Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Calculating the dollar cost to produce the SY20 Formulas Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component

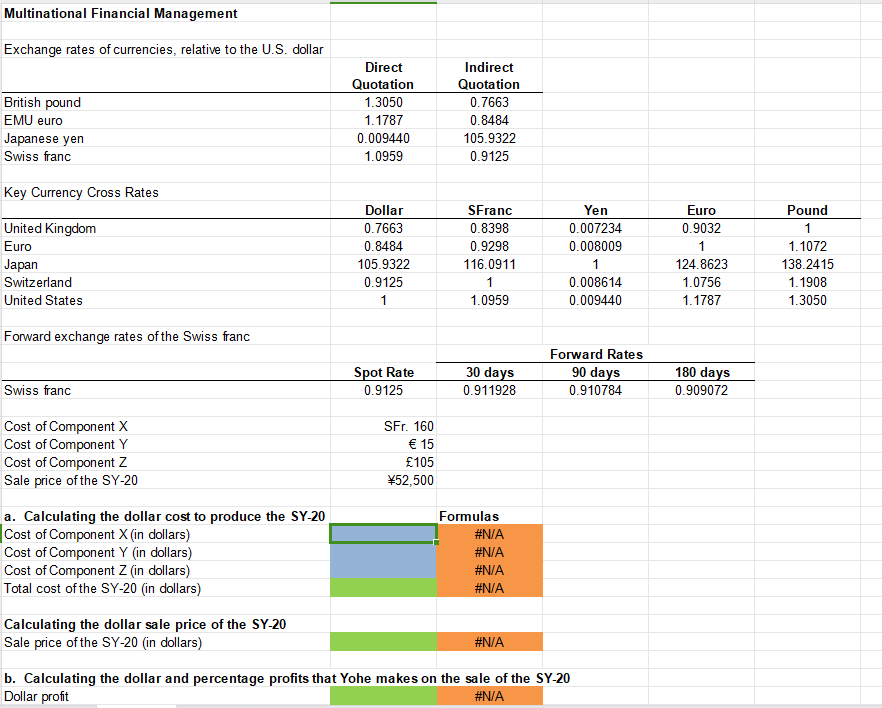

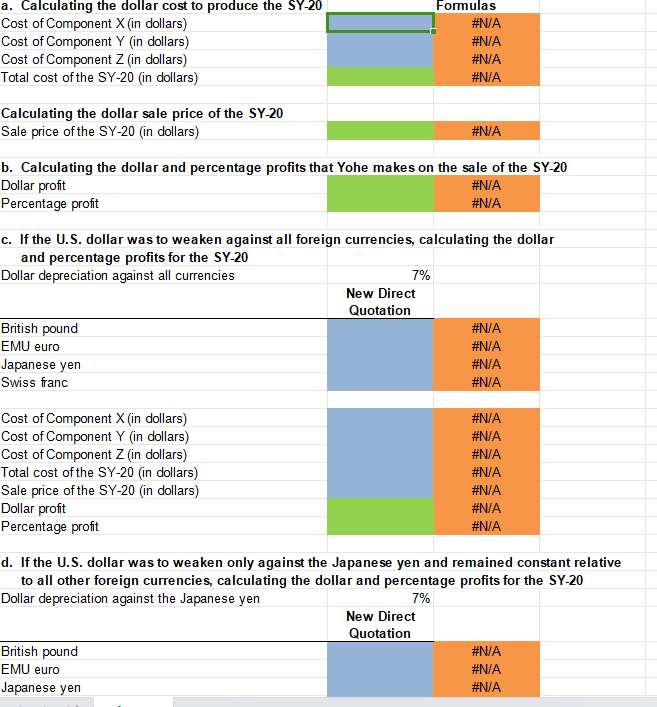

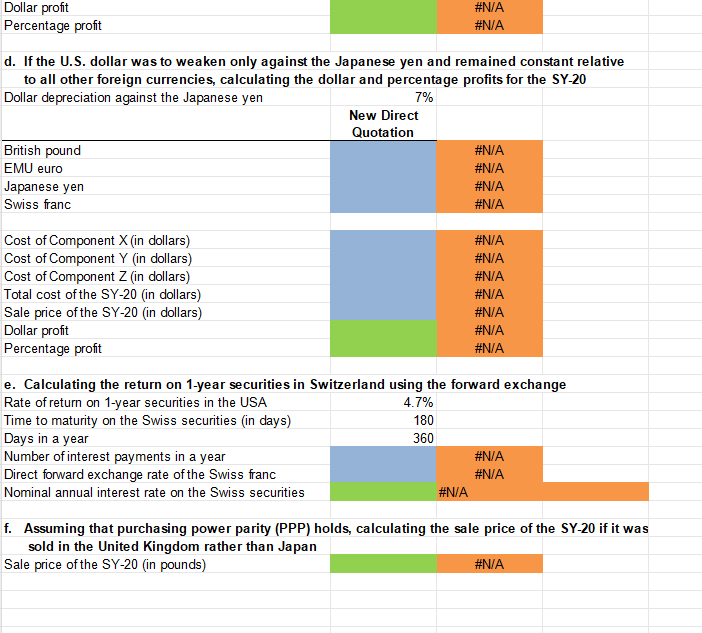

a. Calculating the dollar cost to produce the SY20 Formulas Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) \#N/A \#N/A \#N/A \#N/A Calculating the dollar sale price of the SY-20 Sale price of the SY-20 (in dollars) \#N/A b. Calculating the dollar and percentage profits that Yohe makes on the sale of the SY-20 Dollar profit Percentage profit \#N/A \#N/A c. If the U.S. dollar was to weaken against all foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against all currencies 7% New Direct Quotation British pound EMU euro Japanese yen Swiss franc Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) Sale price of the SY-20 (in dollars) Dollar profit Percentage profit \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against the Japanese yen 7% New Direct Quotation British pound EMU euro Japanese yen \#N/A \#N/A \#N/A Dollar profit Percentage profit \#N/A \#N/A d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against the Japanese yen 7% New Direct Quotation British pound EMU euro Japanese yen Swiss franc Cost of Component X (in dollars) \#N/A Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) Sale price of the SY-20 (in dollars) Dollar profit Percentage profit \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A e. Calculating the return on 1-year securities in Switzerland using the forward exchange Rate of return on 1-year securities in the USA Time to maturity on the Swiss securities (in days) Days in a year Number of interest payments in a year Direct forward exchange rate of the Swiss franc Nominal annual interest rate on the Swiss securities 4.7% 180 360 \#N/A \#N/A \#N/A f. Assuming that purchasing power parity (PPP) holds, calculating the sale price of the SY-20 if it was sold in the United Kingdom rather than Japan Sale price of the SY-20 (in pounds) \#N/A

a. Calculating the dollar cost to produce the SY20 Formulas Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) \#N/A \#N/A \#N/A \#N/A Calculating the dollar sale price of the SY-20 Sale price of the SY-20 (in dollars) \#N/A b. Calculating the dollar and percentage profits that Yohe makes on the sale of the SY-20 Dollar profit Percentage profit \#N/A \#N/A c. If the U.S. dollar was to weaken against all foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against all currencies 7% New Direct Quotation British pound EMU euro Japanese yen Swiss franc Cost of Component X (in dollars) Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) Sale price of the SY-20 (in dollars) Dollar profit Percentage profit \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against the Japanese yen 7% New Direct Quotation British pound EMU euro Japanese yen \#N/A \#N/A \#N/A Dollar profit Percentage profit \#N/A \#N/A d. If the U.S. dollar was to weaken only against the Japanese yen and remained constant relative to all other foreign currencies, calculating the dollar and percentage profits for the SY-20 Dollar depreciation against the Japanese yen 7% New Direct Quotation British pound EMU euro Japanese yen Swiss franc Cost of Component X (in dollars) \#N/A Cost of Component Y (in dollars) Cost of Component Z (in dollars) Total cost of the SY-20 (in dollars) Sale price of the SY-20 (in dollars) Dollar profit Percentage profit \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A \#N/A e. Calculating the return on 1-year securities in Switzerland using the forward exchange Rate of return on 1-year securities in the USA Time to maturity on the Swiss securities (in days) Days in a year Number of interest payments in a year Direct forward exchange rate of the Swiss franc Nominal annual interest rate on the Swiss securities 4.7% 180 360 \#N/A \#N/A \#N/A f. Assuming that purchasing power parity (PPP) holds, calculating the sale price of the SY-20 if it was sold in the United Kingdom rather than Japan Sale price of the SY-20 (in pounds) \#N/A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started