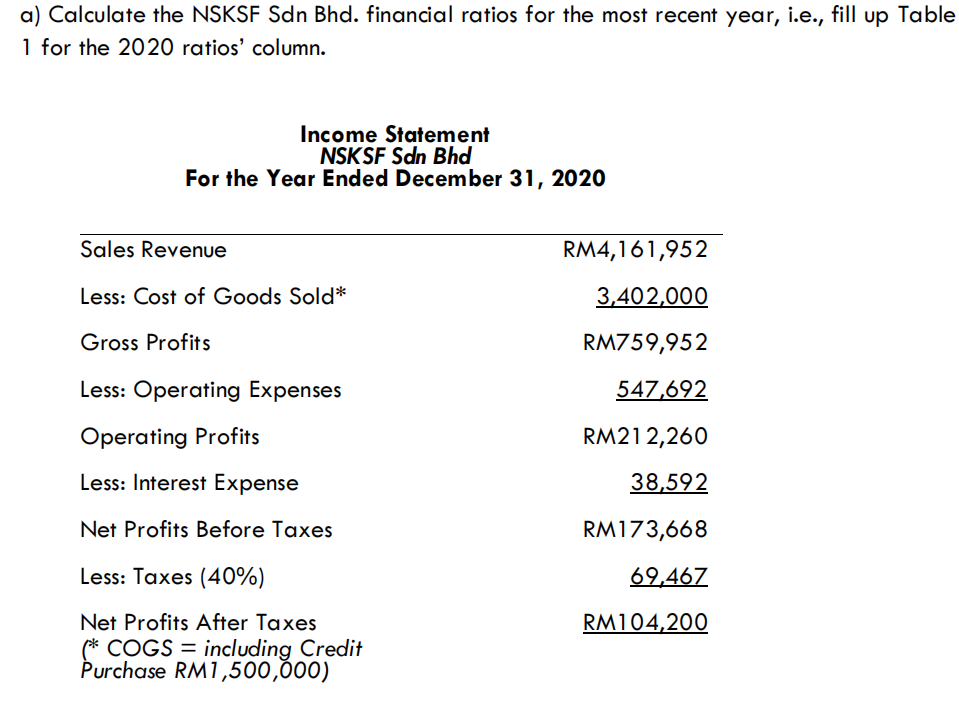

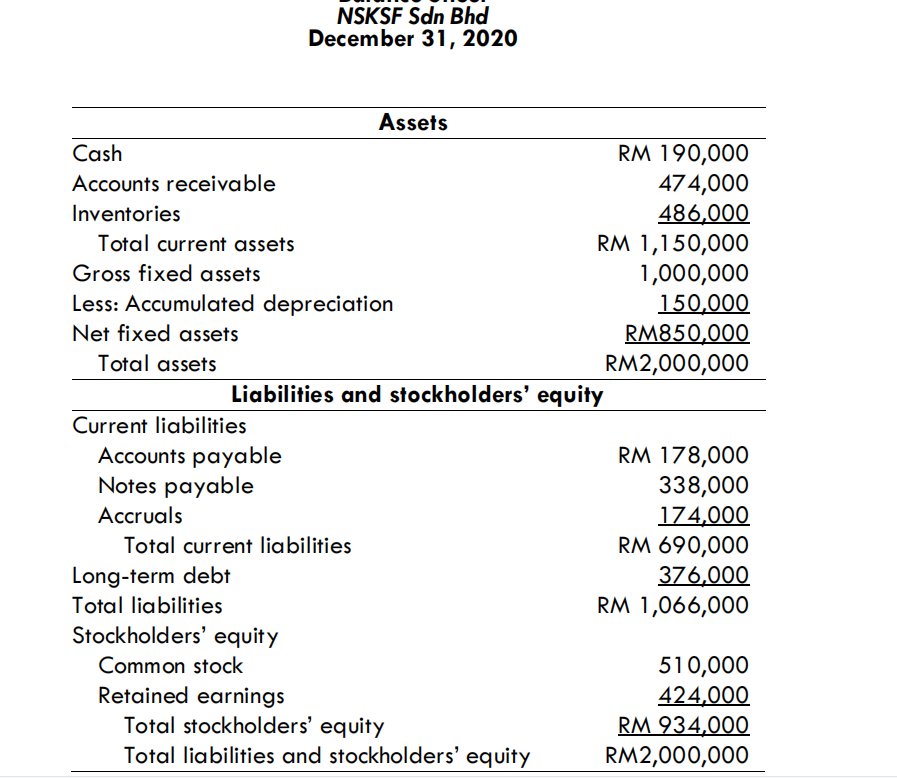

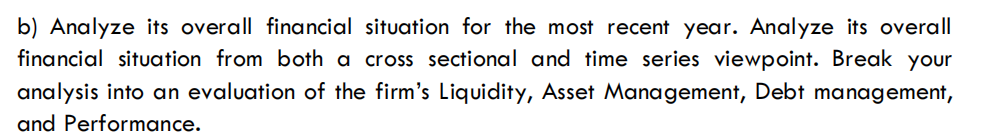

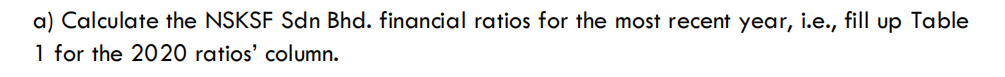

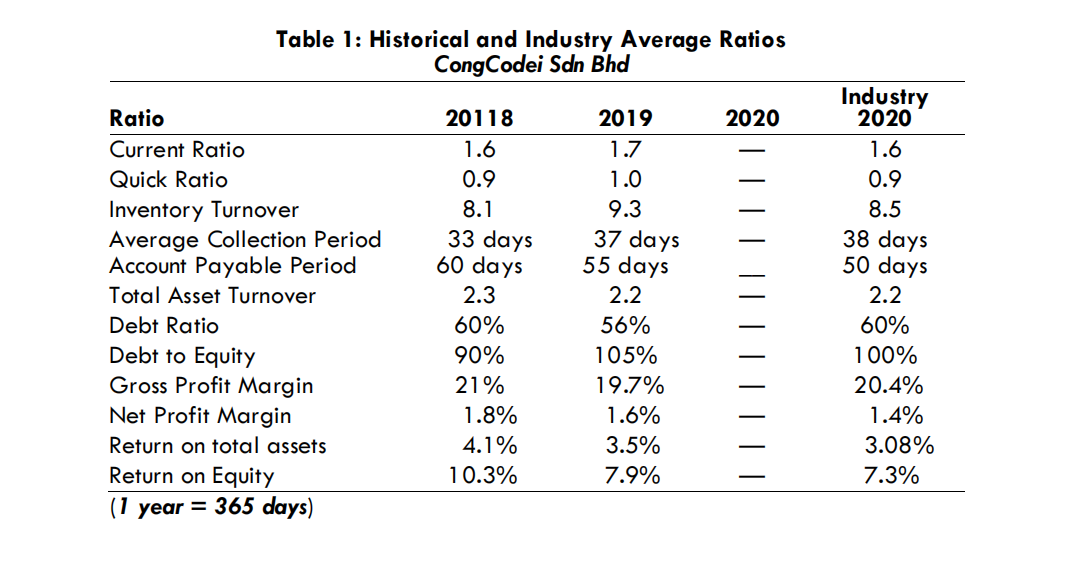

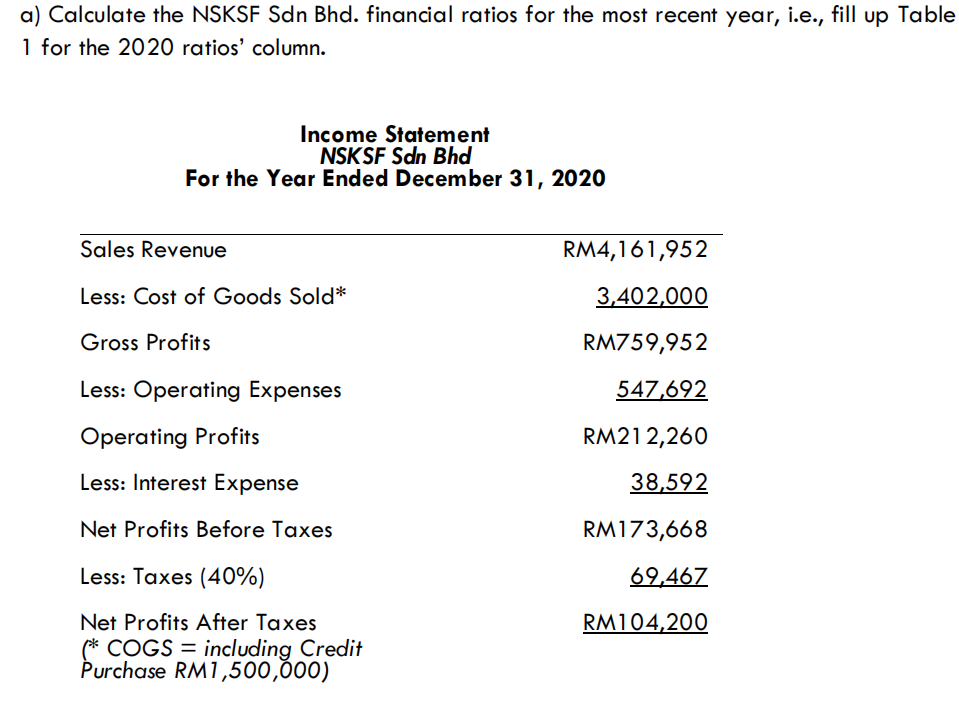

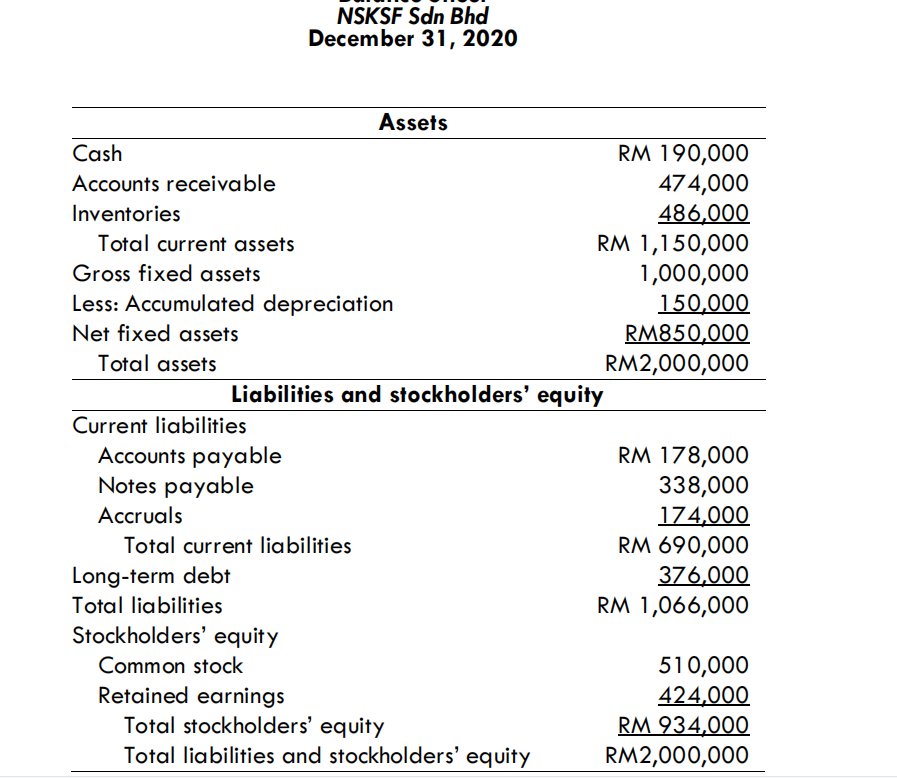

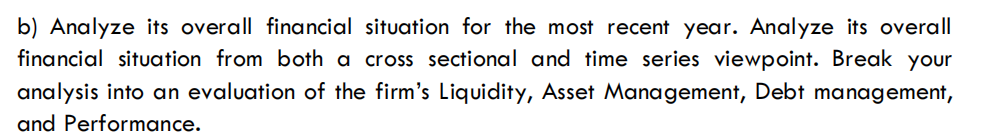

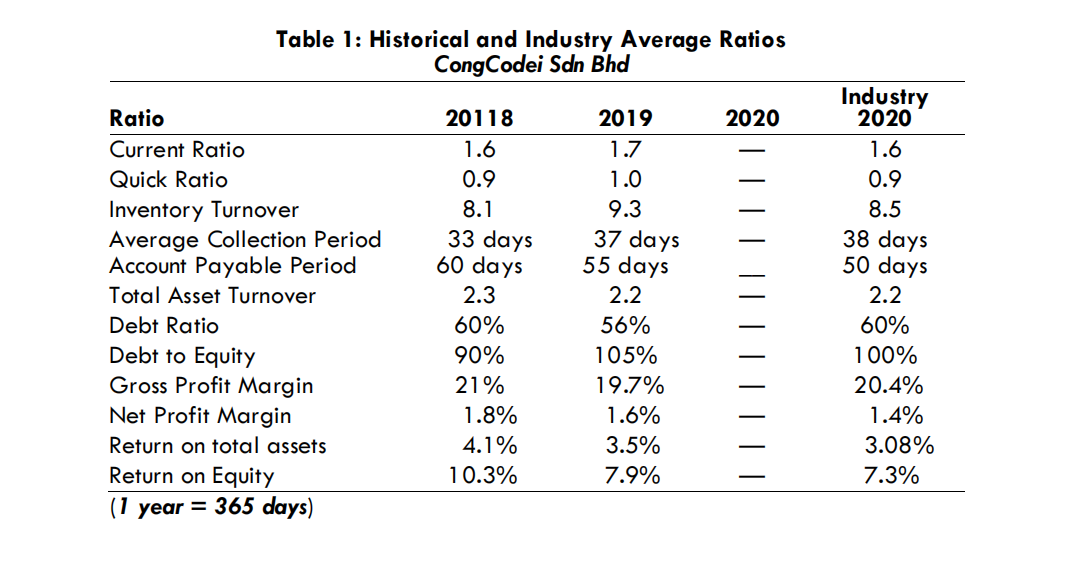

a) Calculate the NSKSF Sdn Bhd. financial ratios for the most recent year, i.e., fill up Table 1 for the 2020 ratios' column. Income Statement NSK SF Sdn Bhd For the Year Ended December 31, 2020 Sales Revenue RM4,161,952 Less: Cost of Goods Sold* 3,402,000 Gross Profits RM759,952 Less: Operating Expenses 547,692 Operating Profits RM212,260 Less: Interest Expense 38,592 Net Profits Before Taxes RM173,668 Less: Taxes (40%) 69,467 RM104,200 Net Profits After Taxes (* COGS = including Credit Purchase RM1,500,000) NSKSF Sdn Bhd December 31, 2020 Assets Cash RM 190,000 Accounts receivable 474,000 Inventories 486,000 Total current assets RM 1,150,000 Gross fixed assets 1,000,000 Less: Accumulated depreciation 150,000 Net fixed assets RM850,000 Total assets RM2,000,000 Liabilities and stockholders' equity Current liabilities Accounts payable RM 178,000 Notes payable 338,000 Accruals 174,000 Total current liabilities RM 690,000 Long-term debt 376,000 Total liabilities RM 1,066,000 Stockholders' equity Common stock 510,000 Retained earnings 424,000 Total stockholders' equity RM 934,000 Total liabilities and stockholders' equity RM2,000,000 b) Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross sectional and time series viewpoint. Break your analysis into an evaluation of the firm's Liquidity, Asset Management, Debt management, and Performance. a) Calculate the NSKSF Sdn Bhd. financial ratios for the most recent year, i.e., fill up Table 1 for the 2020 ratios' column. Table 1: Historical and Industry Average Ratios Cong Codei Sdn Bhd 2020 2019 1.7 1.0 9.3 37 days 55 days Ratio Current Ratio Quick Ratio Inventory Turnover Average Collection Period Account Payable Period Total Asset Turnover Debt Ratio Debt to Equity Gross Profit Margin Net Profit Margin Return on total assets Return on Equity (1 year = 365 days) 20118 1.6 0.9 8.1 33 days 60 days 2.3 60% 90% 21% 1.8% 4.1% 10.3% 2.2 56% 105% 19.7% 1.6% 3.5% 7.9% Industry 2020 1.6 0.9 8.5 38 days 50 days 2.2 60% 100% 20.4% 1.4% 3.08% 7.3%