Question

a. Calculation and discussion of the one-day 95%-Value at Risk of each stock in your portfolio using historical simulation approach. That means, if you have

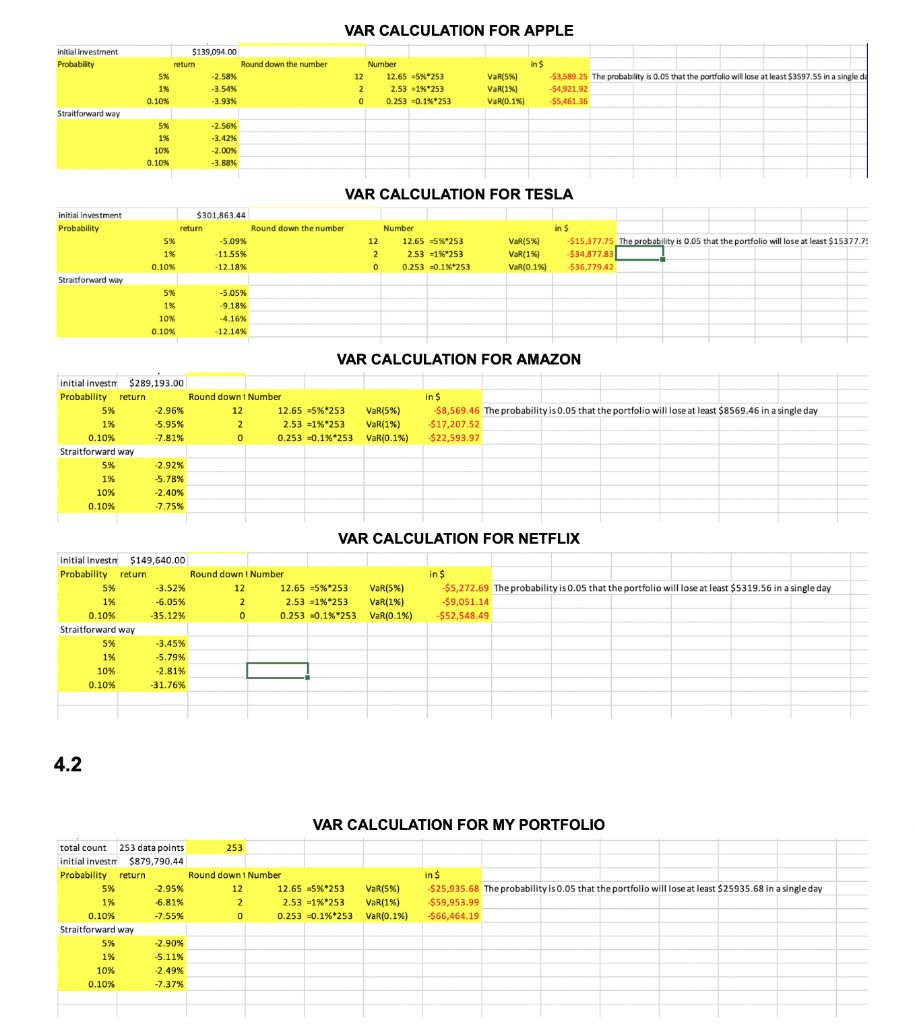

a. Calculation and discussion of the one-day 95%-Value at Risk of each stock in your portfolio using historical simulation approach. That means, if you have four stocks in total, you need VaR for each. b. Calculation and discussion of the five-day 99%-Value at Risk of your portfolio using model- building approach. Show key steps of workings. c. Calculation and discussion of the five-day 99%-Value at Risk of your portfolio using a historical simulation approach. d. Discuss the performance of VaR in (b) and (c), by comparing your calculated VaR results and the portfolios actual five-day returns (Thursday, 28th April 2022 Wednesday 4th May 2022). (portfolio made a loss of $120,261.25 or -13.67%) e. Calculation and discussion of the 95%-Expected Shortfall (CVaR) of your portfolio using a historical simulation approach.

initial investment Probability Straitforward way initial investment Probability 5% 1% 0.10% Straitforward way 5% 1% 10 % 0.10 % initial investm $289,193.00 Probability return 5% -2.96% 1% -5.95% -7.81% 0.10% Straitforward way 5% -2.92% 1% -5.78% 10% -2.40% 0.10% -7.75% initial investm $149,640.00 Probability return. 5% -3.52% 1% -6.05% -35.12% 0.10% Straitforward way 5% -3.45% 1% -5.79% 10% -2.81% 0.10% -31.76% 4.2 total count 253 data points initial investm $879,790.44 Probability return 5% -2.95% -6.81% 1% 0.10% -7.55% Straitforward way 5% -2.90% 1% -5.11% 10% -2.49% 0.10% -7.37% 5% 1% 0.10% 5% 1% 10% 0.10% $139,094.00 -2.58% -3.54% -3.93 % -2.56% -3.42% -2.00% -3.88% $301,863.44 -5.09% -11.55 % -12.18% -5.05% -9,18% -4.16 % -12.14% Round down 1 Number 12 return return Round down the number 2 0 VAR CALCULATION FOR APPLE in $ 12 Number 12.65 -5 %*253 2.53 -1% *253 0.253 0.1% 253 VaR(5%) VaR(1%) VaR(0.1%) -$5,461.36 -$3,589.25 The probability is 0.05 that the portfolio will lose at least $3597.55 in a single da -$4,921.92 2 0 VAR CALCULATION FOR TESLA Number in $ VaR(5%) 12 2 12.65 -5% 253 2.53 -1% 253 0.253 0.1% *253 -$15,377.75 The probability is 0.05 that the portfolio will lose at least $15377.7! -$34,877.83 VaR(1%) VaR(0.1%) 0 -$36,779.42 VAR CALCULATION FOR AMAZON in $ VaR(5%) VaR(1%) VaR(0.1%) -$8,569.46 The probability is 0.05 that the portfolio will lose at least $8569.46 in a single day -$17,207.52 -$22,593.97 VAR CALCULATION FOR NETFLIX in $ 12.65 5 % 253 VaR(5%) VaR (1%) -$5,272.69 The probability is 0.05 that the portfolio will lose at least $5319.56 in a single day -$9,051.14 2.53 =1% 253 0.253 0.1% 253 VaR(0.1%) -$52,548.49 VAR CALCULATION FOR MY PORTFOLIO in $ -$25,935.68 The probability is 0.05 that the portfolio will lose at least $25935.68 in a single day VaR(5%) VaR(1%) VaR(0.1%) -$59,953.99 -$66,464.19 0 Round down the number Round down 1 Number 12 2 0 12.65 = 5%*253 2.53 =1%*253 0.253 0.1% 253 253 Round down 1 Number 12 2 12.65 -5%*253 2.53 = 1% *253 0.253 0.1% *253 initial investment Probability Straitforward way initial investment Probability 5% 1% 0.10% Straitforward way 5% 1% 10 % 0.10 % initial investm $289,193.00 Probability return 5% -2.96% 1% -5.95% -7.81% 0.10% Straitforward way 5% -2.92% 1% -5.78% 10% -2.40% 0.10% -7.75% initial investm $149,640.00 Probability return. 5% -3.52% 1% -6.05% -35.12% 0.10% Straitforward way 5% -3.45% 1% -5.79% 10% -2.81% 0.10% -31.76% 4.2 total count 253 data points initial investm $879,790.44 Probability return 5% -2.95% -6.81% 1% 0.10% -7.55% Straitforward way 5% -2.90% 1% -5.11% 10% -2.49% 0.10% -7.37% 5% 1% 0.10% 5% 1% 10% 0.10% $139,094.00 -2.58% -3.54% -3.93 % -2.56% -3.42% -2.00% -3.88% $301,863.44 -5.09% -11.55 % -12.18% -5.05% -9,18% -4.16 % -12.14% Round down 1 Number 12 return return Round down the number 2 0 VAR CALCULATION FOR APPLE in $ 12 Number 12.65 -5 %*253 2.53 -1% *253 0.253 0.1% 253 VaR(5%) VaR(1%) VaR(0.1%) -$5,461.36 -$3,589.25 The probability is 0.05 that the portfolio will lose at least $3597.55 in a single da -$4,921.92 2 0 VAR CALCULATION FOR TESLA Number in $ VaR(5%) 12 2 12.65 -5% 253 2.53 -1% 253 0.253 0.1% *253 -$15,377.75 The probability is 0.05 that the portfolio will lose at least $15377.7! -$34,877.83 VaR(1%) VaR(0.1%) 0 -$36,779.42 VAR CALCULATION FOR AMAZON in $ VaR(5%) VaR(1%) VaR(0.1%) -$8,569.46 The probability is 0.05 that the portfolio will lose at least $8569.46 in a single day -$17,207.52 -$22,593.97 VAR CALCULATION FOR NETFLIX in $ 12.65 5 % 253 VaR(5%) VaR (1%) -$5,272.69 The probability is 0.05 that the portfolio will lose at least $5319.56 in a single day -$9,051.14 2.53 =1% 253 0.253 0.1% 253 VaR(0.1%) -$52,548.49 VAR CALCULATION FOR MY PORTFOLIO in $ -$25,935.68 The probability is 0.05 that the portfolio will lose at least $25935.68 in a single day VaR(5%) VaR(1%) VaR(0.1%) -$59,953.99 -$66,464.19 0 Round down the number Round down 1 Number 12 2 0 12.65 = 5%*253 2.53 =1%*253 0.253 0.1% 253 253 Round down 1 Number 12 2 12.65 -5%*253 2.53 = 1% *253 0.253 0.1% *253Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started