Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Calculate the value of the equity of Misty Bay Ltd as of 31 December 2019 using the assumptions above. If you need to make

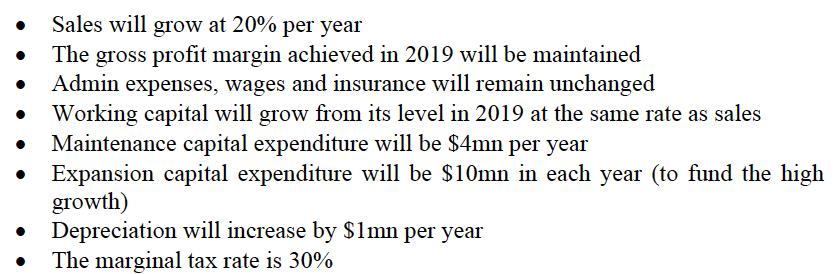

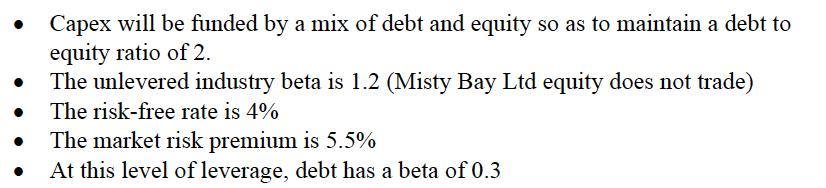

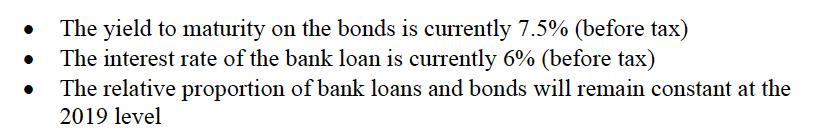

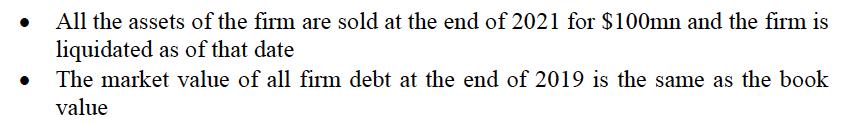

a) Calculate the value of the equity of Misty Bay Ltd as of 31 December 2019 using the assumptions above. If you need to make additional assumptions, clearly state them in your answer.

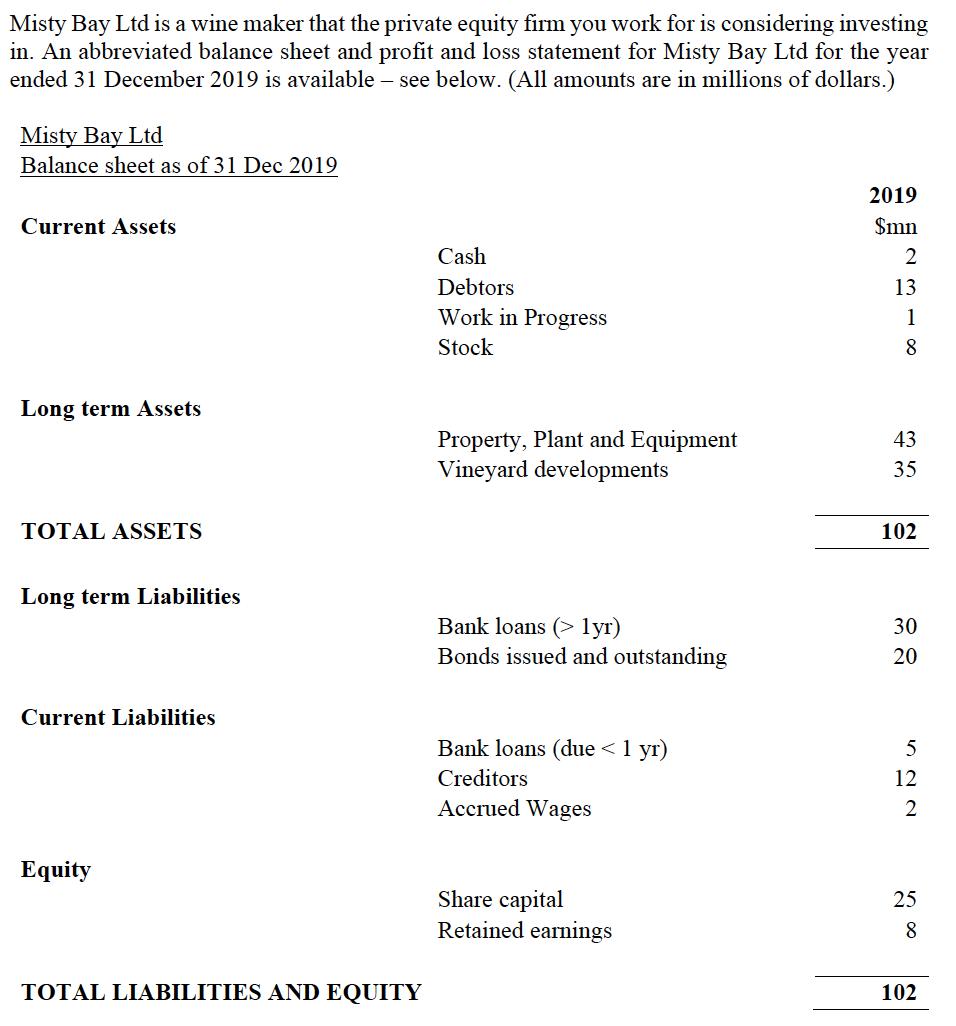

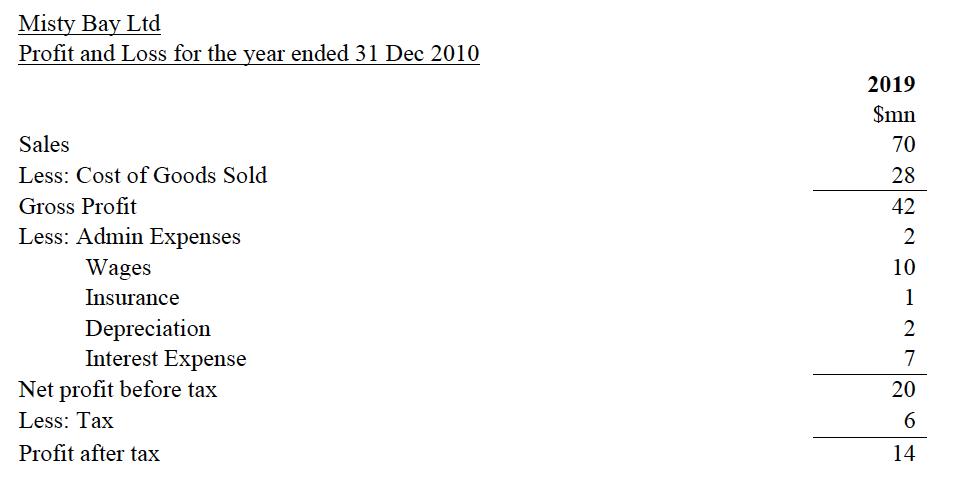

Misty Bay Ltd is a wine maker that the private equity firm you work for is considering investing in. An abbreviated balance sheet and profit and loss statement for Misty Bay Ltd for the year ended 31 December 2019 is available - see below. (All amounts are in millions of dollars.) Misty Bay Ltd Balance sheet as of 31 Dec 2019 Current Assets Long term Assets TOTAL ASSETS Long term Liabilities Current Liabilities Equity TOTAL LIABILITIES AND EQUITY Cash Debtors Work in Progress Stock Property, Plant and Equipment Vineyard developments Bank loans (> 1yr) Bonds issued and outstanding Bank loans (due < 1 yr) Creditors Accrued Wages Share capital Retained earnings 2019 $mn 2 13 1 8 43 35 102 30 20 5 12 2 25 8 102

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a The value of equity is calculated as follows Value of equity Value of assets Value of liabilities ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started