Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Calculate the following values for the investment proposal: (i) Net present value; (ii) Internal rate of return, and; (iii) Return on capital employed (accounting

(a) Calculate the following values for the investment proposal:

(i) Net present value;

(ii) Internal rate of return, and;

(iii) Return on capital employed (accounting rate of return) based on average investment.

(b) Discuss your findings in each section of (a) above and advise whether the investment proposal is financially acceptable.

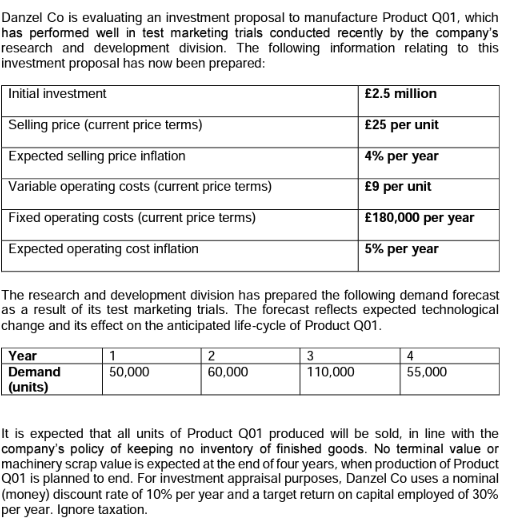

Danzel Co is evaluating an investment proposal to manufacture Product Q01, which has performed well in test marketing trials conducted recently by the company's research and development division. The following information relating to this investment proposal has now been prepared: The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product Q01. It is expected that all units of Product Q01 produced will be sold, in line with the company's policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product Q01 is planned to end. For investment appraisal purposes, Danzel Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started