Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Calculate the NVP of this investment. Is the IRR higher than 6%? B. Calculate the IRR for the investment. C. Determine the simple payback

A. Calculate the NVP of this investment. Is the IRR higher than 6%?

B. Calculate the IRR for the investment.

C. Determine the simple payback period using (1) before-tax cash flows and (2) after-tax cash flows

D. Determine the discounted payback period using after-tax cash flows.

E. Find the APR

F. Calculate the profitability index for the investment.

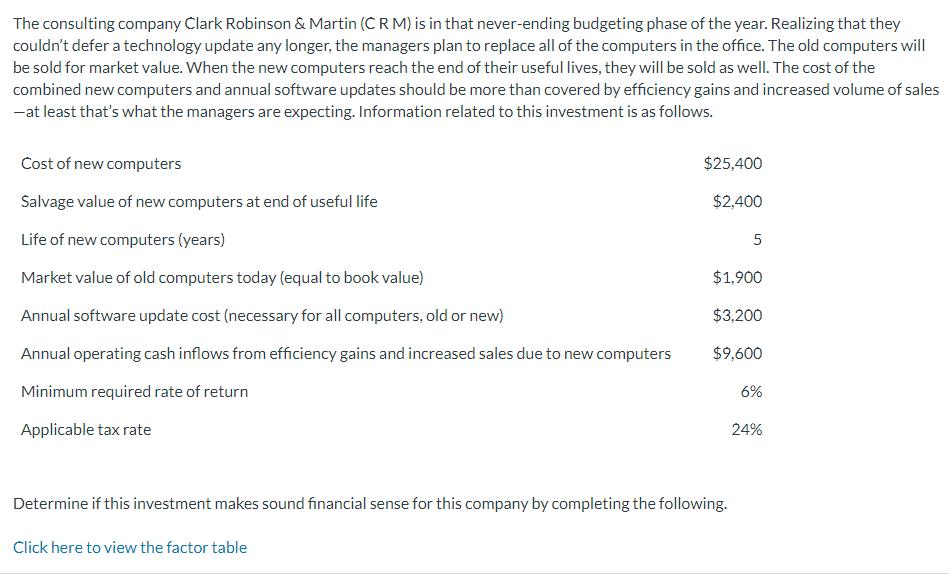

The consulting company Clark Robinson & Martin (CRM) is in that never-ending budgeting phase of the year. Realizing that they couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales - at least that's what the managers are expecting. Information related to this investment is as follows. Cost of new computers Salvage value of new computers at end of useful life Life of new computers (years) Market value of old computers today (equal to book value) Annual software update cost (necessary for all computers, old or new) Annual operating cash inflows from efficiency gains and increased sales due to new computers Minimum required rate of return Applicable tax rate $25,400 $2,400 Click here to view the factor table Determine if this investment makes sound financial sense for this company by completing the following. 5 $1,900 $3,200 $9,600 6% 24%

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Calculate the NVP of this investment Is the IRR higher than 6 NVP 25400 24001006 190010062 3200100...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started