Answered step by step

Verified Expert Solution

Question

1 Approved Answer

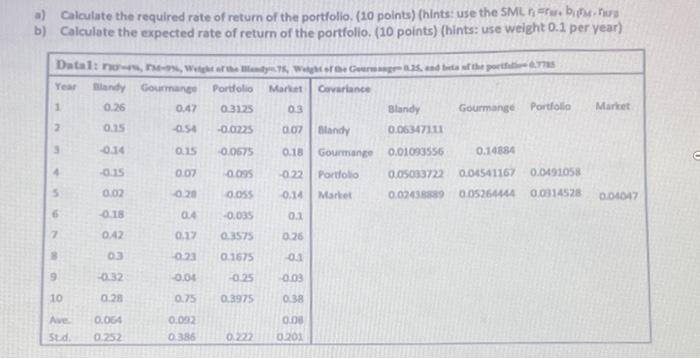

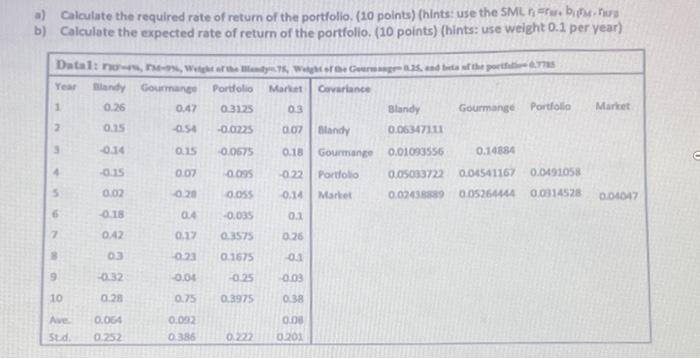

a) Calculate the required rate of return of the portfolio. (10 points) (hints: use the SML n Freebi-TR b) Calculate the expected rate of return

a) Calculate the required rate of return of the portfolio. (10 points) (hints: use the SML n Freebi-TR b) Calculate the expected rate of return of the portfolio. (10 points) (hints: use weight 0.1 per year) Datal: rur-, F-9%, Weight of the Bandy75, Weight of the Gourmange-0.25, and bets of the portfolion 0.7785 Year Blandy Gourmange Portfolio Market Covariance 0.26 2 3 4 5 6 7 8 9 10 Ave. 0.15 -0.15 0.02 -0.18 0.42 0.3 -0.32 0.28 0.064 0.252 0.47 -0.54 0.15 0.07 -0.28 0.4 0.17 0.23 -0.04 0.75 0.092 0.386 0.3125 -0.0225 -0.0675 -0.095 -0.055 -0.035 0.3575 0.1675 -0.25 0.3975 0.222 0.3 0.07 Blandy 0.18 -0.22 Portfolio -0.14 Market 0.26 -0.1 -0.03 0.38 Gourmange 0.08 0.201 Gourmange Portfolio Blandy 0.06347111 0.01093556 0.05033722 0.04541167 0.0491058 0.02438889 0.05264444 0.0314528 0.14884 Market 0.04047  b) Calculate the expected rate of return of the portfolio. ( 10 points) (hints: use weight 0.1 per year)

b) Calculate the expected rate of return of the portfolio. ( 10 points) (hints: use weight 0.1 per year)

a) Calculate the required rate of return of the portfolio. (10 points) (hints: use the SML n Freebi-TR b) Calculate the expected rate of return of the portfolio. (10 points) (hints: use weight 0.1 per year) Datal: rur-, F-9%, Weight of the Bandy75, Weight of the Gourmange-0.25, and bets of the portfolion 0.7785 Year Blandy Gourmange Portfolio Market Covariance 0.26 2 3 4 5 6 7 8 9 10 Ave. 0.15 -0.15 0.02 -0.18 0.42 0.3 -0.32 0.28 0.064 0.252 0.47 -0.54 0.15 0.07 -0.28 0.4 0.17 0.23 -0.04 0.75 0.092 0.386 0.3125 -0.0225 -0.0675 -0.095 -0.055 -0.035 0.3575 0.1675 -0.25 0.3975 0.222 0.3 0.07 Blandy 0.18 -0.22 Portfolio -0.14 Market 0.26 -0.1 -0.03 0.38 Gourmange 0.08 0.201 Gourmange Portfolio Blandy 0.06347111 0.01093556 0.05033722 0.04541167 0.0491058 0.02438889 0.05264444 0.0314528 0.14884 Market 0.04047

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started