Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a, Calculate the modified duration statistic for the Transocean bond (highlighted on the next page). The bond has a face value of $1,000. b, The

a, Calculate the modified duration statistic for the Transocean bond (highlighted on the next page). The bond has a face value of $1,000.

a, Calculate the modified duration statistic for the Transocean bond (highlighted on the next page). The bond has a face value of $1,000.

b, The Transocean bond contain a call option which allows Transocean to call the bond in April 2020. Given the information in the artical, how does the call option affect the risk to the bondholder (your client)?

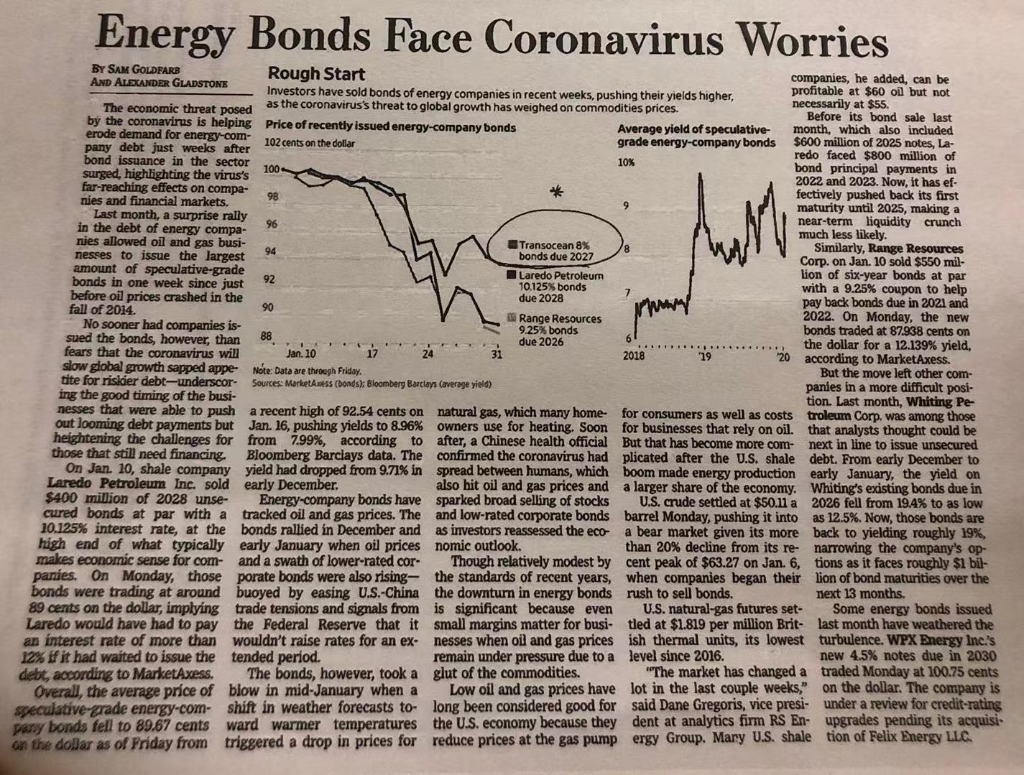

Energy Bonds Face Coronavirus Worries 2018 BY SAM GOLDFARB Rough Start companies, he added, can be AND ALEXANDER GLADSTONE Investors have sold bonds of energy companies in recent weeks, pushing their yields higher, profitable at $60 od but not as the coronavirus's threat to global growth has weighed on commodities prices. The economic threat posed necessarily at $55. by the coronavirus is helping Before its bond sale last Price of recently issued energy-company bonds Average yield of speculative month, which also included erode demand for energy-com- 102 cents on the dollar grade energy-company bonds $600 million of 2025 notes, La- pany debt just weeks after redo faced $800 million of bond issuance in the sector 10% 100 bond principal payments in surged, highlighting the virus's 2022 and 2023. Now, it has ef- far-reaching effects on compa- fectively pushed back its first nies and financial markets. maturity until 2025, making a Last month, a surprise rally near-term liquidity crunch in the debt of energy compa- much less likely. nies allowed oil and gas busi- Transocean 8% Similarly, Range Resources nesses to issue the largest bonds due 2027 Corp. on Jan. 10 sold $550 mil- amount of speculative-grade Laredo Petroleum lion of six-year bonds at par bonds in one week since just 10.125% bonds with a 9.25% coupon to help before oil prices crashed in the due 2028 pay back bonds due in 2021 and fall of 2014. Range Resources 2022. On Monday, the new No sooner had companies is- 9.25% bonds bonds traded at 87.938 cents on sued the bonds, however, than 88 due 2026 the dollar for a 12.139% yield, fears that the coronavirus will Jan. 10 17 24 31 according to MarketAxess. slow global growth sapped appe- Note: Data are through Friday. But the move left other com- tite for risider debt-underscor Sources: Markets (bonds) Bloomberg Barclays Coverage yield) panies in a more difficult posi- ing the good timing of the busi- tion. Last month, Whiting Pe- nesses that were able to push a recent high of 92.54 cents on natural gas, which many home for consumers as well as costs troleum Corp. was among those out looming debt payments but Jan. 16, pushing yields to 8.96% owners use for heating. Soon for businesses that rely on oil. that analysts thought could be heightening the challenges for from 7.99%, according to after, a Chinese health official But that has become more com- next in line to issue unsecured those that still need financing, Bloomberg Barclays data. The confirmed the coronavirus had plicated after the U.S. shale debt. From early December to On Jan. 10, shale company yield had dropped from 9.71% in spread between humans, which boom made energy production early January, the yield on Laredo Petroleum Inc. sold early December also hit oil and gas prices and a larger share of the economy. Whiting's existing bonds due in $400 million of 2028 unse- Energy-company bonds have sparked broad selling of stocks U.S. crude settled at $50.11 a 2026 fell from 19.4% to as low cured bonds at par with a tracked oil and gas prices. The and low-rated corporate bonds barrel Monday, pushing it into as 12.5%. Now, those bonds are 10.125% interest rate, at the bonds rallied in December and as investors reassessed the eco a bear market given its more back to yielding roughly 19%, high end of what typically early January when oil prices nomic outlook. than 20% decline from its re- narrowing the company's op makes economic sense for com- and a swath of lower-rated cor. Though relatively modest by cent peak of $63.27 on Jan. 6, tions as it faces roughly $1 bil- panies. On Monday, those porate bonds were also rising- the standards of recent years, when companies began their lion of bond maturities over the bonds were trading at around buoyed by easing U.S.-China the downturn in energy bonds rush to sell bonds. next 13 months. 89 cents on the dollar, implying trade tensions and signals from is significant because even U.S. natural-gas futures set. Some energy bonds issued Laredo would have had to pay the Federal Reserve that it small margins matter for busi- tled at $1.819 per million Brit- last month have weathered the an interest rate of more than wouldn't raise rates for an ex- nesses when oil and gas prices ish thermal units, its lowest turbulence. WPX Energy Inc.'s 12% it had waited to issue the tended period. remain under pressure due to a level since 2016 new 4.5% notes due in 2030 debt, according to MarketAxess. The bonds, however, took a glut of the commodities. "The market has changed a traded Monday at 100.75 cents Overall, the average price of blow in mid-January when a Low oil and gas prices have lot in the last couple weeks," on the dollar. The company is speculative-prade energy-com- shift in weather forecasts to long been considered good for said Dane Gregoris, vice presi- under a review for credit rating pary bonds fell to 89.67 cents ward warmer temperatures the U.S. economy because they dent at analytics firm RS En upgrades pending its acquisi on the dollar as of Friday from triggered a drop in prices for reduce prices at the gas pump ergy Group. Mary U.S. shale tion of Felix Energy LLC Energy Bonds Face Coronavirus Worries 2018 BY SAM GOLDFARB Rough Start companies, he added, can be AND ALEXANDER GLADSTONE Investors have sold bonds of energy companies in recent weeks, pushing their yields higher, profitable at $60 od but not as the coronavirus's threat to global growth has weighed on commodities prices. The economic threat posed necessarily at $55. by the coronavirus is helping Before its bond sale last Price of recently issued energy-company bonds Average yield of speculative month, which also included erode demand for energy-com- 102 cents on the dollar grade energy-company bonds $600 million of 2025 notes, La- pany debt just weeks after redo faced $800 million of bond issuance in the sector 10% 100 bond principal payments in surged, highlighting the virus's 2022 and 2023. Now, it has ef- far-reaching effects on compa- fectively pushed back its first nies and financial markets. maturity until 2025, making a Last month, a surprise rally near-term liquidity crunch in the debt of energy compa- much less likely. nies allowed oil and gas busi- Transocean 8% Similarly, Range Resources nesses to issue the largest bonds due 2027 Corp. on Jan. 10 sold $550 mil- amount of speculative-grade Laredo Petroleum lion of six-year bonds at par bonds in one week since just 10.125% bonds with a 9.25% coupon to help before oil prices crashed in the due 2028 pay back bonds due in 2021 and fall of 2014. Range Resources 2022. On Monday, the new No sooner had companies is- 9.25% bonds bonds traded at 87.938 cents on sued the bonds, however, than 88 due 2026 the dollar for a 12.139% yield, fears that the coronavirus will Jan. 10 17 24 31 according to MarketAxess. slow global growth sapped appe- Note: Data are through Friday. But the move left other com- tite for risider debt-underscor Sources: Markets (bonds) Bloomberg Barclays Coverage yield) panies in a more difficult posi- ing the good timing of the busi- tion. Last month, Whiting Pe- nesses that were able to push a recent high of 92.54 cents on natural gas, which many home for consumers as well as costs troleum Corp. was among those out looming debt payments but Jan. 16, pushing yields to 8.96% owners use for heating. Soon for businesses that rely on oil. that analysts thought could be heightening the challenges for from 7.99%, according to after, a Chinese health official But that has become more com- next in line to issue unsecured those that still need financing, Bloomberg Barclays data. The confirmed the coronavirus had plicated after the U.S. shale debt. From early December to On Jan. 10, shale company yield had dropped from 9.71% in spread between humans, which boom made energy production early January, the yield on Laredo Petroleum Inc. sold early December also hit oil and gas prices and a larger share of the economy. Whiting's existing bonds due in $400 million of 2028 unse- Energy-company bonds have sparked broad selling of stocks U.S. crude settled at $50.11 a 2026 fell from 19.4% to as low cured bonds at par with a tracked oil and gas prices. The and low-rated corporate bonds barrel Monday, pushing it into as 12.5%. Now, those bonds are 10.125% interest rate, at the bonds rallied in December and as investors reassessed the eco a bear market given its more back to yielding roughly 19%, high end of what typically early January when oil prices nomic outlook. than 20% decline from its re- narrowing the company's op makes economic sense for com- and a swath of lower-rated cor. Though relatively modest by cent peak of $63.27 on Jan. 6, tions as it faces roughly $1 bil- panies. On Monday, those porate bonds were also rising- the standards of recent years, when companies began their lion of bond maturities over the bonds were trading at around buoyed by easing U.S.-China the downturn in energy bonds rush to sell bonds. next 13 months. 89 cents on the dollar, implying trade tensions and signals from is significant because even U.S. natural-gas futures set. Some energy bonds issued Laredo would have had to pay the Federal Reserve that it small margins matter for busi- tled at $1.819 per million Brit- last month have weathered the an interest rate of more than wouldn't raise rates for an ex- nesses when oil and gas prices ish thermal units, its lowest turbulence. WPX Energy Inc.'s 12% it had waited to issue the tended period. remain under pressure due to a level since 2016 new 4.5% notes due in 2030 debt, according to MarketAxess. The bonds, however, took a glut of the commodities. "The market has changed a traded Monday at 100.75 cents Overall, the average price of blow in mid-January when a Low oil and gas prices have lot in the last couple weeks," on the dollar. The company is speculative-prade energy-com- shift in weather forecasts to long been considered good for said Dane Gregoris, vice presi- under a review for credit rating pary bonds fell to 89.67 cents ward warmer temperatures the U.S. economy because they dent at analytics firm RS En upgrades pending its acquisi on the dollar as of Friday from triggered a drop in prices for reduce prices at the gas pump ergy Group. Mary U.S. shale tion of Felix Energy LLCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started