Answered step by step

Verified Expert Solution

Question

1 Approved Answer

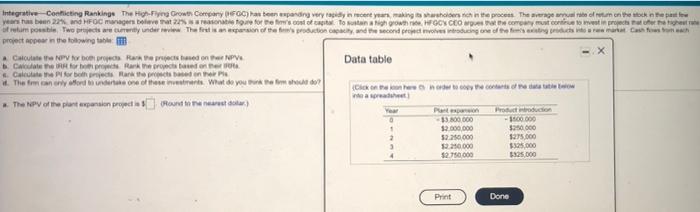

A. calculate the NPV for both projects. Rank based on their NPVs. B. calulate the IRR for both projects. Rank the projects based on their

A. calculate the NPV for both projects. Rank based on their NPVs.

Integrative Conflicting Rankings The High Flying Gowes Comparate pendra very tapinyanga hononte procent. The average rate of an enten tepele years to be 22. HOC gera berrette for most of it to stanih growth HFCX CEO theory continue in projecte of retum post worden under review. The fanno trudio da and the second project when one of the Cash project on the following them Calculate the NPV for borc Reputed on NPV b. Cal her for pro Rank the projected on the Data table Call for both projects and the The can only word as one of the Wat do you komedor Click on the We are The Poeporteron precis Round tons or Pan - 3300 000 360000 2.000.000 550.000 2 52.250.000 1275.000 20.000 $2.750 000 $325.000 3 4 Print Done B. calulate the IRR for both projects. Rank the projects based on their IRRs.

C. calculate the PI for both projects. Rank the projects based on their PIs.

D. the firm can only afford to undertake one of these investments. what do you think the firm should do?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started