Question

a) Calculate the payback period for both projects. Which does payback choose? b) Calculate the IRR for both projects. Which does the IRR method choose?

a)  Calculate the payback period for both projects. Which does payback choose?

Calculate the payback period for both projects. Which does payback choose?

b) Calculate the IRR for both projects. Which does the IRR method choose? Is the choice

clear or is it a close decision? Is the choice consistent with the result of the payback

method?

c) Calculate NPVs for both projects for costs of capital of 10% and 15%.

d) Which project would you choose?

Kneelson and Botes Inc. (K&B) is a construction company that does road and bridge work for the state highway authority. The state government solicits bids on construction projects from private contractors. The winning contractor is chosen based on its bid price as well as its perceived ability to do the work.

Sophisticated contractors develop bids using capital budgeting techniques because most projects require cash outlays for hiring, equipment and materials before getting started (C0). After that the state makes progress payments to cover costs and profits until the job is finished (C1.....Cn).

Contractors know that even after theyve won a bid, realizing the planned profits and cash flows isnt assured in part because government budgets can change while construction progresses. If funding is up, officials tend to add to the work originally ordered leading to increased profits and cash flows. But if funding is down, officials start to nit pick the contract looking for cost savings, which generally leads to lower cash inflows. State budget projections are fairly good for a year or two, but tend to be inaccurate over longer periods.

K&B has been offered two, four year contracts, but doesnt have enough cash or management depth to take on both (mutually exclusive because of resource limitations). One project involves road repair, most of which will be done and paid quickly. The other requires working on a new bridge. The bulk of the cash inflows on bridge projects generally occur near completion.

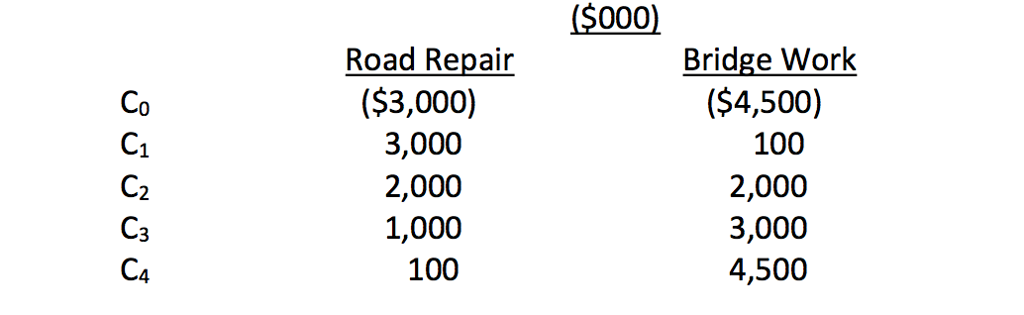

K&Bs estimating department has put together the following projections of the two projects cash flows:

K&B doesnt know its exact cost of capital, but feels its between 10% and 15%. This is not uncommon in smaller companies

The company has hired you as a financial consultant to make a recommendation as to which project to accept.

Road Repair ($3,000) 3,000 2,000 1,000 100 Bridge Work ($4,500) 100 2,000 3,000 4,500 C1 C4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started