Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculate working capital, the current ratio, and the acid-test ratio as of the most recent balance sheet date. b. Based on your calculations

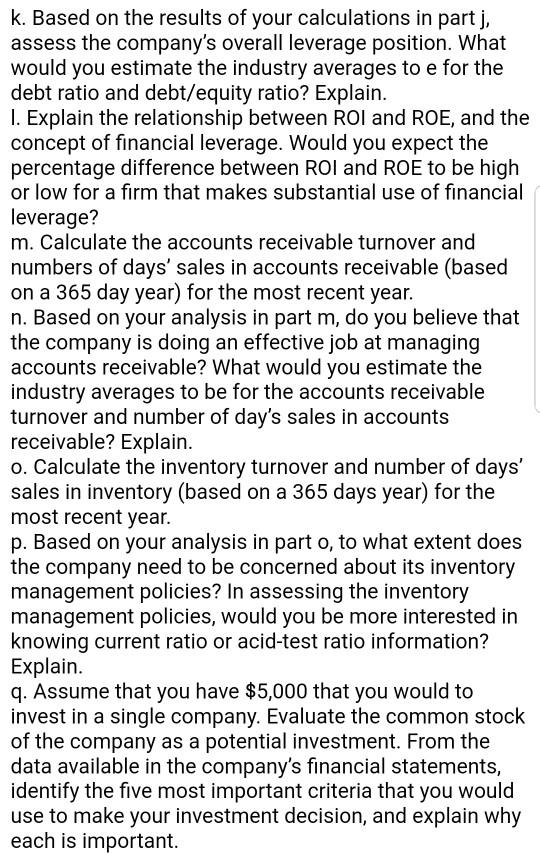

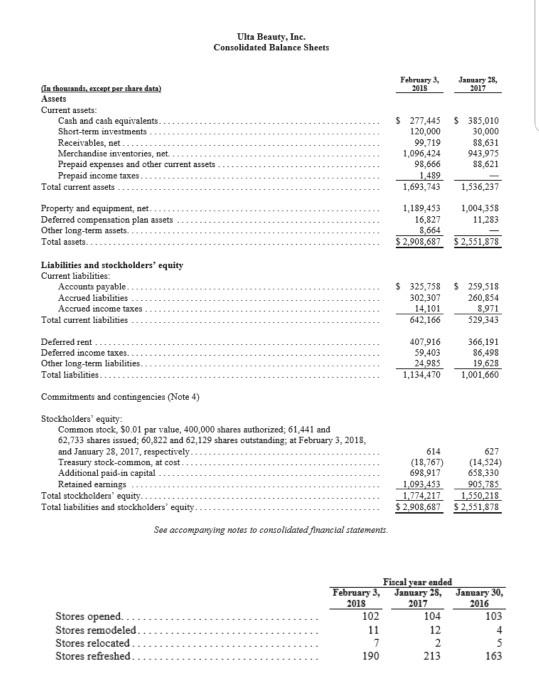

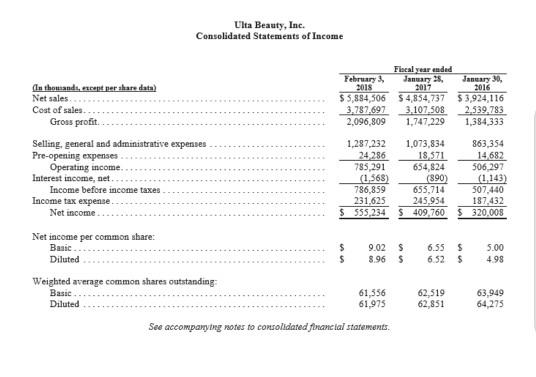

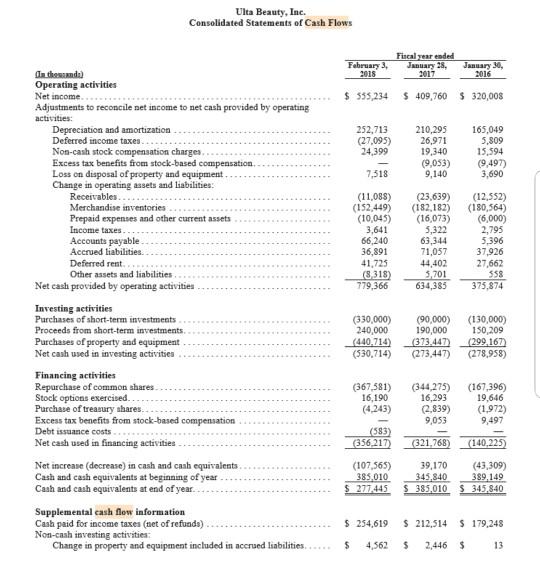

a. Calculate working capital, the current ratio, and the acid-test ratio as of the most recent balance sheet date. b. Based on your calculations in part a, assess the company's overall liquidity position. Explain which ratios indicate particular strengths and/or weaknesses within the company. Assume the following industry averages: current ratio 2.0; acid- test = 1.6. c. Explain how working capital and the current ratio are related. Would you expect a company with a large amount of working capital to always have a high current ratio? d. Calculate ROI, showing margin and turnover, for the most recent year. e. Calculate ROE for the most recent year. f. Calculate the price/earnings ratio for the most recent year, using the company's year-end market price per share of common stock in the numerator and diluted earnings per share in the denominator. g. Calculate the dividend payout and dividend payout and dividend yield ratios for the most recent year. h. Based on the results of your calculations in parts d, e, and f, assess the company's overall profitability. Explain which ratios indicate particular strengths and/or weaknesses within the company. Assume the following industry averages: ROI = 15%; margin = 10%; turnover = 1.5; ROE = 20%; price/earnings = 14.0; dividend payout = 40%; dividend yield = 5%. i. As an investor in this company's stock, would you be pleased with this year's dividend yield? How would your dividend yield "expectations" change, if at all, if the company's ROI was 5% higher? Explain. j. Calculate the debt ratio and the debt/equity as of the most recent balance sheet date. %3D k. Based on the results of your calculations in part j, assess the company's overall leverage position. What would you estimate the industry averages to e for the debt ratio and debt/equity ratio? Explain. I. Explain the relationship between ROI and ROE, and the concept of financial leverage. Would you expect the percentage difference between ROI and ROE to be high or low for a firm that makes substantial use of financial leverage? m. Calculate the accounts receivable turnover and numbers of days' sales in accounts receivable (based on a 365 day year) for the most recent year. n. Based on your analysis in part m, do you believe that the company is doing an effective job at managing accounts receivable? What would you estimate the industry averages to be for the accounts receivable turnover and number of day's sales in accounts receivable? Explain. o. Calculate the inventory turnover and number of days' sales in inventory (based on a 365 days year) for the most recent year. p. Based on your analysis in part o, to what extent does the company need to be concerned about its inventory management policies? In assessing the inventory management policies, would you be more interested in knowing current ratio or acid-test ratio information? Explain. q. Assume that you have $5,000 that you would to invest in a single company. Evaluate the common stock of the company as a potential investment. From the data available in the company's financial statements, identify the five most important criteria that you would use to make your investment decision, and explain why each is important. Ulta Beauty, Inc. Consolidated Balance Sheets Fehruary 3 2018 January 28, 2017 (Ia thouands, except per share data) Assets Current assets: S 277,445 S 385,010 120,000 99,719 1,096,424 98,666 1489 1,693,743 Cash and cash equivalents. Short-term investments Receivables, net... Merchandise inventories, net Prepaid expenses and other current assets Prepaid income taxes. Total current assets- 30,000 88,631 943,975 88,621 1,536,237 Property and equipment, net. Deferred compenasation plan assets Other long-term assets. Total asseta. 1,189,453 16,827 8,664 $2,908,687 1,004,358 11,283 $2,551,878 Liabilities and stockholders' equity Current liabilities: Accounts payable. Accrued liabilities Accrued income taxes Total current liabilities $ 325,758 302,307 14,101 642,166 $ 259,518 260,854 8,971 529,343 Deferred rent. Deferred income taxes. 407,916 59,403 24,985 1,134,470 366,191 86,498 19,628 1,001,660 Other long-term liabilities. Total liabilities. Commitments and contingencies (Note 4) Stockholders' equity: Common stock, $0.01 par value, 400,000 shares authorized; 61,441 and 62,733 shares issued; 60,822 and 62,129 shares outstanding; at February 3, 2018, and January 28, 2017, respectively. Treasury stock-common, at cost. Additional paid-in capital Retained earnings Total stockholdera' equity. Total liabilities and stockholders' equity. 614 627 (18,767) 698,917 1,093,453 1,774,217 $2,908,687 (14,524) 658,330 905,785 1,550,218 $2,551,878 See accompanying notes to consolidated financial statements. Fiscal year ended February 3, January 28, 2018 102 January 30, 2016 2017 Stores opened. Stores remodeled. 104 103 11 12 4 5 163 Store relocated.. 2 Stores refreshed. 190 213 Ulta Beauty, Inc. Consolidated Statements of Income Fiscal year ended January 25, 2017 $ 5,884,506 $4,854,737 $3,924,116 3,107,508 1,747,229 Fehruary 3 2018 January 30, 2016 In thomands, except per share data) Net sales. 3,787,697 2,096,809 Cost of sales. 2,539,783 1,384,333 Gross profit. Selling, general and adminiatrative expenses Pre-opening expenses. Operating income. Interest income, net Income before income taxes Income tax expense. Net income.. 1,287,232 24,286 785,291 (1,568) 786,859 231,625 555,234 S 409,760 1,073,834 18,571 654,824 (890) 655,714 245,954 863,354 14.682 506,297 (1,143) 507,440 187,432 $ 320,008 Net income per common share: Basic . 9.02 S 6.55 5.00 Diluted 8.96 S 6.52 4.98 Weighted average common shares outstanding: Basic. 61,556 61,975 62,519 62,851 63,949 64,275 Diluted See accompanying notes to consolidated financ tal statements. Ulta Beauty, Inc. Consolidated Statements of Cash Flows February 3, 2018 Fiscal year ended January 28, 2017 January 30, 2016 da thesanda) Operating activities Net income. Adjustments to reconcile net income to net cash provided by operating activities: $ 555,234 $ 409,760 $ 320,008 Depreciation and amortization Deferred income taxes. Non-cash stock compensation charges. Excess tax benefits from stock-based compensation. Loss on disposal of property and equipment. Change in operating assets and liabilities: Receivables.. 252,713 (27,095) 24,399 210,295 26,971 19,340 (9,053) 9,140 165,049 5,809 15,594 (9,497) 3,690 7,518 (11,088) (152,449) (10,045) 3,641 66,240 36,891 41,725 (8,318) 779,366 (23,639) (182,182) (16,073) 5,322 63,344 71,057 44,402 5,701 634,385 (12,552) (180,564) (6,000) 2,795 5,396 37,926 27,662 558 375,874 Merchandise inventories Prepaid expenses and other current assets Income taxes. Accounts payable. Accrued liabilities.. Deferred rent. Other assets and liabilities Net cash provided by operating activities Investing activities Purchases of short-term investments Proceeds from short-term investments. Purchases of property and equipment Net cash used in investing activities (330,000) 240,000 (440,714) (530,714) (90,000) 190,000 (373.447) (273,447) (130,000) 150,209 (299,167) (278,958) Financing activities Repurchase of common ahares. Stock options exercised... Purchase of treasury shares. Excess tax benefits from stock-based compensation Debt issuance costs. Net cash used in financing activities. (367,581) 16,190 (4,243) (344,275) 16,293 (2,839) 9,053 (167,396) 19,646 (1,972) 9,497 (583) (356,217) (321,768) (140,225) Net increase (decrease) in cash and caah equivalents. Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year.. (107,565) 385,010 $ 277,445 39,170 345,840 $ 385,010 S 345,840 (43,309) 389,149 Supplemental cash flow information Cash paid for income taxes (net of refunda) Non-caah investing activities: Change in property and equipment included in accrued liabilities... $ 254,619 $ 212,514 $ 179,248 4,562 2,446 $ 13

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 22 A Calculate current ratio Calculate the current ratio u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started