified. To finance the purchase of the coach, Golden plc raised a loan of \\( 250000 \\) at an interest rate of \5 per annum, payable annually in arrears. The loan is repayable on 31 December 20X9. While preparing the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\), the financial director discovered that the purchase of the coach and the related loan were not recorded in the financial statements for the year ended 31 December 20X6. The omission is considered to be material. The following is an extract from the published statement of profit or loss for the year ended 31 December \\( 20 \\times 6 \\) and from the draft statement of profit or loss for the year ended 31 December \\( 20 \\times 7 \\). The effect of the omission has not been incorporated into the draft financial statements for the year ended 31 December \\( 20 \\times 7 \\). The corporation tax rate is \20. There are no temporary differences relating to the coach. a) Effect of error on opening retained earnings for year ended 31 December \\( 20 \\times 7 \\) (and adjustment to profit for \\( 20 \\times 6 \\) ) b) Adjusting journal entry 6 c) Statement of profit or loss Workings Adjustment to profit for the \\( 20 \\times 7 \\) year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started