Answered step by step

Verified Expert Solution

Question

1 Approved Answer

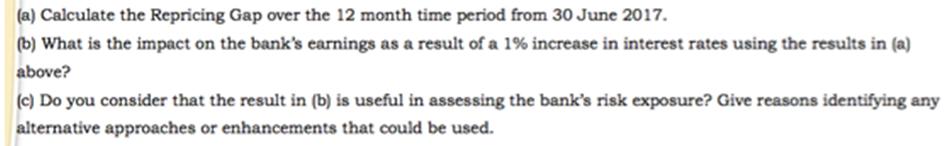

(a) Calculate the Repricing Gap over the 12 month time period from 30 June 2017. (b) What is the impact on the bank's earnings

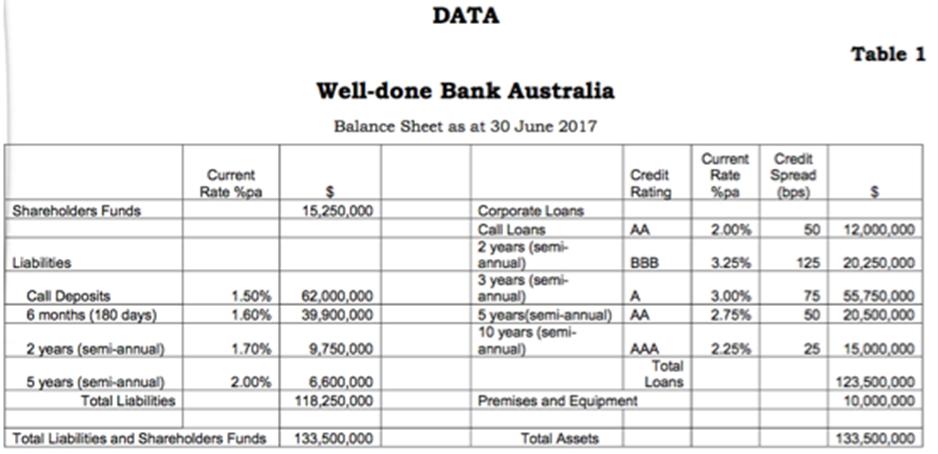

(a) Calculate the Repricing Gap over the 12 month time period from 30 June 2017. (b) What is the impact on the bank's earnings as a result of a 1% increase in interest rates using the results in (a) above? (c) Do you consider that the result in (b) is useful in assessing the bank's risk exposure? Give reasons identifying any alternative approaches or enhancements that could be used. DATA Table 1 Well-done Bank Australia Balance Sheet as at 30 June 2017 Current Rate %pa Credit Spread _(bps) Current Credit Rate %pa Rating Shareholders Funds Corporate Loans Call Loans 2 years (semi- annual) 3 years (semi- annual) 5 years(semi-annual) AA 10 years (semi- annual) 15,250,000 AA 2.00% 50 12,000,000 Liabilities BBB 3.25% 125 20,250,000 Call Deposits 6 months (180 days) 1.50% 1.60% 62,000,000 39,900,000 3.00% 2.75% 75 55,750,000 50 20,500,000 A 2 years (semi-annual). 1.70% 9,750,000 2.25% 25 15,000,000 AAA Total Loans 5 years (semi-annual). 2.00% 6,600,000 118,250,000 Premises and Equipment 123,500,000 10,000,000 Total Liabilities Total Liabilities and Shareholders Funds 133,500,000 Total Assets 133,500,000

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that the initial interest rates on the loans are 1 year 75 pa 2 years 80 pa 3 years 85 pa 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started