Answered step by step

Verified Expert Solution

Question

1 Approved Answer

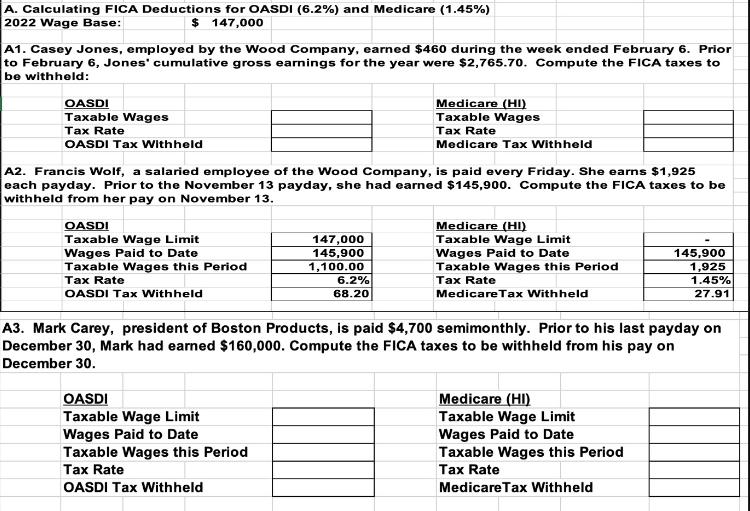

A. Calculating FICA Deductions for OASDI (6.2%) and Medicare (1.45%) 2022 Wage Base: $ 147,000 A1. Casey Jones, employed by the Wood Company, earned

A. Calculating FICA Deductions for OASDI (6.2%) and Medicare (1.45%) 2022 Wage Base: $ 147,000 A1. Casey Jones, employed by the Wood Company, earned $460 during the week ended February 6. Prior to February 6, Jones' cumulative gross earnings for the year were $2,765.70. Compute the FICA taxes to be withheld: OASDI Taxable Wages Tax Rate Medicare (HI) Taxable Wages Tax Rate OASDI Tax Withheld Medicare Tax Withheld A2. Francis Wolf, a salaried employee of the Wood Company, is paid every Friday. She earns $1,925 each payday. Prior to the November 13 payday, she had earned $145,900. Compute the FICA taxes to be withheld from her pay on November 13. OASDI Taxable Wage Limit Medicare (HI) Wages Paid to Date 147,000 145,900 Taxable Wages this Period 1,100.00 Tax Rate OASDI Tax Withheld 6.2% 68.20 Taxable Wage Limit Wages Paid to Date Taxable Wages this Period Tax Rate Medicare Tax Withheld 145,900 1,925 1.45% 27.91 A3. Mark Carey, president of Boston Products, is paid $4,700 semimonthly. Prior to his last payday on December 30, Mark had earned $160,000. Compute the FICA taxes to be withheld from his pay on December 30. OASDI Taxable Wage Limit Wages Paid to Date Taxable Wages this Period Tax Rate OASDI Tax Withheld Medicare (HI) Taxable Wage Limit Wages Paid to Date Taxable Wages this Period Tax Rate Medicare Tax Withheld

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started